Functioning of Form 360

Skip information indexHow to attach invoices to the Model 360 form

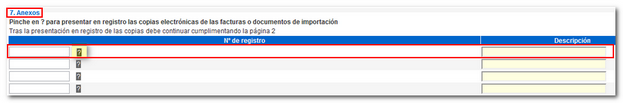

Using the form for processing model 360, electronic copies of invoices or import documents will be attached by record. This action is performed from section "7. Annexes" on page 2.

Preliminary considerations:

- The supported formats for the invoice files you need to attach are PDF and TIFF.

- One invoice per registered file is recommended. However, more than one can be included per file. In this case, if it is not possible to include a file per invoice, the file name will refer to the operations included and will be as short and descriptive as possible (for example: invoices1a15.pdf) and without strange characters.

- The total volume of the shipment may not exceed 5 MB ( RGE and form). If your case exceeds this size, only the invoices with the most significant amounts should be attached. The country to which the refund request is addressed may subsequently request the remaining invoices, in which case the country will be duly informed of the procedure to be followed.

- Individually, a single file cannot exceed 4 MB , always respecting the maximum of 5 Mb for the set of files.

- You can reduce the size of attachments by scanning the invoice and saving it as a . JPG and pasting it into a Word document. Then print the Word document to PDF.

- If you need to attach any invoice once the refund request has been submitted, you can modify the submitted one by replacing one of the registration references with another one that includes the necessary invoices, always taking into account the maximum capacity of 5 MB in shipping.

- There is a limit of 10 files attached per Registry entry ( RGE ).

Procedure:

-

Locate section "7. Annexes" on page 2 and Incorporates the codes of the registry entries of the electronic copies of invoices or import documents by registration. To do this, click on the "New Registration" icon, identified by a blank sheet of paper with a green "+" above it.

