Presentation of the request.

The Tax Agency has enabled a form on its electronic headquarters so that pensioners who once made contributions to labor mutual funds can request a refund of the PIT corresponding to the years 2019 to 2022 and previous years not prescribed that result from the application of DT2 of the LIRPF.

Regarding the statement of PIT 2024, if the Tax Agency has all the information, the reduction will already appear in the tax data with the concept ("Adjustment for Mutual Societies - DT2 LIRPF"), and the adjustment will be automatically applied in the statement of PIT 2024.

To access the form and submit the application, you can use:

- Electronic certificate or DNIe

- Cl@ve

- Reference number

In the help available in the side menu you can consult all the information related to these means of identification.

In addition to your own name, the application can be submitted by power of attorney (the power of attorney for procedure CG63C or GENERALEY58 must be registered), succession or with any of the accepted Social Collaboration agreements. In the latter case, the applicant's reference number will also be requested.

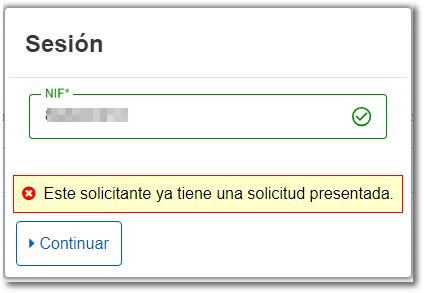

In the first window, the applicant is identified, click "Continue":

By identifying the applicant, it will also be detected whether he or she has already submitted an application.

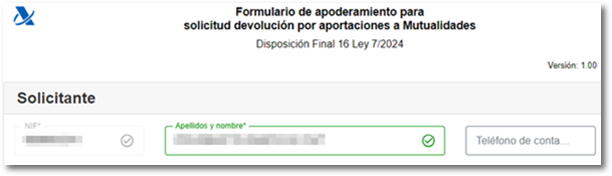

Once identified, access the form:

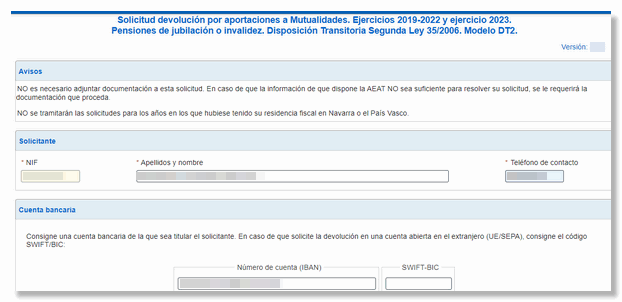

The NIF and the name and surname will already be filled in, and you will only need to provide the contact telephone number and the IBAN of the bank account you own to receive the corresponding transfer. If you want to indicate a bank account opened abroad, you can do so by adding the code SWIFT - BIC in the available field.

Before submitting your application, please review the information in the "Application and Authorization" section.

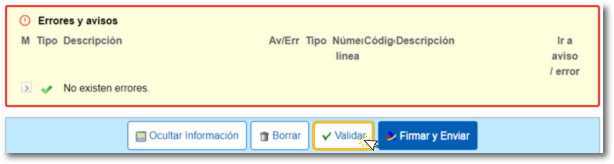

Click the "Validate" button to check that there are no errors and finally, "Sign and Send".

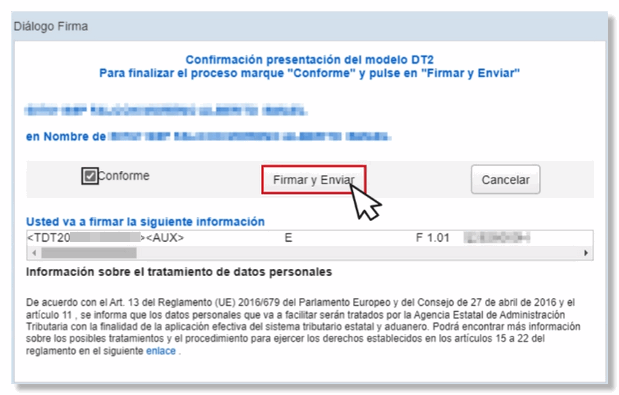

In the next window, check the "I agree" box and click "Sign and Send" again.

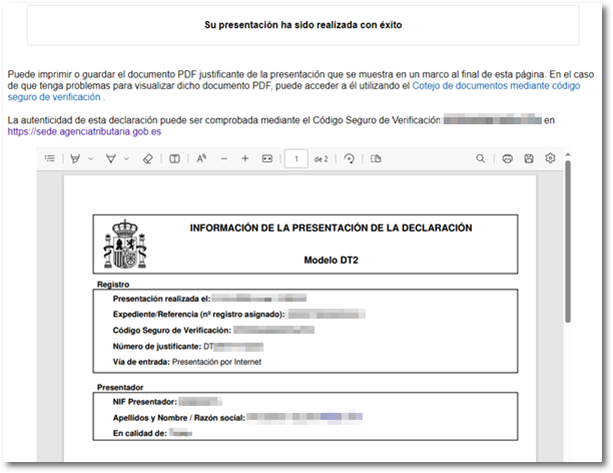

You will receive proof of submission with the corresponding Secure Verification Code.

It will not be necessary to submit any additional documentation to this form but the AEAT may request documentation from the applicant if all the information necessary to process the application is not available.