Form 685

Form 685, "Tax on bets and random combinations" can only be submitted online, so an electronic certificate or electronic DNI is required.

In addition to the holder of the declaration, it may also be submitted by a third party acting on his or her behalf, whether it be a social collaborator or a representative to carry out the procedure.

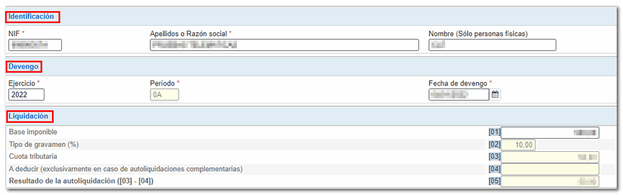

Fields marked with an asterisk are mandatory. Fill in the identification data, accrual and settlement.

At the bottom of the form you will find the available buttons:

-

Show or hide information about errors or completion notices.

-

"Delete Return" deletes the data from the return you are working on to start a new one.

-

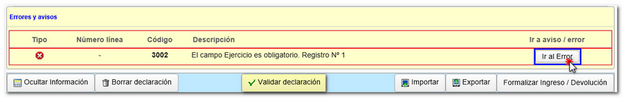

Using the "Validate declaration" button you can check if you have any warnings or errors. The list of errors and warnings detected will be displayed, which you can access for correction from the "Go to Error" or "Go to Warning" button next to the description of the fault. Remember that the notices provide relevant information that should be reviewed but do not prevent the filing of the tax return. If the declaration contains errors, these must be corrected.

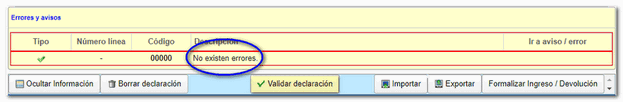

If no errors are detected in the declaration, the description will state that there are no errors.

-

You also have the buttons "Import" and "Export" . Use the "Export" button to save the information entered as long as the declaration has been successfully validated. The file is saved by default in the download folder that the browser has by default, however, you can choose the path in which you want to save the file in BOE format, which will have the name NIF of the declarant and extension .685. From "Import", you can retrieve the declaration obtained through an external program or with this form. Please note that, from this option, if there is data previously indicated in the form, this will be lost when the file is imported. If the form provided by the Tax Agency has not been used to obtain the file, it must be ensured that it complies with the registration design approved for model 685.

-

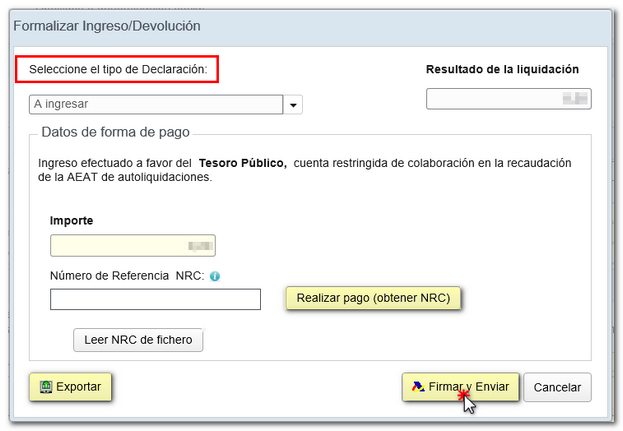

Use the button "Formalize Income/Refund" to submit the declaration once it has been completed and validated.

In the pop-up window, select the type of return. If the result is to enter, it will be necessary to first obtain the NRC and then submit the self-assessment. The NRC is the Full Reference Number, a 22-character code that serves as proof of payment. From the form itself, on the "Make payment" button (NRC)”, it is possible to connect to the payment gateway to automatically generate a NRC with the data contained in the declaration.

If you choose one of the types of debt recognition, after filing the declaration, you must process the debt from the "Process debt" button that will appear in the response window or from the "Collection" section or from the "Pay, defer and consult" block.

In this same window it is also possible to obtain the declaration with the published logical design format and .685 extension from the "Export" button. You can choose the path where you want to save the file, which will be named NIF of the declarant - fiscal year - period and the extension .685. You can retrieve the declaration using the "Import" option at any time if you close the window.

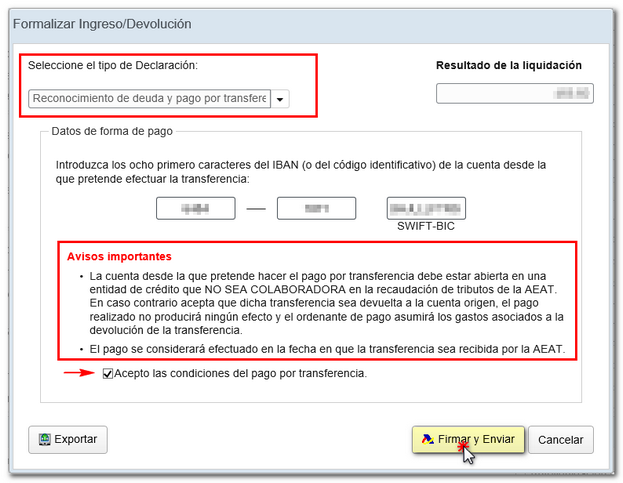

Form 685 also includes the option of debt recognition and payment by transfer from a bank account opened in a NON-COLLABORATING Credit Institution, by choosing "Debt recognition and payment by transfer" from the drop-down menu "Select the type of Declaration".

Finally, click "Sign and Send".

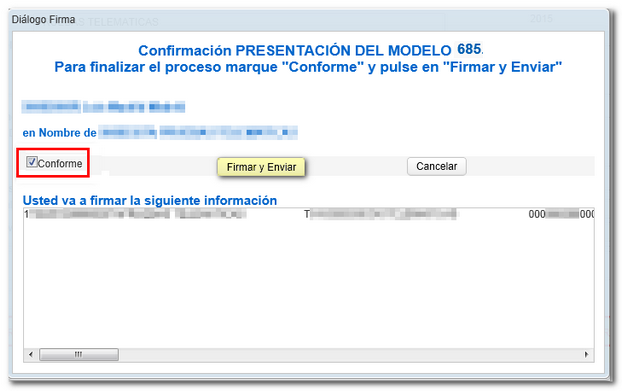

In the new window, check "OK" to confirm the submission. The text box will display the encoded content of the declaration. To continue filing your return, click on "Sign and Send."

The result of a successful submission will be a response page showing the text "Your submission has been successfully submitted" with an embedded PDF containing the submission information (Secure Verification Code, receipt number, day and time of submission, and presenter details).