Model 113

In addition to the holder of the declaration, it may also be submitted by a third party acting on his or her behalf, whether it be a social collaborator or a representative to carry out this specific procedure. Submission via the Internet requires identification with a certificate or electronic DNI .

To correctly view all parts of the form, before accessing it, check the zoom and font size set in the browser (once the declaration has been submitted, you can return to the previous zoom and font size).

- In Microsoft Edge , access the three horizontal dots icon, located in the upper right corner and under "Zoom" select 100% with the "+" and "-" signs, then press "Settings", "Appearance", "Fonts" and under "Font size" select "Medium (recommended)".

- In Google Chrome , go to "Settings" (from the three vertical dots), "Appearance", "Font size" and select "Medium (recommended)", in "Page zoom" select 100%. You can also select 100% zoom from "Zoom In/Out".

- In Mozilla Firefox , access the three-stripe icon, in "Size" select 100% with the "+" and "-" signs, press "Options", "General", "Language and appearance" and in "Fonts and colors" select a size smaller than the current one, if you do not see the form correctly.

- In Safari , go to "View," "Zoom In," or "Zoom Out."

After identifying yourself, you will access the data completion screen. In this section, fill in the boxes marked with an asterisk as they are mandatory.

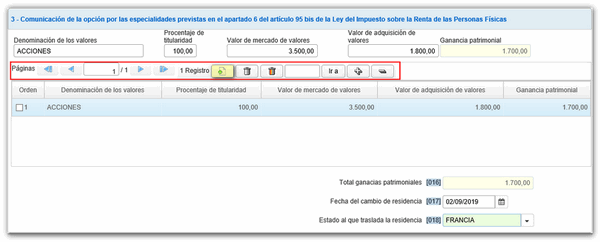

After completing the taxpayer and representative details, in section 3 you will have to indicate the option to apply the special features provided for in section 6 of article 95 bis, the capital gain made clear, the maintenance of ownership of the shares or interests, the identification of the shares or interests that give rise to the capital gains due to a change of residence, as well as the percentage of ownership, the market value of the shares or interests referred to in section 3 of article 95 bis of the Tax Law and the State to which the residence is transferred.

To add a record, click on the blank sheet with a green "+". You can delete records and move between them from the button bar.

At the bottom of the screen are the options available in the form.

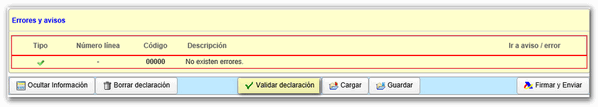

To check if there are errors in the declaration, press the " Validate declaration " button. If it contains errors, the "Errors" tab will be enabled with the description of the error and the "Go to Error" button that takes you to the box to modify or complete. If the statement contains no errors you will get the message "No errors exist".

The form has a timeout due to inactivity, we recommend that you save the declaration to avoid losing the completed data. Press the " Save " button and you will get a .ses file that you can save to the path you want. If you do not select a path, it is saved in the "Downloads" folder or in the browser's default folder. The file will be named dat-113- NIF -ddmmayyy.ses and you can recover it by pressing the " Load " button.

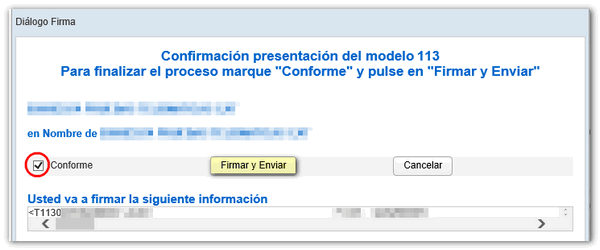

After validating and saving the declaration, you can submit it by clicking the " Sign and Send " button. In the new window, check the "Accept" box to confirm the filing of the declaration. The text box will display the encoded content of the declaration. Finally, click "Sign and Send" to continue with the presentation.

The result of a successful filing will be a response page with an embedded PDF containing a first page with the filing information (registration entry number, Secure Verification Code, receipt number, filing day and time, and filer details) and, on subsequent pages, the full copy of the return.