Tax Agency: Frequently Asked Questions. General issues

Skip information indexGeneral issues

It is a system for keeping records of Value Added Tax through the Electronic Office of the AEAT, by means of the quasi-immediate supply of billing records.

In this way, the SII allows the moment of registration or accounting of invoices to be brought closer to that of the actual execution of the economic operation underlying them.

The SII will be mandatory for the following taxpayers who have a monthly VAT settlement period:

-

Registered with REDEME (Monthly VAT Return Registry)

-

Large Businesses (turnover of over €6,010,121.04)

-

VAT Groups

- Holders of tax warehouses for gasoline, diesel or biofuels included in the objective scope of the Hydrocarbon Tax, as well as entrepreneurs or professionals who extract these products from tax warehouses (from 01/01/2025).

The SII will also be applicable to other taxpayers who voluntarily decide to join it.

Entrepreneurs or professionals not established in the Spanish territory of application of the Tax (TAI) who have the status of taxable persons with a monthly settlement period will be obliged to keep VAT record books and, since the entry into force of Royal Decree 596 /2016, they must take them through the electronic headquarters of the State Tax Administration Agency (SII).

An exception is made for those who are not established whose only translations carried out in the TAI are intra-Community acquisitions exempt according to article 26, section Three and Four of the Value Added Tax Act, and who do not submit Form 303. In such a case, they obtain the refund for the amounts borne in the TAI through the provisions of articles 119 or 119 bis of the Value Added Tax Act.

Similarly, the new SII can be applied to all other taxpayers who, established or not, choose to opt in voluntarily.

By choosing at any time in the census declaration (boxes 143 and 532 of form 036), being included from the day after the end of the settlement period in which said option was exercised.

Example: A company that opts for the SII, submitting form 036 on April 10, 202X, will be included in the system from July 1, 202X.

Those taxpayers who opt for the SII will maintain their quarterly settlement period.

Yes. Parties opting in must remain for the calendar year.

Those who choose the SII They must comply with the provision of billing records for at least the calendar year for which the option is exercised.

Once this is fulfilled, parties may opt out of the system in the tax register declaration (form 036) in the month of November prior to the start of the calendar year in which it comes into effect.

Royal Decree-Law 2/2026, of February 3, extends the extraordinary term for waiving the option for the application of SII for the fiscal year 2026 until February 16, 2026.

Unless the business owner or professional still has a monthly settlement period:

-

Exclusion from the REDEME means exclusion from the SII from the first day of the settlement period in which the exclusion agreement has been notified.

-

Discontinuing the application of the special regime for business groups means leaving the SII from the moment this takes place.

Excluded taxpayers shall be obliged to file forms 347 and 390.

Taxpayers applying the SII must keep the following Record Books on the Tax Agency's E-Office, supplying invoicing records electronically:

-

Issued Invoices Record Book.

-

Received Invoices Record Book.

-

Investment Goods Record Book.

-

Record Book for Certain Intra-Community Transactions.

To do this, the taxpayer must send the Tax Agency billing details and using this information the different Record Books will be configured, practically in real time.

This information will be sent electronically, specifically using Web Services based on XML message exchanges.

These messages will all have the same header stating information on the holder of each record book, as well as information for the year and period in which the transactions were performed. This header will be followed by a block containing the invoice contents.

Furthermore, the electronic supply of invoice records is done using an online form when the taxpayer has a small number of transactions or the taxpayer wishes to send specific invoice records separately.

This information shall be supplied in accordance with the record fields approved by the Ministry of Finance and Civil Service through the corresponding Ministerial Order HFP/417/2017, of 12 May

No. What shall be sent are the invoice record fields specified in the Ministerial Order HFP/417/2017, of 12 May, concerning information referred to in Royal Decree 596/2016 of 2 December.

A) Issued Invoices

Within four calendar days from the issue of the invoice, unless the invoices are issued by the recipient or by a third party, in which case, said period will be eight calendar days.

In any event, the supply of goods or services must be carried out before the 16th of the month in which the Tax on the transaction that is to be recorded accrues. However, for operations not subject to the Tax for which the invoice is issued, the last period will be established according to the date on which the transaction is carried out. This deadline coincides with the end of the term to issue an invoice in accordance with article 11 of the Royal Decree 1619/2012, thus if a business issues the invoice on the 15th day of the month following the accrual, that same day they should send the invoicing records through SII (except in the case of intra-community shipments).

Example 1: A businessman A provides a service to another businessman on 1 August 2025, issuing the corresponding invoice on the same day. The deadline for submitting the registration of this invoice through the SII ends on August 7.

Example 2: A business A provides a service to another business on 3 September 2025, issuing the corresponding invoice on 10 October 2025 (the deadline for issuance ends on 15 October). The term to send the record of this invoice through SII finishes on 15 October (operational on deadline).

