Income 2019

Skip information indexFiling of Income Tax Returns 2019

The 2019 Income Tax Return can be submitted using a file that has been previously generated from an external help program and that conforms to the registry design published for Form 100 for that year. Access is available on the Electronic Office, on the page for procedures for form 100.

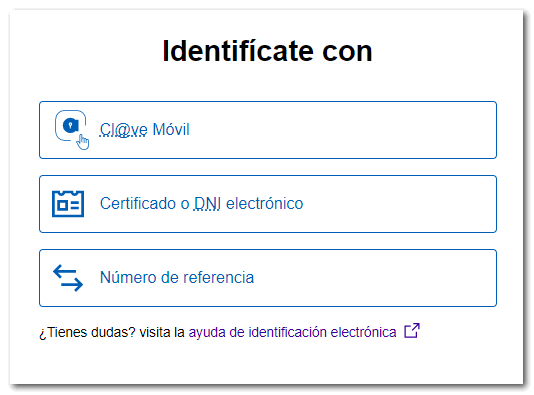

Access requires identification with an electronic certificate, DNIe or Cl@ve or with a valid Income reference for the current year. Choose the way you are going to identify yourself.

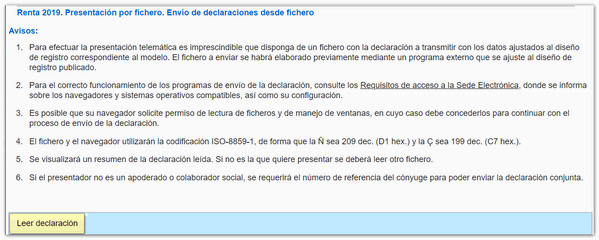

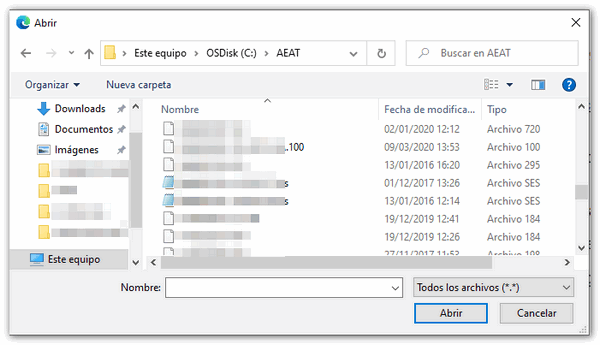

On the next page, click the "Read declaration" button and locate the file with the declaration data.

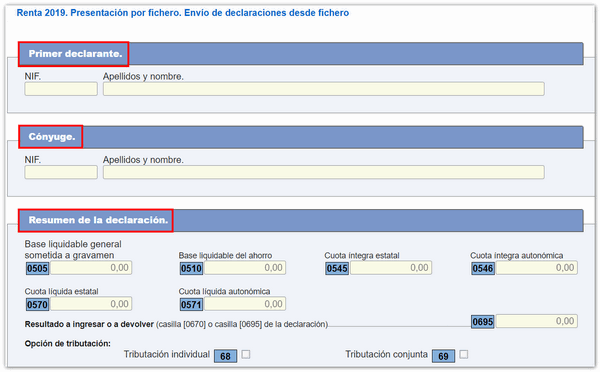

When reading the file, a summary of the declaration will be loaded with the identification data, economic data and the result of the declaration. If the result is an income, you must include the NRC (proof of payment), or obtain it at this time by clicking the "Make payment" button. Get NRC ". You can also select other payment methods.

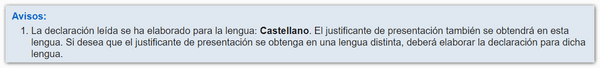

In addition, the notice indicates the language in which the declaration was prepared. If you want the receipt or declaration to be obtained in another language, you must prepare the declaration for that language.

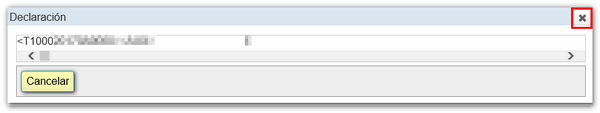

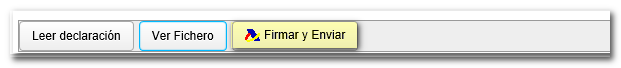

At the bottom are the available options. Using the "View File" button you can view the uploaded encrypted file. To return to the declaration, click on the X or press "Cancel".

Review the information and, if it is correct, click on "Sign and Send" to proceed with filing the return.

Finally, if everything is correct, you will receive the response sheet that says "Your submission has been successful" and a Secure Verification Code so that the authenticity of the declaration can be verified in the Electronic Office in the section "Comparison of documents using a secure verification code", in addition to the PDF that contains a first page with the submission information (registry entry number, Secure Verification Code, receipt number, day and time of submission and details of the presenter) and, on the following pages, the complete copy of the declaration.

In cases where there is recognition of debt, a link to submit the deferral or compensation request will be displayed on the response sheet for successfully submitting the request. In this case, click "Process debt".