Common assumptions of modification in Renta WEB

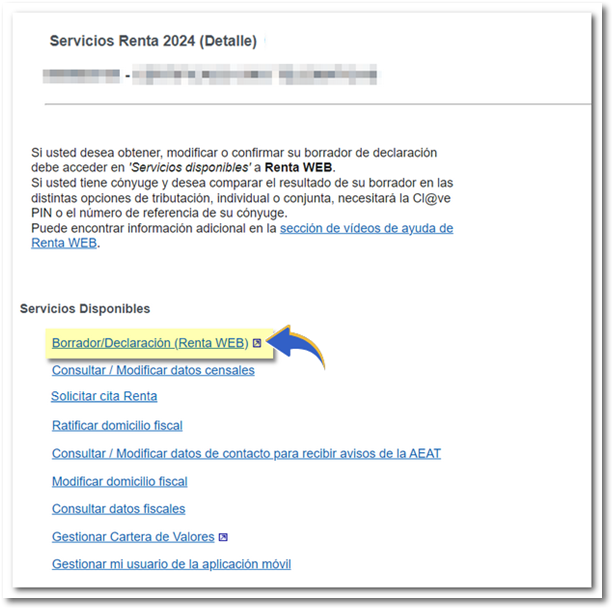

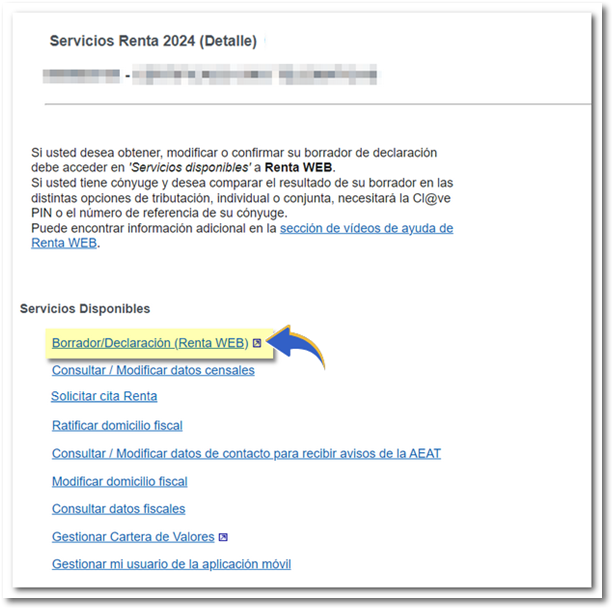

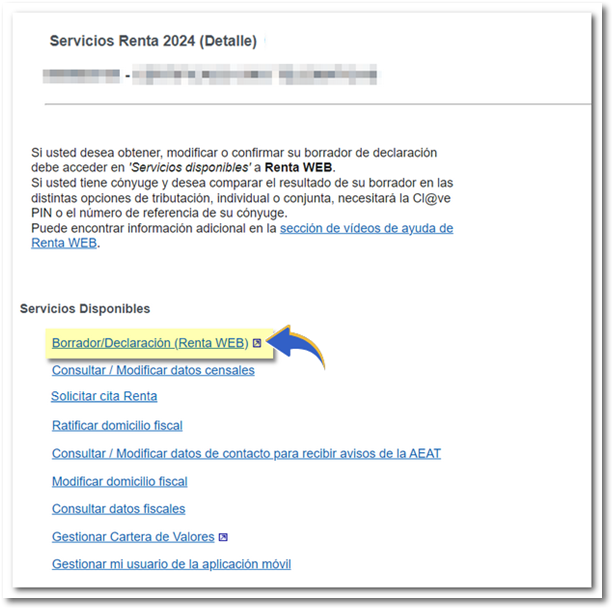

To incorporate the fees paid to unions and professional associations, access the " Draft/Declaration Processing Service (Renta DIRECTA and Renta WEB) ", identify yourself and within your file click on "Draft/Declaration (Renta WEB)" in the "Available Services" section. Check the data in the identification data window and click "Accept".

