FAQs

Skip information indexSpecific issues- Criterion of collections and payments in IRPF (art. 7.2.1º RIRPF) vs Special Regime of the VAT cash criterion (RECC)

They will be recorded with the operation code “07”.

Additionally, at the time of making the collections/payments corresponding to the operations subject to the RECC, the following columns must be entered:

Charges: date of collection, paid amounts, means of collection used, bank account or means of collection used.

Payments: payment date, paid amounts, used means of payment, bank account or means of payment used.

The average payment/charge will be made with one of the following:

01: Transfer

02: Check

03: Not charged/paid (accrual deadline, 31-12 of the year following the date of operation / forced accrual in bankruptcy proceedings)

04: Other means of collection/ payment

05: Direct debit.

If there are multiple payments, a line will be recorded for each payment.

The 31st of December of the year following the one in which the operation was carried out as it is the accrual date. The subsequent payments received will not generate any account entry.

In the "Payment/Collection Method" column, the value to be entered is 03.

The 31st of December of the year following the one in which the operation was carried out as it is the accrual date. The subsequent payments made will not generate any account entry.

In the "Payment/Collection Method" column, the value to be entered is 03.

Yes, taking into account the general accrual basis, without prejudice to collection data requirements.

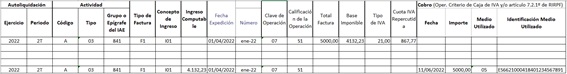

The invoice issued on April 1, 20XX must be registered in the Registry of Issued Invoices with the operation code “07”.

Once collected, the information must be provided in the Register of invoices issued for said collection, indicating, in addition to the common data ("Issue date", Invoice identification, " NIF Recipient", "Recipient name" and "Operation code"), the group of columns called "Collection": date of collection, paid amounts, means of collection used, bank account or means of collection used.

When the invoice has been identified in a fiscal year/period, it is not necessary to record it again in the subsequent collections/payments that take place in said fiscal year/period.

In the example, the invoice was registered in the 2Q with date 04/01/2022, so when the collection dated 06/11/2022 is registered as it is within the same period, it is only necessary to identify the common data of the invoice and the amounts of the corresponding collections.

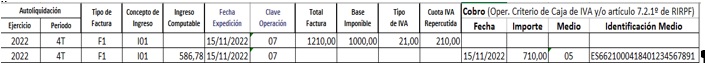

If the collections occur in a fiscal year/period other than the fiscal year/period of the original invoice registration, it will be necessary to completely identify the invoice to which the aforementioned collections/payments are linked.

In the example, if the invoice has not been collected in full in 2022 and a collection is made in the first quarter of 2023, the taxpayer must record the following in that period:

The record of collections and payments must be accompanied by the record of the invoice to which they are linked when appropriate (the original invoice to which the collections/payments that occur throughout the year are linked must be reflected in the Record Book, which is unique for each fiscal year).

Example 1

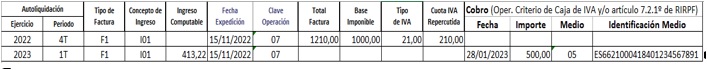

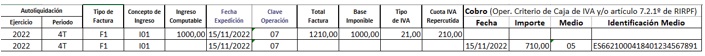

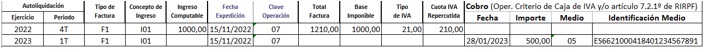

For example, let's see how to record in the 2023 Invoice Issued Registry Book an invoice issued in 4Q/2022 with collections in 2022 for an amount of 710 and in 1Q/2023 for an amount of 500, taking into account that in the 2023 Registry Books the source invoices for which there have been collections and payments in said fiscal year must be noted.

Thus, the 2022 Registry Book should show this content:

And the 2023 Registry Book should show this content:

Effects on personal income tax:

Given that the “Computable Income” must not include the output VAT fee, the amount of the VAT Tax Base corresponding to the collection made must be entered.

In the previous example, this calculation has been carried out as follows:

Collection date 11/15/2022:

Computable Income = Taxable Base * (Collection Amount/Total Invoice) = 1000.00 * (710.00/1210.00) = 586.58

Collection date 01/28/2023:

Computable Income = Taxable Base * (Collection Amount/Total Invoice) = 1000.00 * (500.00/1210.00) = 413.22

When entering in the column “Income Concept” = “I01" (Operating Income), the amount that will be transferred to the corresponding box “Operating Income” of form 100 will be the amount that the taxpayer has entered in the column “Computable Income”:

- In model 100 corresponding to the 2022 Personal Income Tax: 413.22

- In model 100 corresponding to the 2023 Personal Income Tax: 586.78

Effects on VAT:

