FAQs

Skip information indexRecord book of invoices received (VAT) and purchases and expenses (IRPF)

Both may coincide unless, among other situations, when the deduction will be carried out in a different settlement period to the one in which the invoice is received within the four years following the accrual.

The recipient of the transaction will record the data of the invoice received. You must calculate and record the incurred fee corresponding to said invoice, as well as complete the “Deductible Fee” column. You must mark an S in the Taxpayer Investment column.

No recordings shall be made in the Issued Invoices Record Book.

The invoice received from the community supplier will be recorded in the Register of Invoices Received and will be identified using code 2.NIF - VAT” in the ID type column. The “Country Code” will not be mandatory.

In the field "Special regime code or Importance" the value of 09 is stated. The incurred fee corresponding to the aforementioned invoice must be calculated and recorded, as well as the “Deductible Fee” column must be completed.

No recordings shall be made in the Issued Invoices Record Book.

In these cases, it should not be reported with the “Investment Taxable Subject” field, which is only used when the declarant is a taxable subject of the Tax in accordance with the provisions of articles 84.One.2 and 4 of the VAT Law, as long as they have their origin in operations other than intra-community acquisitions of goods and services.

In the case of imports, we will consider, for the purposes of the registration books, the following documents: the invoice from the non-EU supplier of current goods (only for the purposes of PIT), he SAD and the freight forwarder's invoice.

When the invoice from the non-EU supplier is received and paid prior to the admission of the current goods at Customs, an accounting receipt (invoice type F6) of the expense for the amount of the invoice will be recorded in the Personal Income Tax Purchase and Expense Record Book. However, if the taxpayer chooses to carry out the registration with the entry of current goods into the warehouse, said accounting receipt will not be recorded.

When the import takes place, it will be recorded in the Register of Invoices Received of the VAT and in the Personal Income Tax Purchase and Expense Record Book the SAD (single administrative document). For invoice number and date of issue, you should enter the reference number on the SAD itself and the date of admission by the Customs Administration, respectively.

On the other hand, the "VAT Rate", the "Tax Base" and the "Input VAT Quota" must be entered, as well as the "Deductible Quota" column must be completed.

Under Supplier identification details, enter the details for the importer and record book holder.

When registering the SAD, the following details must be taken into account:

- The "Taxable Base" will be indicated as the Customs Value of the merchandise, plus any other taxes that accrue outside the territory of application, plus any import taxes and any accessory expenses that are not part of the Customs Value and that occur up to the first place of destination within the community (Taxable Base, box 47 SAD).

- The amount to be paid will be entered as "Input VAT Fee" and "Deductible Fee".

- As "Deductible Expense" the difference between the Taxable Base of the SAD and the amount of the invoice of the non-EU supplier that has been paid prior to the admission of the SAD. But if the taxpayer chooses to carry out the registration with the entry of current goods into the warehouse, the Taxable Base of the SAD will be recorded.

Any expenses incurred subsequent to the admission of the SAD not included in the tax base of the VAT on the import will generate the registration of separate invoices. The only part of the forwarding agent's invoice which will be registered will be that corresponding to the provision of its service (not the amount of VAT on the import required from the customer as advanced payment).

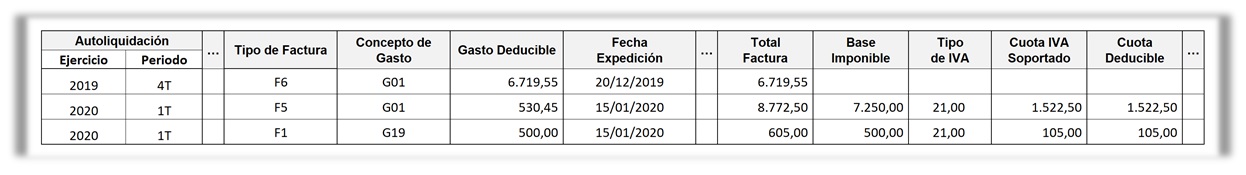

Example: An import operation is carried out on 15-1-2020 through the Barcelona Customs for which the following invoices are issued:

- Invoice from the US Supplier dated 21-12-2019 and payment to said supplier on the same day, with BASE 10,000 USD, corresponding to €6,719.55.

