Form 390 - Technical assistance

Skip information indexPrevious years Submission of Form 390 of 2018 by SMS

For years prior to 2019, taxpayers not required to use the electronic certificate may obtain the pre-declaration of form 390 through the form available on the electronic site to submit the declaration by sending a SMS .

In this case, the link "Model 390" must be used. Exercise 2018. Filing of declaration with confirmation by SMS " in the 2018 Fiscal Year of "Procedures from previous fiscal years" available in the list of procedures of "Form 390. VAT Annual Summary Declaration" on the electronic site.

Access does NOT require identification using an electronic certificate or Cl@ve .

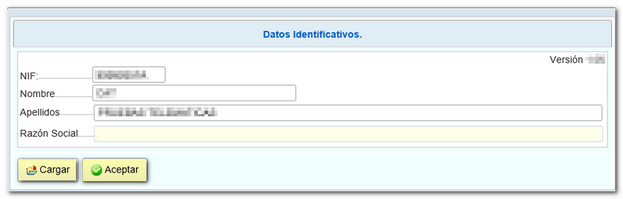

First you will get the window to enter identification data, fill in the NIF , name and surname or company name. Please pay attention to the completion of NIF since this information cannot be modified later (to change it, it will be necessary to generate a new declaration, starting the completion from the beginning).

In the identification data window you will have two options:

- "Load" a .ses file saved in a previous session,

- "Accept" to access the form and complete the declaration from the beginning.

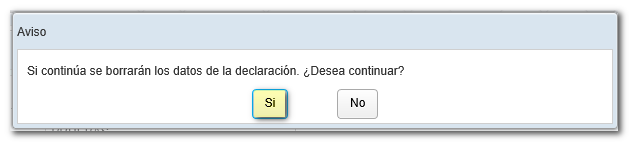

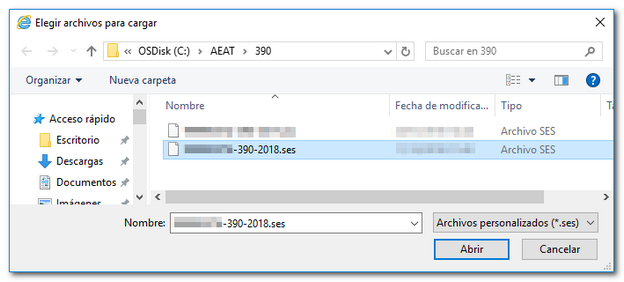

If you press "Upload" a notice will appear warning that the data you have previously entered will be deleted when uploading the declaration. Select the .ses file from wherever it is saved.

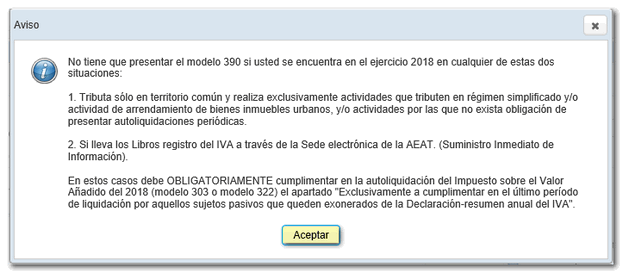

If you press "Accept" you will access the form, displaying a prior notice informing you of the cases in which there is no obligation to submit form 390.

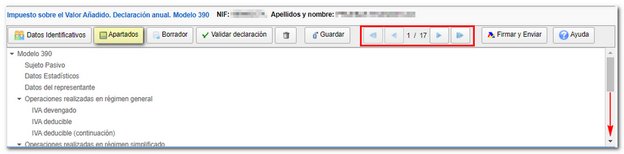

The form consists of 17 pages that you can access from the arrow commands or by clicking the "Sections" button to go directly to the different sections of the declaration.