Example 3: an employer makes a delivery within the EC to a French client. The transport of the goods begins on June 19, 2025, and the invoice is issued on July 15, 2025 (last day to issue the invoice in accordance with article 11.2 RD 1619/2012 and date on which the accrual of the operation occurs). The deadline for submitting the registration of this invoice through the SII ends on July 21.

B) Received Invoices

Within a period of four calendar days from the date on which the accounting record of invoice is made and, in any case, before the 16th of the month following the settlement period in which the corresponding operations have been included (period in which the input VAT is deducted).

The accounting of the invoice is understood to have taken place on the date of entry into the accounting system, regardless of the date shown on the accounting entry.

Example 4: A businessman who receives an invoice on July 9 of 2025 decides to record and deduct the incurred fee in form 303 for the month of July, proceeding to register it in his accounting records with an entry date in the system on August 13. The deadline for submitting the registration of this invoice through the SII ends on August 18, 2025 (the deadline applies, and August 15 is a Friday, a national holiday).

Example 5: A businessman who receives an invoice on August 9, 2025 proceeds to record it in his accounting records with an entry date in the system of October 13. The term to send the record of this invoice through SII finishes:

-

On October 15th, if you deduct the invoice in the September 303 model (the deadline applies).

-

On October 17th if you deduct the invoice in form 303 of October.

In accordance with previous examples, an invoice can be deducted once it has been received and it is entered in the record book of invoices received before the end of the term to submit Form 303, in which it is included. Nonetheless, it is important to take into account the deadline to send records through SII on the 15th day of the month following that in which the deduction takes place.

Example 6: an employer proceeds to account an invoice received, for which they do not have the receipt date. The date of entry into the system is October 13, 2025. The term to send the record of this invoice through SII finishes on 17 October. The bill can be deducted starting from the settlement period corresponding to October.

In the case of imports, the four calendar days apply from when the document stating the customs VAT settlement is recorded for accounting purposes, and in any event, before the 16th of the month following the settlement period in which the corresponding transactions are included (term in which the VAT borne is deducted).

Example 7: A businessman imports merchandise released for free circulation on October 25, 2025, with the acceptance of the SAD and settlement of VAT by Customs taking place on that same date. The entrepreneur decides to record and deduct the incurred fee in Form 303 for the month of October, proceeding to register it in the accounting records on November 10, 2025. The term to send the SAD record through SII finishes on 14 November.

C) Certain Intra-Community transactions

Within the four calendar days of the date of dispatch or transport or, if applicable, from the date of receipt of the goods in question.

D) Information on Investment Assets

Within the filing period of the last settlement of the year (up to 30 January).

E) Rectified invoices

Within four calendar days of the issue date or the accounting entry of the invoice, respectively.

In the event that the rectification determines an increase in the amount of the quotas initially deducted in accordance with the provisions of article 114.Two.1 LIVA, the term will be the general term of invoices received.

PERIODS WHEN INCLUSION IN THE SII TAKES PLACE ON A DATE OTHER THAN 1 JANUARY: The period for dispatching the information corresponding to the period between 1 January and the date of entry in the SII will be from the date of entry until the end of the fiscal year.

TERM CALCULATIONS: We must take into account that the calculation of the four and eight calendar day terms referred to above exclude Saturdays, Sundays and national holidays.

In the event that the deadline of the 15th of the following month falls on a Saturday, Sunday or national holiday, it will be moved to the first following business day.

No, it's about sending to the Tax Agency's E-Office certain information that is currently in:

-

Traditional VAT Registration Books

-

Invoices

-

Form 347

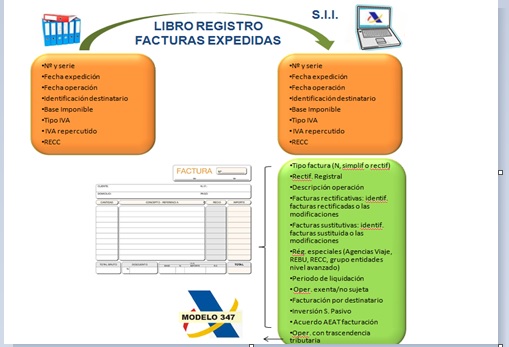

The information relating to the Register of Issued Invoices that must be communicated to the AEAT through the SII (contained both in the current Register Books and in the fields of the invoices themselves) is shown below:

INFORMATION TO BE SENT WITH THE S.I.I. (Immediate Information Sharing System)