- Invoice from the National Freight Forwarder dated 15-1-2020 and paid on the same day, with the following amounts:

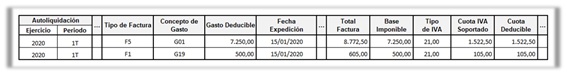

The following entries must be made in the Record Book of VAT Invoices Received:

- The SAD with issue date 01-15-2020 and invoice type “F5” (Imports - SAD-), recording the reference number as the identification number, taxable base €7,250 and fee €1,522.50. (The foreign supplier's invoice will not be registered).

- The freight forwarder invoice with issue date 01-15-2020 and invoice type “F1” (Invoice in which the recipient is identified -articles 6, 7.2 and 7.3 of RD 1619/2012-), recording only the provision of services subject to and not exempt from VAT with a tax base of €500 and a fee of €105.

The concepts invoiced by the freight forwarder that correspond to supplies or payments made on behalf of the importer must not be recorded.

The following notes must be made in the Personal Income Tax Purchases and Expenses Record Book:

- The invoice from the non-EU supplier with issue date 20-12-2019, with invoice type “F6” (accounting receipt) and with a deductible expense of €6,719.55. Leaving the tax base and the VAT quota without content.

- The SAD with issue date 01-15-2020 and invoice type “F5” (Imports - SAD-), recording as identification number the reference number, taxable base €7,250, fee €1,522.50 and the deductible expense of €530.45 corresponding to the rest of the concepts that make up the taxable base once the invoice from the non-EU supplier has been discounted.

- The freight forwarder invoice with issue date 01-15-2020 and invoice type “F1” (Invoice in which the recipient is identified -articles 6, 7.2 and 7.3 of RD 1619/2012-), recording only the provision of services subject and not exempt from VAT with a tax base of €500, a VAT fee of €105 and a deductible expense of €500.

Alternatively, when the taxpayer chooses to carry out the registration with the entry of current goods into the warehouse, the following notes must be made:

- The SAD with issue date 01-15-2020 and invoice type "F5" (Imports - SAD-), recording as identification number the reference number, taxable base €7,250, fee €1,522.50 and the deductible expense of €7,250.

- The freight forwarder's invoice with issue date 01-15-2020 and invoice type "F1" (Invoice in which the recipient is identified -articles 6, 7.2 and 7.3 of RD 1619/2012-), recording only the provision of services subject and not exempt from VAT with a tax base of €500, a VAT fee of €105 and a deductible expense of €500.

The concepts invoiced by the freight forwarder that correspond to supplies or payments made on behalf of the importer must not be recorded.

And if the taxpayer has opted to keep personal income tax and VAT together in the unified Record Book of Invoices Received, Purchases and Expenses, the following entries must be made:

Alternatively, when the taxpayer chooses to carry out the registration with the entry of current goods into the warehouse, it may be done with the following entries:

The concepts invoiced by the freight forwarder that correspond to supplies or payments made on behalf of the importer must not be recorded.

(1) Taxes, accessory expenses, etc. generated until reaching the first destination point in the interior of the Community.

(2) Article 64 LIVA.

Yes, as indicated in art. 67.2 RIVA . When the entire input tax is deductible, the same content that appears in the column “Input VAT quota” will be entered in the “Deductible fee” column.

If a pro rata is applied, the deductible VAT amount should be stated based on the percentage of the provisional deduction.

The issuer of the receipt will record it in the Record Book of Received Invoices with operation code "02" and invoice type "F6"

The tax base will be the base on which the compensation is calculated and the total amount of the consideration will be indicated as "Total invoice".

The information corresponding to the compensation percentage will be recorded in the "Type of compensation" column. VAT"and the amount of compensation resulting from applying said percentage to the tax base in the " VAT input quota" column; The amount of compensation will be recorded as a deductible fee

Yes, taking into account that in the columns "Type of VAT", " VAT input quota" and "Deductible quota" will be entered as zero. The amounts included in the "Total invoice" column will match those in the "Taxable base" column.

Yes, taking into account that zero will be entered in the columns "VAT Type", "Input VAT Rate" and "Deductible Rate". The amounts included in the "Total invoice" column will match those in the "Taxable base" column.