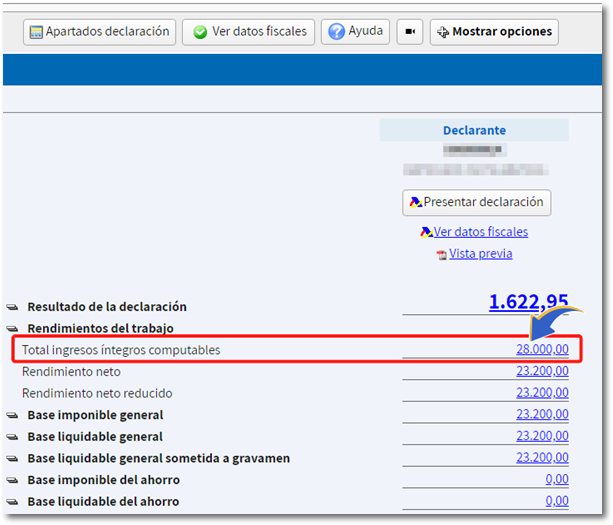

If you do not need to provide additional information to transfer tax data to the declaration, you will access the "Return Summary". Locate the "Work income" section and in the "Total computable gross income" concept, click on the numerical link of the declarant, spouse or other declarants in the family unit for whom this data is to be incorporated. Please note that it is not possible to enter data in the joint mode.

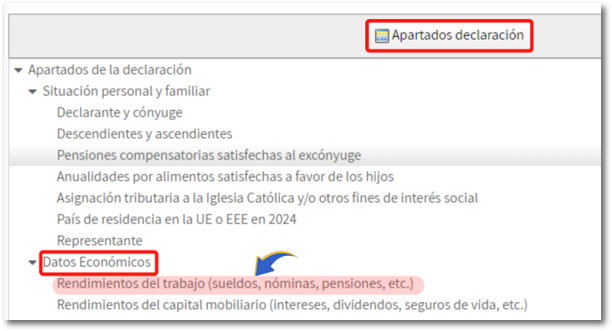

You can also access it from "Declaration sections" and in "Economic Data" access "Work income (salaries, payrolls, pensions, etc.)".

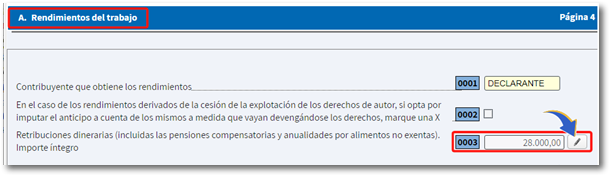

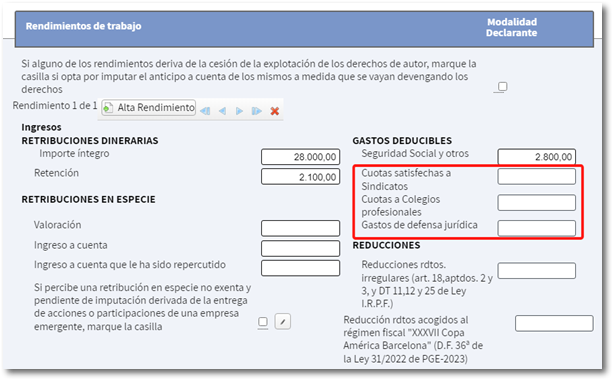

To enter data, double-click on box 0003 or on the button with the pencil icon next to each box.

Enter the appropriate amounts and click "Accept". The amounts entered will be reflected in the corresponding boxes of the declaration.

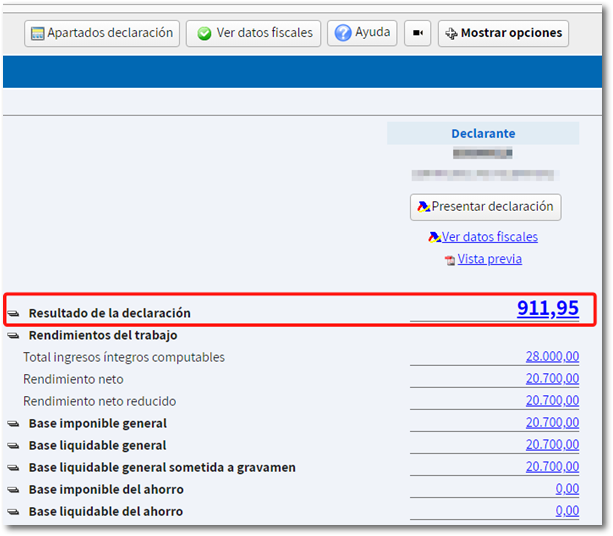

To check the result of the declaration after the modifications, return to the "Declaration Summary".

