Evolution of the calculation base consistent with the improvement in voluntary compliance. Indicator III of the Strategic Plan

The main objective guiding the actions of the Tax Agency is to improve compliance during the voluntary period, increasing the induced effect of its control actions and decreasing the weight of the quantitative results obtained in these activities.

Traditionally, the assessment of its performance has been closely linked to the results of control and the fight against fraud that the Tax Agency makes public annually. These results quantify the Agency's control activities on a cash basis (income from settlements, regardless of the year in which the settlement was made), but they cannot be considered as the sole and main factor that measures its performance, since an approach based solely on the sum of quantitative results without considering extraordinary results may not adequately reflect said activity. It is therefore essential to take a broader approach.

This third strategic indicator analyses the evolution of the calculation base, which is a more limited concept than the results of the control actions. The concept of calculation base, defined for the purposes of determining the financing system of the Tax Agency, includes direct income from the control actions and the reductions in refunds derived from settlements resulting from verification and investigation actions . In addition, other concepts such as income from crimes against the Public Treasury are excluded from the calculation base. In monitoring this indicator, the existence of extraordinary results is also taken into account, which due to their amount or nature may be difficult to repeat and may also distort comparisons between years.

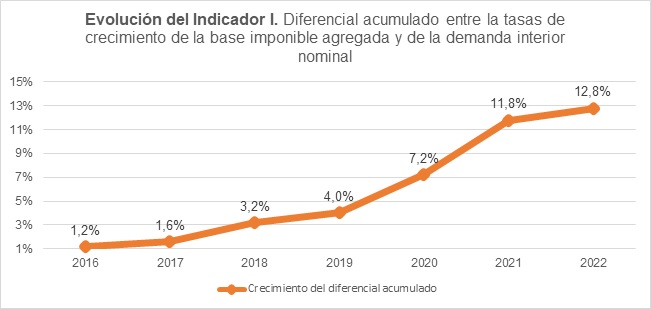

This strategic indicator complements the two previous ones ( the expansion of the tax bases and measurement of the induced effects ), which measure the evolution of voluntary compliance with tax obligations in the medium term. Ultimately, the basis of this indicator is to compare the evolution of control actions (calculation basis) in relation to the evolution of voluntary compliance. To this end, the differential that may exist between the growth rate of the aggregate tax bases and that of the main economic magnitudes must be considered, as well as other factors involved, such as the reduced or insured tax bases, or the induced effects of preventive and control actions.

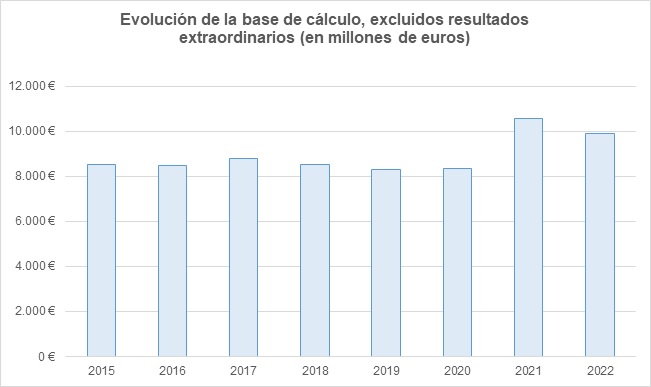

The evolution of the calculation base without taking into account the extraordinary results , in millions of euros, has been the following:

The evolution of the calculation base, excluding extraordinary results, has remained relatively stable over the years, with a slight decrease overall. However, in 2021 there was an increase due to an increase in ordinary results, which was balanced in 2022. In this last year, there was a return to the previous trend, with a slight decrease in ordinary results (-6.39%), although this was offset in the overall calculation base by the increase in extraordinary results, which grew by 10.28% (from 3,102.955 to 3,421.814 million euros). As indicated in the Strategic Plan of the Tax Agency 2020-2023, improvements in voluntary compliance are expected to lead to a stabilization trend or even a gradual decrease in real terms of the calculation base, without considering any extraordinary results that may arise.

As reflected in Indicator I, with the data available for the period 2016-2022, the aggregate tax base has experienced increases greater than those of nominal domestic demand , accumulating a differential of 12.8% in this period . This result has a positive impact on collection and suggests an improvement in voluntary compliance in the period analyzed . This improvement is consistent with the trend towards freezing or gradually reducing in real terms the amount of the calculation base, as mentioned above, without considering extraordinary results. Improving voluntary compliance is crucial to achieving this goal and is in line with the trend towards stabilisation or gradual decrease in the amount of the calculation base. This implies not only an increase in tax revenues, but also a reduction in dependence on quantitative control results.

It is important to note that the focus on the calculation basis should not overshadow the primary objective of improving voluntary compliance with tax obligations. Success in this area is critical for the Tax Agency, and any improvement in control results must be seen in the context of this core mission.

In summary, the Tax Agency seeks to improve voluntary compliance, reduce dependence on quantitative control results and stabilise or gradually reduce the calculation base, taking into account extraordinary results. This is achieved through a strategic approach that assesses the evolution of the calculation basis in relation to improved voluntary compliance and other economic factors.