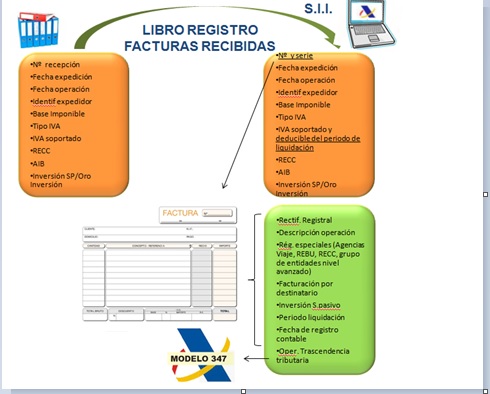

For its part, the information relating to the Record Book of Received Invoices that must be communicated to the AEAT through the SII (contained both in the current Record Books and the invoice fields) as follows:

INFORMATION TO BE SENT WITH THE S.I.I. (Immediate Information Sharing System)

Yes. This should be notified using Form 036 from June 2017, selecting box 740, stating in box 739 (page 5) the date of agreement (first mark cause 123 on page 1 "Modification of VAT details").

The Immediate Supply of Information system (SII) has the following advantages for the taxpayer:

-

Reduction of formal obligations, eliminating the obligation to submit forms 347 and 390.

-

Obtaining “Tax Data” since the electronic Office will have a “declared” and “verified” Registry Book with the contrast information from third parties that belong to the group of this system

Likewise, you will be able to access the information on invoices included in the record books of your clients and/or suppliers who apply the SII.

These tax details are a useful tool to assist in preparing the return as they will reduce errors, make things easier and enhance legal certainty.

-

Reduction in terms for filing VAT returns, since the Tax Agency has the information on transactions in almost real time and with greater detail on transactions.

-

Reduction in verification terms, for the same reasons as above.

-

Reduction in information requirements, since many of the current requirements are aimed at requesting invoices or data contained therein to verify certain operations.

In Royal Decree 596/2016 of 2 December on the modernisation, improvement and promotion of the use of electronic media in the management of Value Added Tax, which modifies the VAT Regulation approved by Royal Decree 1624/1992 of 29 December, the General Regulations for tax management and inspection actions and procedures and for the development of shared regulations for tax application procedures, approved by Royal Decree 1065/2007 of 27 July, and the Regulation governing invoicing obligations, approved by Royal Decree 1619/2012 of 30 November (Official State Gazette 6 December).

The fields for recording the information to be provided have been approved by the Ministry of Finance and Civil Service through the corresponding Ministerial Order HFP/417/2017, of 12 May

No

No. The withdrawal of the obligation to submit Form 390 shall be included in the Ministerial Order of the Ministry of Finance and Civil Service HFP/417/2017, of 12 May.

The Immediate Disclosure of Information (hereinafter, 'SII') will be applicable in the terms established by provincial regulations.

Starting in fiscal year 2026:

-

Those business owners with their tax domicile in Navarre, whose total volume of operations in the previous year exceeded 12 million euros, of which 75% or more were carried out in common territory, will apply the SII in accordance with state regulations.

-

Those business owners with their tax domicile in the Basque Country, whose total volume of operations in the previous year exceeded 12 million euros, of which 75% or more were carried out in common territory, will apply the SII in accordance with state regulations.

The aforementioned limit of 12 million euros was 10 million euros until the 2025 financial year (from 2022 for Navarre and from 2018 for the Basque Country).

Taxpayers must file the formal requirements required of them in accordance with the respective regulations, with the competent Regional or State Administration ratione loci, in accordance with the competency criteria for verification and inspection.

From the 2026 tax year onwards, the inspection authority for those taxpayers who must pay taxes in proportion to the volume of their operations carried out in the common and regional territories will correspond to the State when:

-

The taxpayer has their tax domicile in the common territory and their volume of operations in the previous year is less than or equal to €12 million.

-

The taxpayer has their tax domicile in the common territory and their volume of operations in the previous year is greater than €12 million, provided that the percentage of operations carried out in the foral territory is not equal to or greater than 75%, or 100% in the case of entities covered by the special regime of group of entities, in which case the competence would correspond to the competent Foral Council by reason of the territory.

-

The taxpayer has their tax domicile in the foral territory and their volume of operations in the previous year is greater than €12 million, provided that the percentage of operations carried out in the common territory is equal to or greater than 75%.

The aforementioned limit of 12 million euros was 10 million euros until the 2025 financial year (from 2022 for Navarre and from 2018 for the Basque Country).

The first records that must be submitted within four calendar days (excluding Saturdays, Sundays and national holidays) are those corresponding to the Registration Books of the first month or quarter from which the company is included in SII and which correspond to:

- Invoices issued from the 1st of the month in which the inclusion takes effect, which document transactions accrued in said month (or quarter), in the case of the Register of Invoices Issued.

- Invoices recorded in the accounts from the 1st of the month in which the inclusion takes effect, the deduction for which is applicable in the settlement period of said month (or quarter), in the case of the Record Book of Invoices Received.

- Goods whose transport or receipt takes place from the 1st of the month in which the inclusion takes effect, in the case of the Register of certain intra-Community operations.