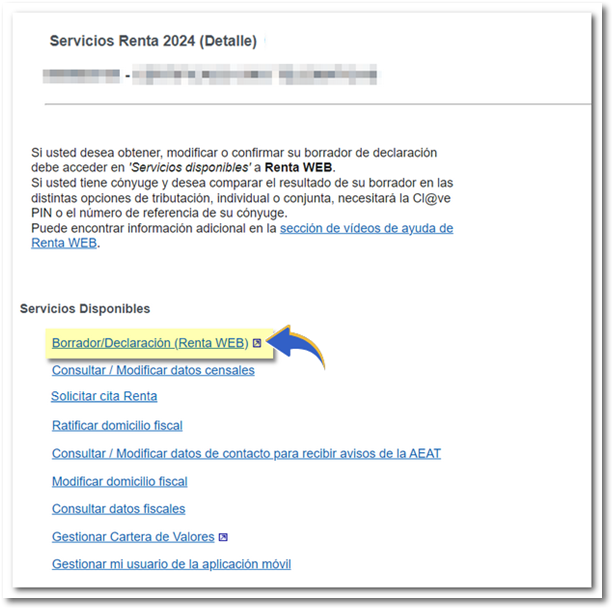

To include this deduction in your tax return, go to " Draft/Tax Return Processing Service (Renta DIRECTA and Renta WEB) ", log in and, within your file, click on "Draft/Tax Return (Renta WEB)" in the "Available Services" section. Check the data in the identification data window and click "Accept".

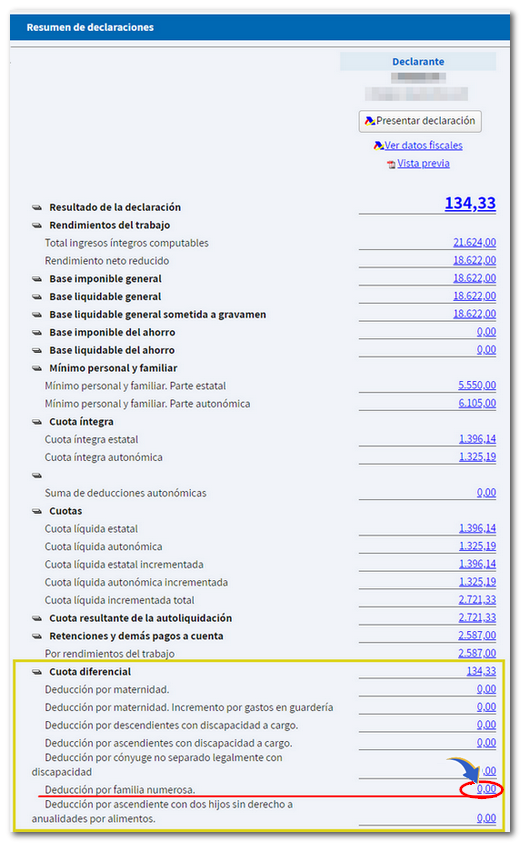

If you do not need to provide additional information to transfer tax data to the declaration, you will access the "Return Summary". Locate the "Differential rate" section and access the numerical link located under the "Deduction for large families" concept. Please note that it is not possible to enter data in the joint mode.

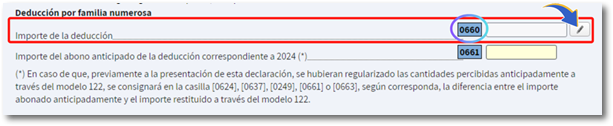

In the data entry window, double-click on box 0660 or on the button with the pencil icon next to the box.