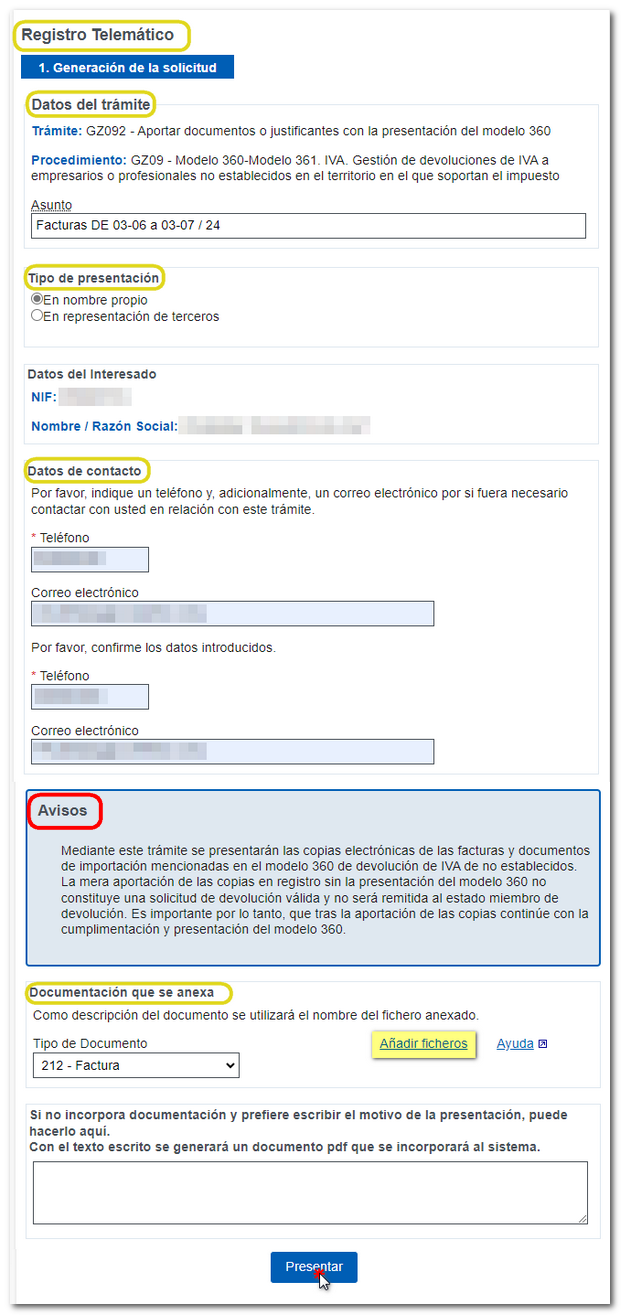

Then, click on the literal "Registration procedure".

-

The form will then link to the electronic registry, opening a new window where you must complete the "Subject" section, indicate the type of submission (on your own behalf or on behalf of a third party), the interested party's details, contact information, and select the file with copies of the electronic invoices and import documents mentioned in Form 360. Click "Add File". To check supported file extensions and sizes, click the "Help" button.

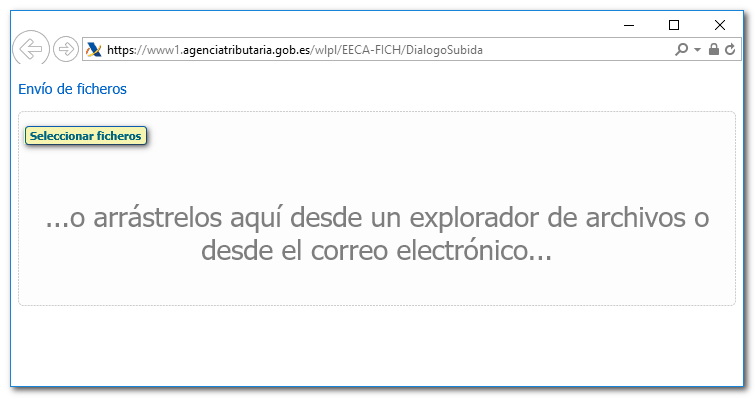

Press "Select Files" to access the file or drag the file into the window.

-

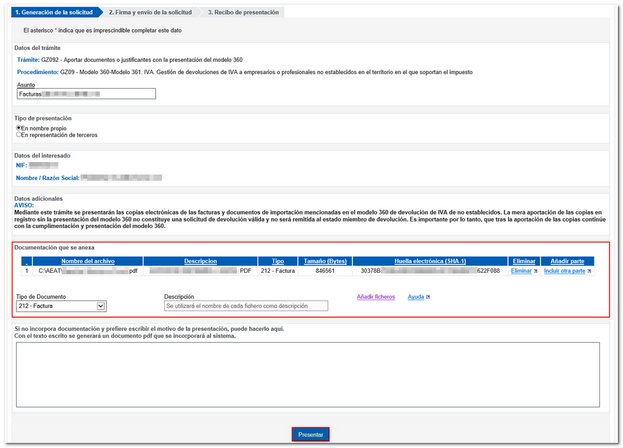

The attached file will appear automatically in the "Attached documentation" section. Once you have attached the files, click "Submit".

-

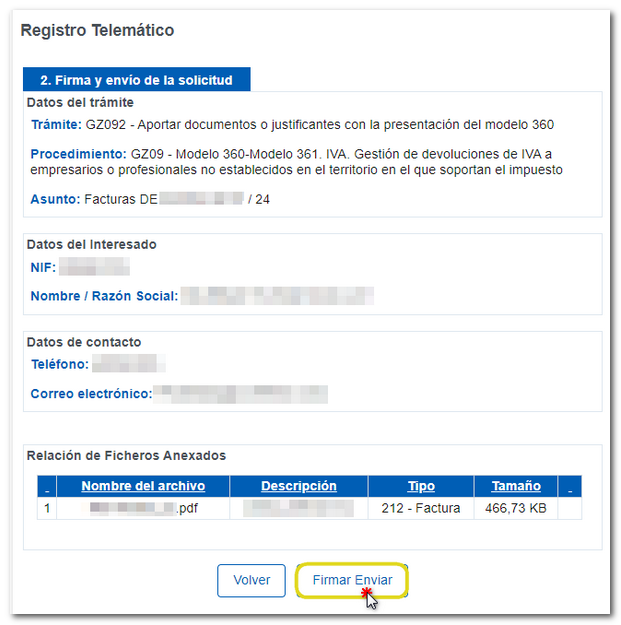

Then, click "Sign and Send."