This receipt is not considered an invoice, which means that it is an operation that has no significance for theVAT but yes for him PIT. Therefore, the common and exclusive fields of the Personal Income Tax will be recorded in the Record Book of Invoices Received and Purchases and Expenses.

This receipt is not considered an invoice, which means that it is an operation that has no significance for theVAT but yes for him PIT. Therefore, the common and exclusive fields of the Personal Income Tax will be recorded in the Record Book of Invoices Received and Purchases and Expenses.

-

Invoices are received on the same date.

-

They come from a single supplier.

-

The total amount of the operations, VAT not included, does not exceed 6,000 euros.

-

The amount of the operations documented in each invoice does not exceed 500 euros, VAT not included.

Simplified invoices do not include the separately charged fee (except those that are qualified – art. 7.2 and 3 Billing Regulations).

In these cases, the "Quota" column will not need to be completed.VAT supported", it will only be mandatory to fill in the tax rate and one of the following two fields: gross tax base or total amount. If you only provide the total amount, the gross tax base must state a zero value.

Zero will be recorded as "Deductible fee".

If there are several tax rates in the breakdown of the operation, the taxable base and the tax rate must be recorded.

The receiver must register the invoice with the key F1 and it will be registered by assigning the invoice a sequential number that cannot be the same as another already registered with the same date and issuer, and the column containing the registration number assigned to the presentation in the registry of the authorization agreement that covers that registration will be completed.

Before making the entry in the registry book, in order to identify these invoices through their series, the taxpayer who has obtained an authorization granted in accordance with the provisions of article 62.5 of the Value Added Tax Regulations must send a copy of the authorization in the procedure of the electronic headquarters of the Tax Agency provided for providing it.

When an invoice is entered into the register under an authorisation for simplification of invoicing or authorised registration systems in accordance with the provisions of article 62.5 RD 1624/1992 ( RIVA ), must be identified in the corresponding book, recording as a series the registration number of the authorization (“RGE#############”) obtained by electronically submitting said authorization at the electronic headquarters of the Agency

01: General regime operation.

02: If it is an operation for which compensation is paid to suppliers under the Special Regime for Agriculture, Livestock and Fishing (REAGYP), the value 02 will be entered in the column "Operation Key", the information corresponding to the compensation percentage will be entered in the "VAT Rate" column and the amount of compensation resulting from applying said percentage to the tax base in the "Input VAT Quota" column.

03 : Operations to which the special regime for used goods, works of art, antiques and collector's items applies.

04 : Special regime for gold investment.

05 : Special scheme for travel agents.

06 : Special regime for group of entities in VAT (Advanced Level).

07 : If the operation is affected by the special regime of the cash criterion, the value 07 will be recorded in the "Operation Code" column and the information corresponding to each payment, partial or total, in the group of columns called "Payment", taking into account that in the "Means Used (Payment)" column the value that corresponds to the following will be recorded:

- 01: Transfer

- 02: Check

- 03: Not paid (accrual deadline, 31-12 of the year following the date of operation / forced accrual in bankruptcy proceedings)

- 04: Other payment methods

- 05: Direct debit

08 : Transactions subject to the IPSI / IGIC (Tax on Production, Services and Imports / General Indirect Canary Islands Tax).

09: Intra-Community acquisitions of goods and provision of services.

12 : Business premises leasing operations.

13 : Invoice corresponding to an import (reported without associating it with a SAD).

18 : Operations of activities included in the Special Equivalence Surcharge Regime (RERE)

19: Operations of activities included in the Special Regime for Agriculture, Livestock and Fisheries (REAGYP)

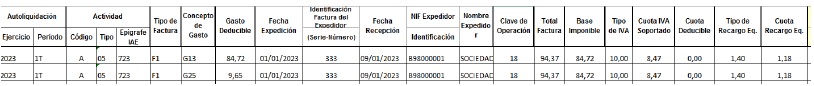

The transaction will be recorded with a two-line entry, stating:

- In the first line and with the concept of expense to which the invoice refers (for example, G01 if it corresponds to the purchase of stock), the “Tax Base” is transferred to the “Deductible Expense” column and is left without content. the “Deductible Fee” for being covered by the special VAT equivalence surcharge regime.