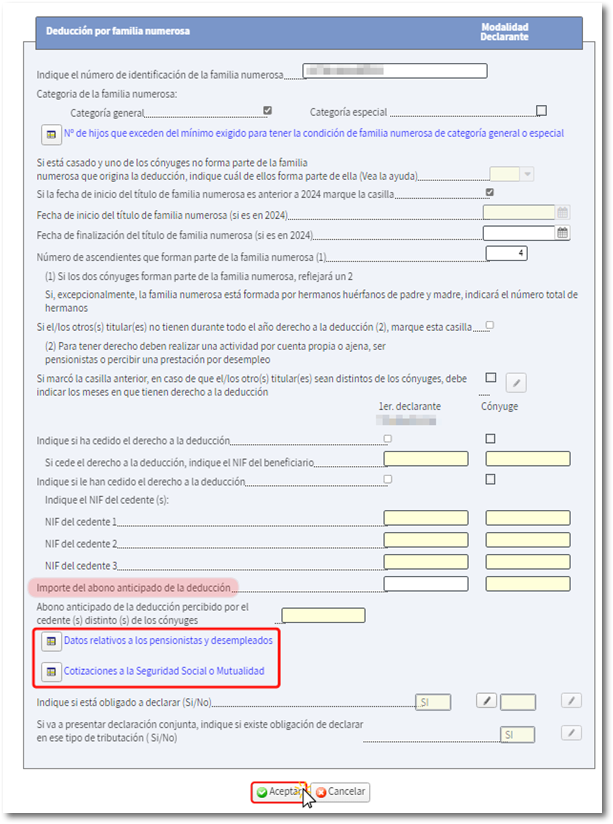

Fill in the required information, such as the identification number of the large family or inform whether you have received the advance payment of the deduction. Check whether you need to complete the data relating to pensioners or unemployed persons and Social Security or Mutual Insurance Contributions. When finished, press "Accept".

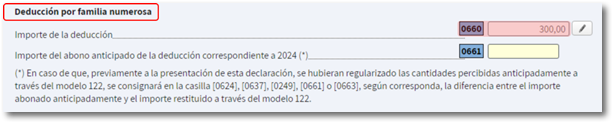

The amount of the deduction will be reflected in the corresponding box for the large family deduction (0660).

In the "Return Summary" you can see the updated result and the breakdown of the deductions applied.

To include this deduction in your tax return, go to " Draft/Tax Return Processing Service (Renta DIRECTA and Renta WEB) ", log in and, within your file, click on "Draft/Tax Return (Renta WEB)" in the "Available Services" section.

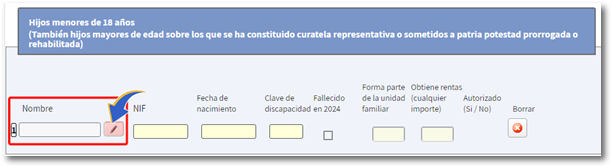

Check the data in the identification data window and in the "Children under 18 years of age" section, double-click on the "Name" field or press the pencil icon next to the concept to review the information of the children who generate this deduction, or include them if they do not appear.

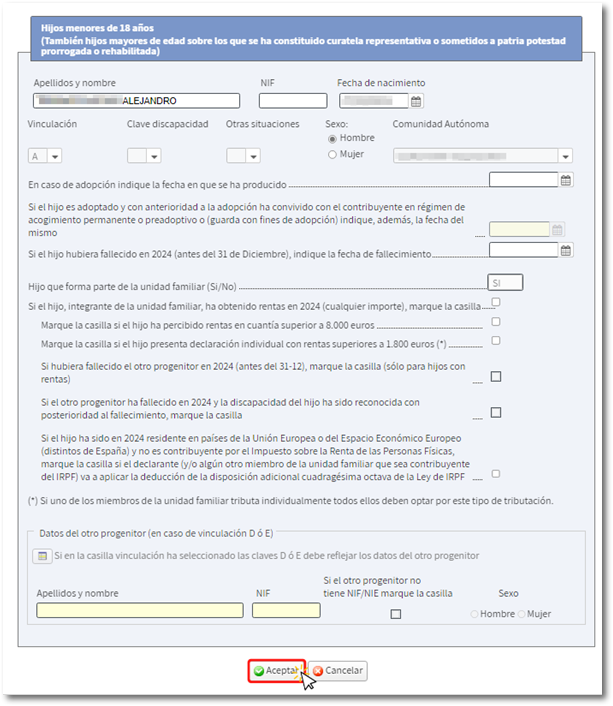

In the pop-up window, provide your identification and family details, then click "Accept." Verify that the data has been saved correctly and press "OK" again.

