Form 390 - Technical assistance

Skip information indexForm 390. Simulator (Open)

The "Model 390. Exercise 2025. Simulator 390 (OPEN)" does not require electronic identification and allows for a simulation of model 390 of the annual summary of VAT.

The simulator does not allow the filing of the declaration.

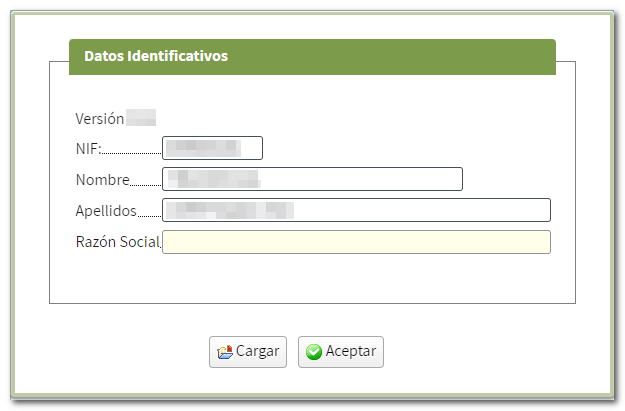

In the initial window, complete the identifying data, which will not be validated against the Tax Agency's census. You can start with a zero declaration by pressing "Accept", or "Load" the data from a previous session saved from the same simulator (file with .ses extension).

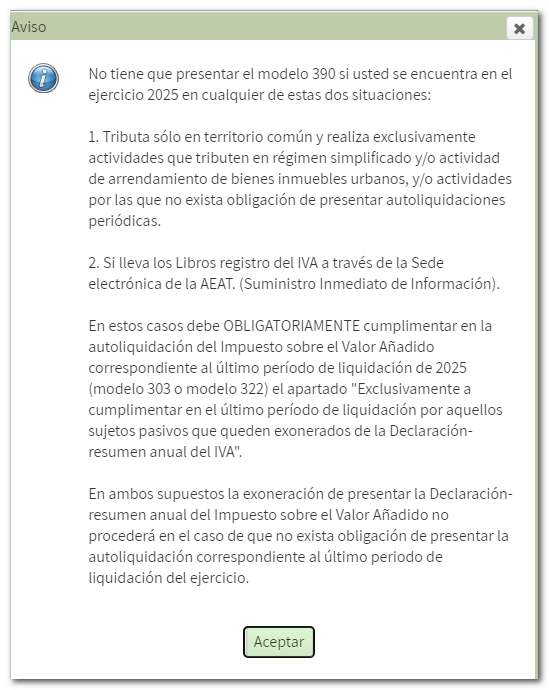

After clicking "Accept", a notice will be displayed with the exemption conditions for submitting form 390. Review the information and click "Accept".

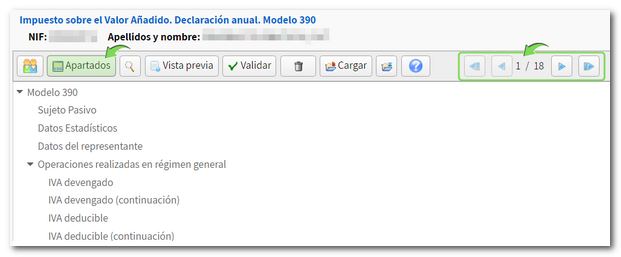

Access the different pages of the declaration from the "Sections" index or use the navigation arrows.

On some pages, you will need to click the pencil icon to enter more information.

If you have any questions about completing the form, access the option "ADI. Need help"? in the lower right corner to link to Tax information and available assistance services.

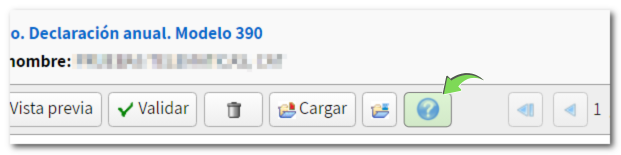

You will also find the instructions for completing the form under the "?" button with the question mark in the top menu.

You also have a box search engine, both by box number and by concept, using the magnifying glass icon. Once you have obtained the search, select the page and press the "Go to page" button.

![]()

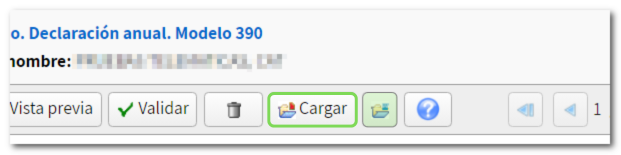

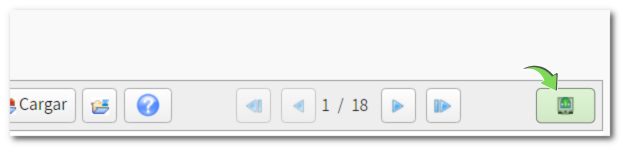

Using the "Keep"You can save the data, obtaining a file with the .ses extension that you can retrieve in later sessions using the "Load" button, in the initial window and in the top button bar.

When you save the file, it will be downloaded by default to the folder that the browser has as its default. You will also be able to select a different location. The file will be named NIF of the declarant-390-exercise of the declaration, with the extension .ses.

NOTE: The file with the .ses extension obtained when saving the simulation can only be loaded in the "Model 390. Exercise 2025. Simulator 390 (OPEN)". It is not possible to upload it to the form for the electronic submission of model 390.

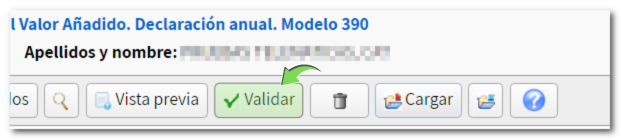

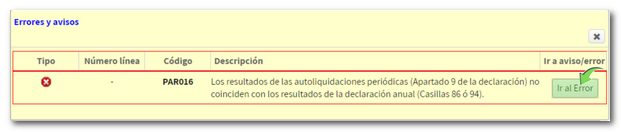

Check for errors by clicking the " Validate " option in the top menu.

Any detected warnings or errors will be displayed. Notices are for informational purposes only and do not impede submission. Errors must be corrected in order to file the return.

The "Go to error" and "Go to notice" buttons direct you to the box or page that needs to be reviewed or corrected.

Using the "Export" button, you will generate a file with the data included in the declaration. You will only be able to obtain it if the declaration is correct (does not contain errors). The file will be named NIF of the declarant-390-exercise of the declaration, with the extension .390, which you can read from the Presentation option (with file).

Note: If the declarant is For legal entities, such as SA or SL, it will not be possible to export.

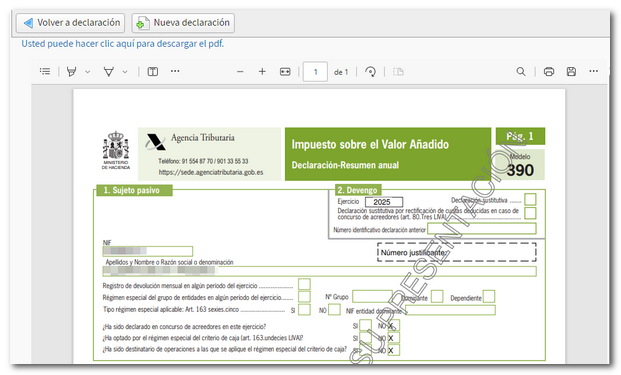

At any time you can obtain a draft of the declaration in PDF , from the "Preview" button, not valid for submission and save it using the option "You can click here to download the pdf ". For correct viewing of the draft you need a PDF viewer.

Press "Return to declaration" or start another declaration from scratch by pressing "New declaration".