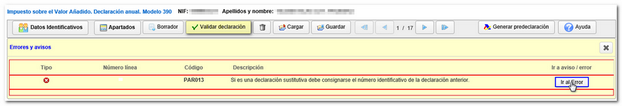

Once you have completed the declaration, from the top menu, check if there are any errors by clicking the "Validate declaration" option. Any detected errors or warnings will be displayed. Remember that the warnings provide relevant information to take into account but do not hinder the filing of the declaration. If the declaration contains errors, these must be corrected. "Go to error" and "Go to notice" places you in the corresponding box to modify or complete. If the statement contains no errors you will get the message "No errors exist".

The "Save" button allows you to save a file, with the entered data, that is not validated (may contain errors or be incomplete) and does not follow the published logical design; This file has the name NIF -390-exercise and the extension .ses. If you do not select a directory, this file will be automatically saved to the system "Downloads" folder or to the directory set by the browser to save downloaded files. You can retrieve this file by pressing the "Upload" button when accessing the form or from the button bar at the top.

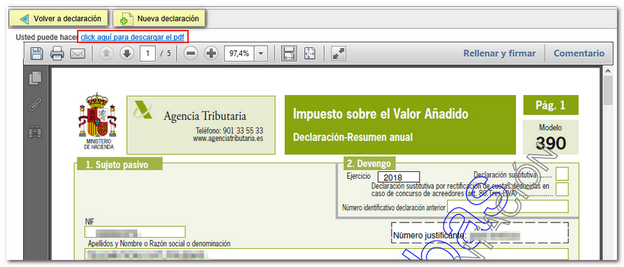

In addition, if before filing the declaration you want to obtain a draft to review the data, you have the tool "Draft" that generates a PDF , not valid for filing, with your declaration. For correct viewing of the draft you need a PDF viewer; We recommend the latest version compatible with your operating system. To return to the declaration, click on "Return to declaration" or create a new declaration by clicking on "New declaration". You can download the PDF by clicking "click here to download the pdf ".

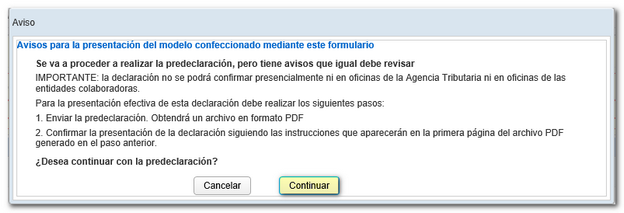

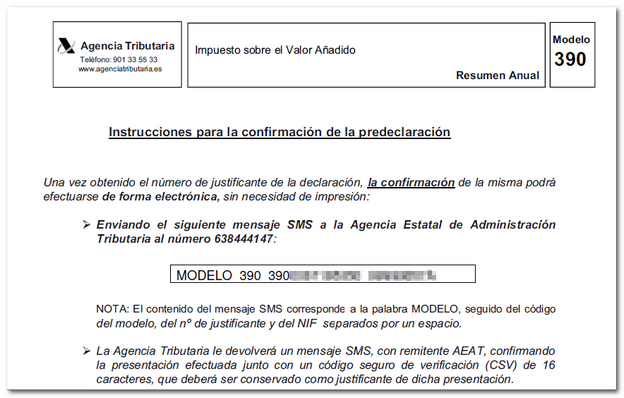

If there are no errors, you can obtain the pre-declaration in PDF of model 390 by pressing the button "Generate pre-declaration ". A notice will be displayed informing you of the procedure to follow to file the Model 390 declaration using SMS .

Next, you get the PDF with the pre-declaration. On the first page "Instructions for confirmation of pre-declaration" the procedure for filing via SMS is explained. First, locate the receipt number on page 1 of the declaration. You must send a SMS to the number indicated in the PDF with the message MODEL 390, followed by the receipt number and NIF , separated by spaces.

After sending the SMS , the Tax Agency will return another SMS , with sender AEAT , confirming that the submission has been made correctly and returning the CSV (Secure Verification Code) of 16 characters, which you must keep as proof of submission by SMS . Please note that the Tax Agency will always send a SMS in response. With the CSV obtained you will be able to consult the presentation through the Electronic Office, in the section "Comparison of documents using a secure verification code ( CSV )".