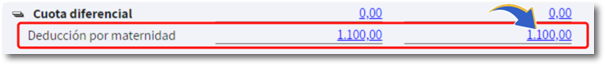

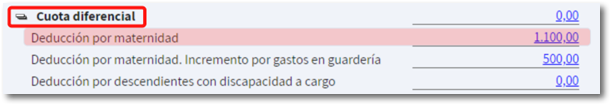

If you do not need to provide additional information to transfer tax data to the declaration, you will access the "Return Summary". As a general rule, the amount of the maternity deduction will already appear filled in. Locate the "Differential quota" section and the "Maternity deduction" concept. Click on the numerical link to access the section of the declaration where you can check and modify, if applicable, the details of this deduction.

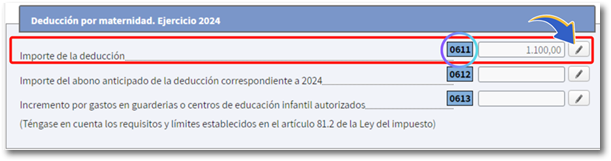

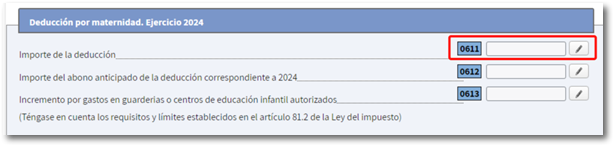

In the data entry window, double-click the appropriate box or the button with the pencil icon next to box 0611 "Deduction Amount" to edit this information.

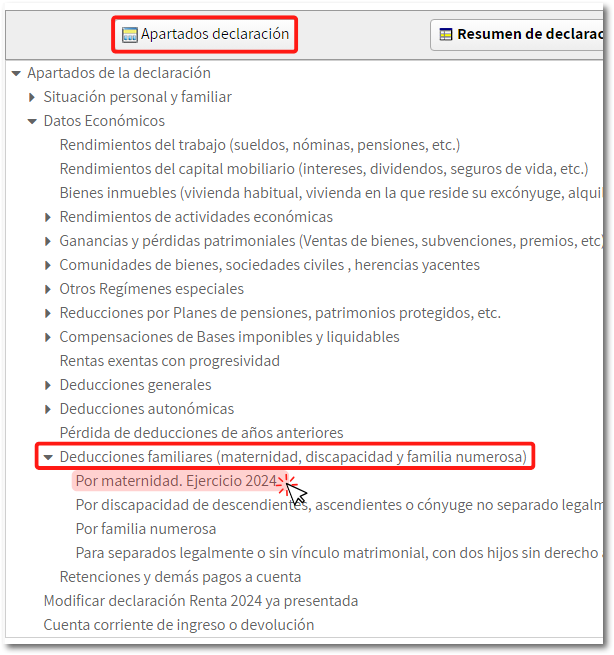

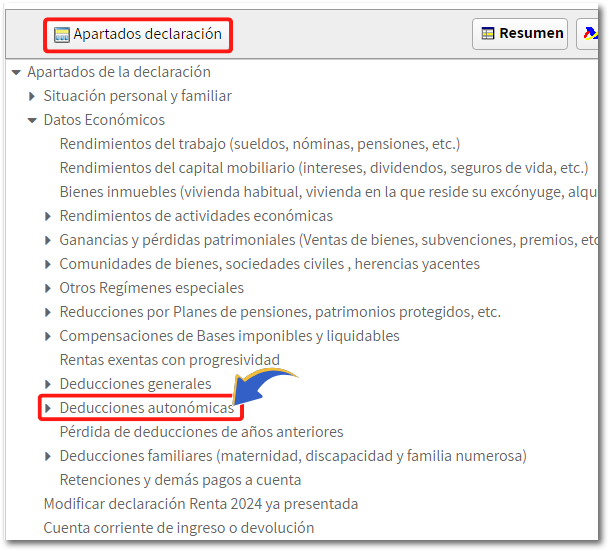

If the deduction does not initially appear in the declaration, from the "Return Summary" click on "Declaration Sections". Locate the section "Family deductions (maternity, disability and large family)" and access the concept "For maternity. Exercise 2024".