The calculation carried out by the system to transfer to model 303 of the period to which the collection corresponds, the part of the Tax Base and the Output VAT Quota corresponding to the collection made is as indicated for personal income tax. These calculations do not have to be transferred to the Registry Book, they are only detailed to understand the amounts that are transferred by the system to form 303. Specifically:

“Taxable Base” box of type 21% of form 303 of Q4 2022:

BI at 21% = Taxable Base at 21% * (Collection Amount/Total Invoice) = 1000.00 * (710.00/1210.00) = 586.58

“Quota” box of type 21% of form 303 of the 4th quarter of 2022:

21% Fee = 21% Fee * (Collection Amount/Total Invoice) = 210.00 * (710.00/1210.00) = 123.22

(Note that 586.78 + 123.22 = 710.00, the amount of the collection received on 11/15/2022)

“Taxable Base” box of type 21% of form 303 of the 1st quarter of 2023:

BI at 21% = Taxable Base at 21% * (Collection Amount/Total Invoice) = 1000.00 * (500/1210.00) = 413.22

“Quota” box of type 21% of form 303 of the 1st quarter of 2023:

21% Fee = 21% Fee * (Collection Amount/Total Invoice) = 210.00 * (500.00/1210.00) = 86.78

(Note that 413.22 + 86.78 = 500.00, the amount of the collection received on 01/28/2023)

When recording an invoice corresponding to an operation subject to the Special Cash Criteria Regime with more than one collection line, it must be taken into account that in "Fiscal Year" and "Period" the value corresponding to the "Collection Date" of each line will be recorded.

Example 2

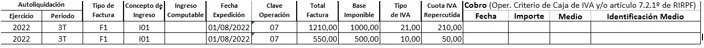

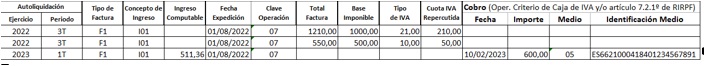

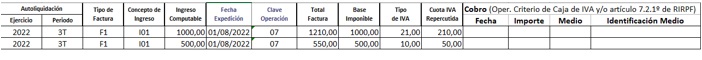

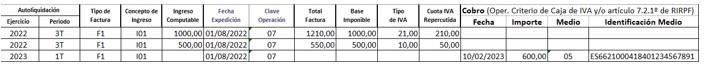

Let us now assume an invoice issued at the time the operation is carried out on 1-8-2022 with 2 VAT rates and 3 charges (1-11-2022, 10-2 -2023 and 10-15-2023).

It will be recorded in the 2022 Registry Book with the following lines:

- 2 lines with 2022-3T corresponding to the 2 VAT rates of the operation date 1-8-2022.

- 1 line with 2022-4T corresponding to the collection of 1-11-2022.

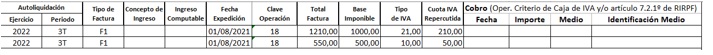

The 3Q 2022 Logbook should display this content:

The Logbook in 4Q 2022 should show this content:

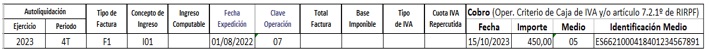

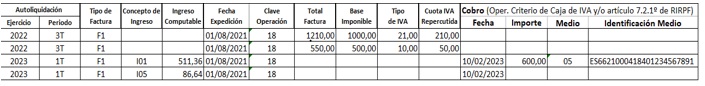

It will be recorded in the 2023 Registry Book with the following lines:

- 2 lines with 2022-3T corresponding to the 2 VAT rates of the operation date 1-8-2022.

- 1 line with 2023-1T corresponding to the collection of 02-10-2023.

- 1 line with 2023-4T corresponding to the collection of 10-15-2023.

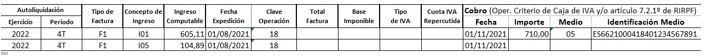

The 1Q 2023 Logbook should display this content:

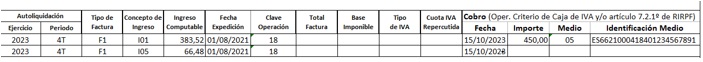

The 4Q 2023 Logbook should display this content:

Effects on personal income tax:

Given that the “Computable Income” must not include the VAT amount charged, the amount of the total VAT Tax Base corresponding to the collection made must be entered. In cases of more than one type of VAT, both the sum of the Tax Bases of each type (1000.00+500.00) and the sum of the Total Invoice of each type of VAT must be taken into account (1210.00 +550.00).