- In the second line, given that the taxpayer is covered by the special VAT equivalence surcharge regime and the “Input VAT Quota” is not subject to self-assessment in VAT form 303 but it does constitute another expense of the activity carried out in IRPF, concept G25 will be entered and in “Deductible Expense” the sum of the columns “Input VAT Quota” and “Eq Surcharge Quota.” of the first line.

The operation key in this case will be 18 (unified books)

For example, if the taxpayer covered by the special VAT equivalence surcharge regime receives an invoice for €100.00 of tax base with a VAT at 21%, how should he record the expense?

The input VAT amount is only a deductible expense for Personal Income Tax to the extent that it is not a deductible amount for VAT, as happens when the pro rata rule is applied. However, the expenditure resulting from applying the provisional apportionment will be subject to an adjustment as a consequence of the regularisation of the apportionment made through form 303/322 in the last period of the fiscal year.

Thus, when the final pro rata is calculated and has been regularized in the declaration-settlement of the last VAT period because it was different from the provisional pro rata, an expense entry will be made for the input VAT quota that is not deductible from VAT in the Purchases and Expenses Record Book, for the amount of the adjustment and the corresponding sign depending on whether the final proration is greater (negative) or less (positive) than the provisional one.

In said entry, "SF" will be entered in the "Invoice Type" column, "G25" in the "Expense Concept" column, the " NIF of the Issuer" will be left blank, in the "Issuing Party Name" column, the FINAL PRO RATA ADJUSTMENT will be entered and, depending on the direction of the adjustment, in the "Deductible Expense" column, the following will be entered:

-

If the final apportionment is less than the provisional apportionment: the amount, with a positive sign, corresponding to the input VAT quota that is no longer deductible in VAT as a consequence of the reduction of the definitive proportion with respect to the provisional one.

-

If the final apportionment is greater than the provisional apportionment: the amount, with a negative sign, corresponding to the input VAT quota that has become VAT deductible as a result of the increase in the definitive prorata with respect to the provisional one.

If it is an operation related to a capital asset, it must be recorded in the column with the S mark to identify that it corresponds to boxes with that name in the model.

If the taxpayer decides that an invoice will be deducted in the future and not in this period in which it is registered, this column will be filled out with the mark S and nothing will be said in the deduction period and year.

When the obligated party decides to deduct an invoice from an entry corresponding to a previous "Fiscal Year" and "Period" in which it was indicated that it would be "Deductible in a Subsequent Period" and said field now has the value "S", in the Deduction Period field the "Fiscal Year" and "Period" in which the invoice is deducted must be entered.

Thus, if in an entry referring to the year and self-assessment period X, "S" is entered in the Deductible in Subsequent Period column, the corresponding invoice is not taken into account when calculating form 303 for year and period X, without the need to indicate the specific Deduction Period (which, we suppose, will be decided to be done in a subsequent period Y).

However, when said Period Y arrives in which the obligated party decides to deduct said invoice, he will have to make a new entry in the Record Book of Received Invoices with "Fiscal Year" and "Period" of self-assessment Y, completing an "S" in the "Deductible in Subsequent Period" indicator and recording the fiscal year and period Y in "Fiscal Year" and "Period" of the Deduction Period column.

There is an obligation to issue an invoice, (articles 2 and 3 RD 1619/2012 that regulates billing obligations) this must be registered, and must indicate the taxable base “VAT Type” and “Input VAT quota and, where applicable, the deductible quota, the operation key and its identification of whether it is an operation or without reverse charge, as well as the type of invoice that is being registered.

The amounts included in the “Total invoice” column will coincide with those corresponding to the “Taxable base” and “Input VAT quota” columns.

Information on the applicable prorated percentage will be provided through form 303. However, the following should be noted:

-

the "deductible tax liability" field will be calculated by applying the provisional pro-rata.

-

In the case of investment goods, information on adjustments from the Record book for investment goods shall be supplied annually.

It includes two types of documents:

-

Any document that supports the book entry of the operation when the person who carries out the operation is an employer or professional not established in the Community (art. 2.4 Invoicing regulation).

-

Documents that are not considered invoices but which are eligible for the deduction. They will be registered with the number assigned to them by the owner of the Book, which cannot be the same as another already reported with the same date and issuer.