Double-click on box 0611 for "Deduction Amount" or the button with the pencil icon next to the box.

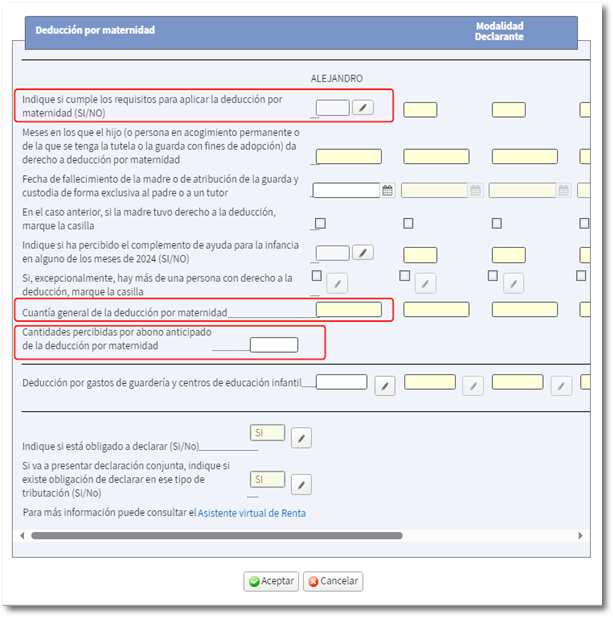

Please indicate whether you meet the requirements to apply this deduction, how and since when. You must also indicate whether you have received the advance payment and include the data for the increase for childcare expenses, if you can apply the increase for this type of expenses to the deduction. Before continuing, you will be prompted to review the information you entered.

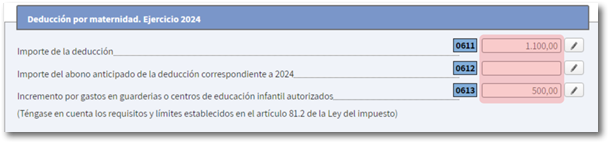

The amount will be reflected in box 0611.

The deduction applied and the result of the declaration after this change will be reflected in the "Return Summary" window.

Go to " Draft/Declaration Processing Service (Renta DIRECTA and Renta WEB) ", identify yourself and within your file click on "Draft/Declaration (Renta WEB)" in the "Available Services" section. Check the data in the identification data window and click "Accept".

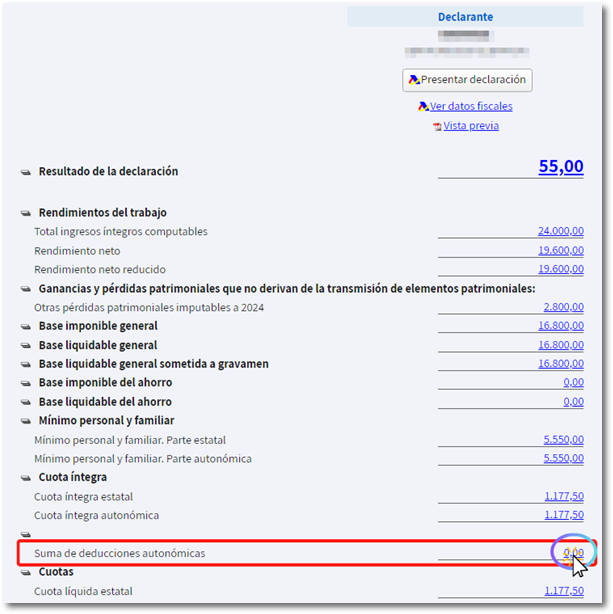

If you do not need to provide additional information to transfer tax data to the declaration, you will access the "Return Summary". Please note that it is not possible to enter data in the joint mode.