In the example, this calculation has been carried out as follows:

Collection date 01/11/2022:

Computable Income = ∑ Taxable Base * (Collection Amount / ∑ Total Invoice) = 1500.00 * 710.00/1760.00 = 605.11

Collection date 02/10/2023:

Computable Income = ∑ Taxable Base * (Collection Amount / ∑ Total Invoice) = 1500.00 * 600.00/1760.00 = 511.36

Collection date 10/15/2023:

Computable Income = ∑ Taxable Base * (Collection Amount / ∑ Total Invoice) = 1500.00 * 450.00/1760.00 = 383.52

When entering in the column “Income Concept” = “I01" (Operating Income), the amount that will be transferred to the corresponding box “Operating Income” of form 100 will be the amount that the taxpayer has entered in the column “Computable Income”:

- In model 100 corresponding to the 2022 Personal Income Tax: 605.11

- In model 100 corresponding to the 2023 Personal Income Tax: 894.88 (511.36+383.52)

Effects on VAT:

The calculation carried out by the system to transfer to model 303 of the period to which the collection corresponds, the part of the Tax Base of each type and the Output VAT Quota of each type corresponding to the collection made is analogous to that indicated for personal income tax, but, in this case, the tax base of each type is taken into account. Specifically, the calculations for model 303 for Q4 2022 are shown (for Q1 and Q4 2023, only the amount of the charge would have to be changed in the equation):

“Taxable Base” box of type 21% of form 303 of Q4 2022:

BI at 21% = Taxable Base at 21% * (Collection Amount/∑ Total Invoice) = 1000.00 * 710.00/1760.00 = 403.41

“Quota” box of type 21% of form 303 of the 4th quarter of 2022:

21% Fee = 21% Fee * (Collection Amount/∑ Total Invoice) = 210.00 * 710.00/1760.00 = 84.72

“Taxable Base” box of type 10% of form 303 of Q4 2022:

BI at 10% = Taxable Base at 10% * (Collection Amount/∑ Total Invoice) = 500.00 * 710.00/1760.00 = 201.70

“Quota” box of type 10% of form 303 of the 4th quarter of 2022

:

10% Fee = 10% Fee * (Collection Amount/∑ Total Invoice) = 50.00 * 710.00/1760.00 = 20.17

(Note that 403.41+84.72+201.70+20.17 = 710.00, the amount of the collection received on 11/01/2021)

In personal income tax:

The detailed explanation in the answer to question 6 is completely applicable to this case.

In VAT:

In example 1:

The amounts that are transferred by the system to model 303 of 4Q of 2022 will be:

- “Taxable Base” box for rate 21%: 1000.00

- “Quota” box of type 21%: 210.00

No impact on model 303 regarding the payments received.

In example 2:

The amounts that are transferred by the system to model 303 of 3Q of 2023 will be:

- “Taxable Base” box for rate 21%: 1000.00

- “Quota” box of type 21%: 210.00

- “Taxable Base” box for the 10% rate: 500.00

- “Quota” box of type 10%: 50.00

No impact on model 303 regarding the payments received.

NOTE: The “Operation code” to be entered must be “01”.

Example 1:

The Logbook in 4Q 2022 should show this content:

The 1Q 2023 Logbook should display this content:

Effects on personal income tax:

Given that the “Computable Income” must not include the output VAT amount, the amount of the VAT Tax Base must be entered at the time the transaction has been accrued.

When entering in the column “Income Concept” = “I01" (Operating Income), the amount that will be transferred to the corresponding box “Operating Income” of form 100 will be the amount that the taxpayer has entered in the column “Computable Income”:

- In model 100 corresponding to the 2022 Personal Income Tax: 1000.00

- In model 100 corresponding to the 2023 Personal Income Tax: 0.00

Effects on VAT:

The detailed explanation in the answer to question 6, regarding the transfer of amounts to form 303, is completely applicable to this case.

Example 2:

The 3Q 2022 Logbook should display this content:

The 4Q 2022 Logbook should display this content:

The 1Q 2023 Logbook should display this content:

The 4Q 2023 Logbook should display this content:

Effects on personal income tax:

Given that the “Computable Income” must not include the output VAT amount, the amount of the VAT Tax Base must be entered at the time the transaction has been accrued.

In this example:

When entering in the column “Income Concept” = “I01" (Operating Income), the amount that will be transferred to the corresponding box “Operating Income” of form 100 will be the sum of the amounts that the taxpayer has entered in the column “Computable Income”:

- In model 100 corresponding to the 2022 Personal Income Tax: 1500.00 (1000.00+500.00)

- In model 100 corresponding to the 2023 Personal Income Tax: 0.00

Effects on VAT:

The detailed explanation in the answer to question 6 regarding the transfer of amounts to form 303 is completely applicable to this case.