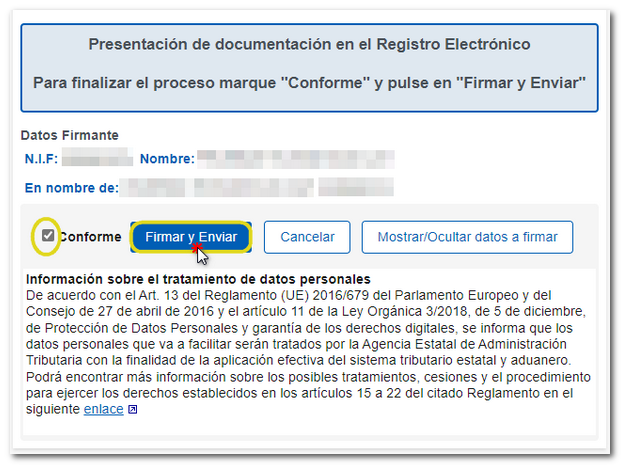

Check the "I agree" box and click "Sign and Send."

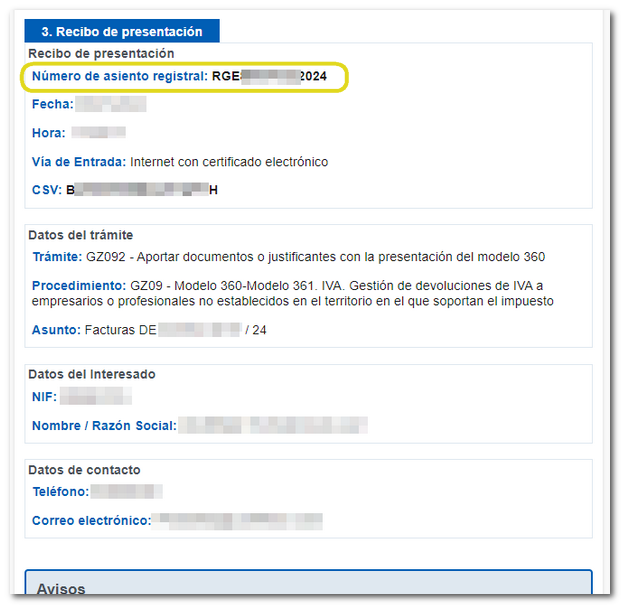

After signing and submitting the application, you will receive an acknowledgement of receipt of that submission, which will show the RGE ("Registration entry number") associated with the submission.

-

Once you have submitted the registration entries, return to the Annexes screen on the refund request form to continue with the declaration. Click “Return to attachments table.”

It is also possible to access the registry to add the PDF with the scanned invoices from the link that appears in the notices for filing the procedure "Presentation of model 360 by file". Once the PDF / TIFF have been submitted, then enter the form to indicate the RGE in the "Annexes" section.

To consider

-

Each invoice sent is registered for the AEAT for an indefinite period. It can be included in future shipments by simply manually indicating the RGE that was initially obtained.

-

If the 360 form is not submitted, even if the invoice is submitted, it is not taken into account.

-

The RGE can be consulted at any time through the "My Files" portal of the Electronic Office, through the "Registration" option (this consultation requires an electronic certificate).

-

Once the declaration has been submitted, if you wish to send more invoices, you can modify the declaration or cancel the previous one and send a replacement.