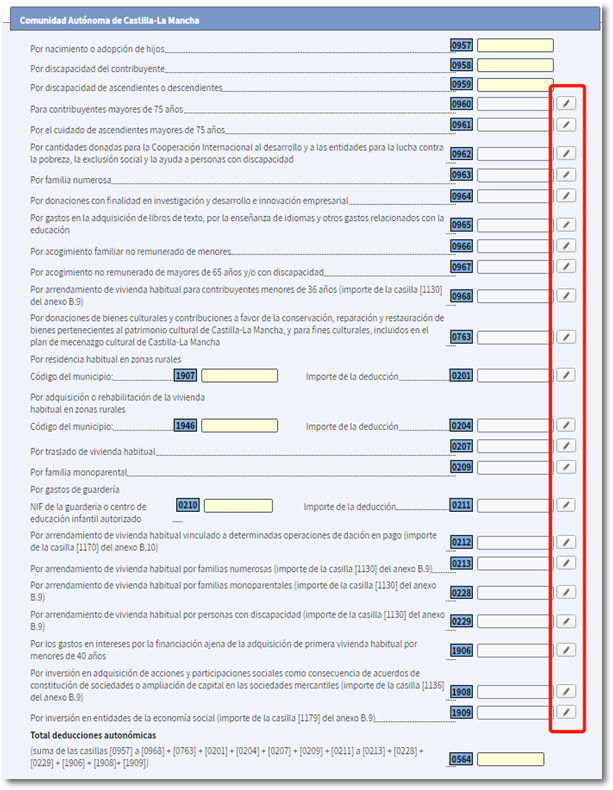

You can access the summary concepts by clicking on the numerical link in the "Sum of regional deductions" section of the declarant, spouse or other declarants.

Or from "Declaration sections" in the "Regional deductions" section.

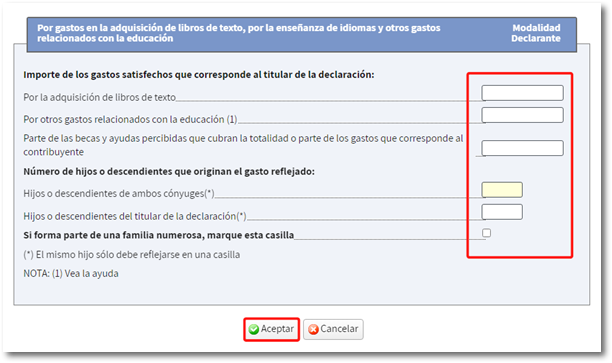

The application will take you directly to the list of deductions for your Autonomous Community. To enter data, double-click on the field or press the pencil icon next to the concept.

Check the appropriate options or enter the required data.

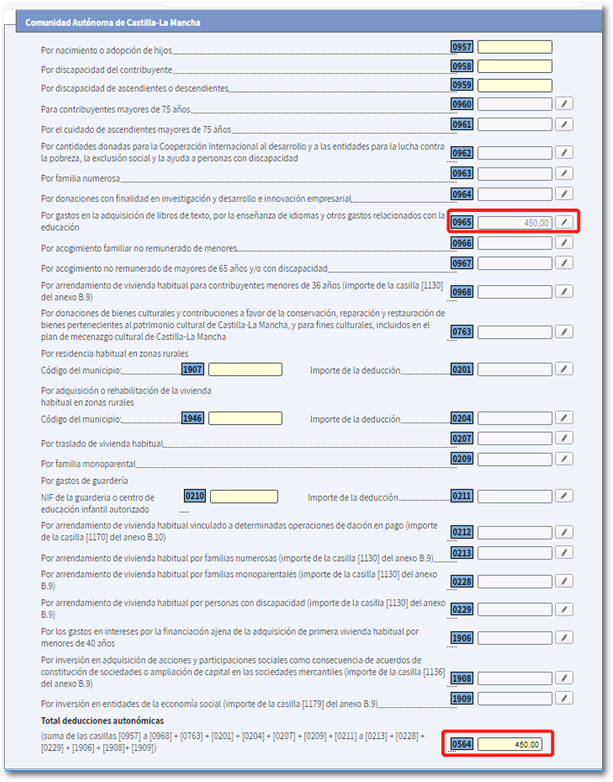

If the changes have been saved correctly and you are entitled to the deduction , the applied deduction will be displayed in the corresponding box.

If deductions are not applied on the return, there may be some condition that is not met for the deduction to apply. You can check the requirements that must be met for the deduction to be applied, within the corresponding section, by clicking on the "Help" button located at the top with the question mark (?).

Back in the "Return Summary" the amounts corresponding to the deduction will be reflected.