Example 1

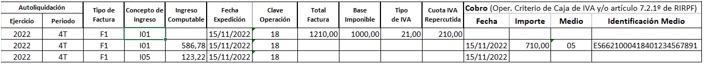

The 4Q 2022 Logbook should display this content:

The 1Q 2023 Logbook should display this content:

Effects on personal income tax:

Since the taxpayer is in the special regime of the equivalence surcharge, the “Computable Income” will include, in addition to the amount of the VAT Taxable Base (Income Concept: “I01”), the amount corresponding to the output VAT fee (Income Concept “I05”), corresponding to the collection received.

In the previous example, this calculation has been carried out as follows:

Collection date 11/15/2022:

Computable Income I01 = Taxable Base * (Collection Amount/Total Invoice) = 1000.00 * (710.00/1210.00) = 586.78

Computable Income I05 = VAT Fee * (Collection Amount/Total Invoice) = 210.00 * (710.00/1210.00) = 123.22

Collection date 01/28/2023:

Computable Income I01 = Taxable Base * (Collection Amount/Total Invoice) = 1000.00 * (500.00/1210.00) = 413.22

Computable Income I05 = VAT Fee * (Collection Amount/Total Invoice) = 210.00 * (500.00/1210.00) = 86.78

When entering in the column “Income Concept” = “I01" and “I05", the amounts that will be transferred to the “Operating income” and “VAT accrued” boxes, respectively, of form 100 will be the amounts that the taxpayer has been recorded in the “Computable Income” column:

In model 100 corresponding to the 2022 Personal Income Tax:

- To the “Operating Income” box: 586.78 (the one of the concept “I01”)

- To the “VAT accrued” box: 123.22 (the one in the concept “I05”)

In model 100 corresponding to the 2023 Personal Income Tax:

- To the “Operating Income” box: 413.22 (the one from the concept “I01”)

- To the “VAT accrued” box: 86.78 (the one from the concept “I05”)

Effects on VAT:

No incident.

Example 2

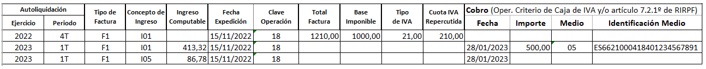

The 3Q 2022 Logbook should display this content:

The 4Q 2022 Logbook should display this content:

The 1Q 2023 Logbook should display this content:

The 4Q 2023 Logbook should display this content:

Effects on personal income tax:

Since the taxpayer is in the special regime of the equivalence surcharge, and has more than one type of VAT, in the “Computable Income” the amount of the sum of the Tax Bases of each type must be taken into account (Income Concept: “I01”), the amount of the sum of the VAT payments charged (Income Concept “I05”) and the sum of the Total Invoice of each type of VAT, corresponding to the collection received.

In the previous example, this calculation has been carried out as follows:

Collection date 01/11/2022:

Computable Income I01 = ∑ Taxable Base * (Collection Amount / ∑ Total Invoice) = 1500.00 * 710.00/1760.00 = 605.11

Computable Income I05= ∑ VAT Fee * (Collection Amount/∑ Total Invoice) = 260.00 * 710.00/1760.00 = 104.89

Collection date 02/10/2023:

Computable Income I01 = ∑ Taxable Base * (Collection Amount / ∑ Total Invoice) = 1500.00 * 600.00/1760.00 = 511.36

Computable Income I05= ∑ VAT Fee * (Collection Amount/∑ Total Invoice) = 260.00 * 600.00/1760.00= 88.64

Collection date 10/15/2023:

Computable Income I01 = ∑ Taxable Base * (Collection Amount / ∑ Total Invoice) = 1500.00 * 450.00/1760.00 = 383.52

Computable Income I05= ∑ VAT Fee * (Collection Amount/∑ Total Invoice) = 260.00 * 450.00/1760.00= 66.48

When entering in the column “Income Concept” = “I01" and “I05", the amounts that will be transferred to the “Operating income” and “VAT accrued” boxes, respectively, of form 100 will be the amounts that the taxpayer has been recorded in the “Computable Income” column:

In model 100 corresponding to the 2022 Personal Income Tax:

- To the “Operating Income” box: 605.11 (the one in the concept “I01”)

- To the “VAT accrued” box: 104.89 (the one from the concept “I05”)

In model 100 corresponding to the 2023 Personal Income Tax:

- To the “Operating Income” box: 894.88 (that of the concepts “I01”: 511.36+383.52)

- To the “VAT accrued” box: 155.12 (the one for the concepts “I05”: 88.64+66.48)

Effects on VAT:

No incident.