Application for intra-community operator tax certificate

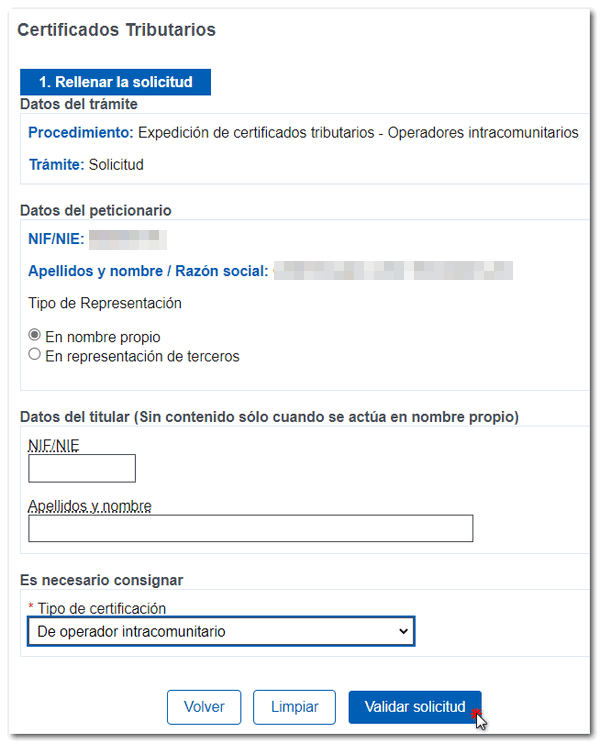

After identifying yourself with one of the enabled means (certificate, Cl@ve or DNI electronic) and accessing the application form, it will only be necessary to complete the DNI / NIE and the surnames and first name in case of requesting the certificate on behalf of third parties. Under "Certification Type" choose the option that best suits your request: "From intra-community operator" or "From historical intra-community operator (REGISTRATION/REMOVAL)". Finally, press "Validate request" .

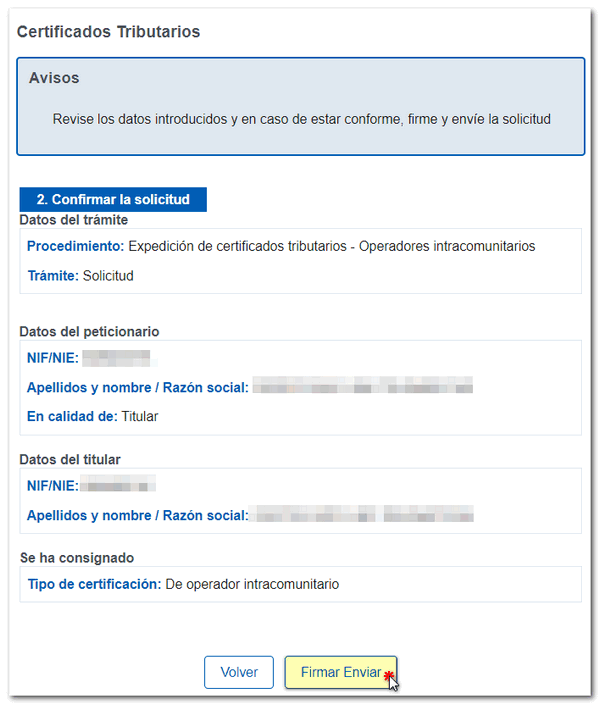

Confirm the data and press "Sign Send".

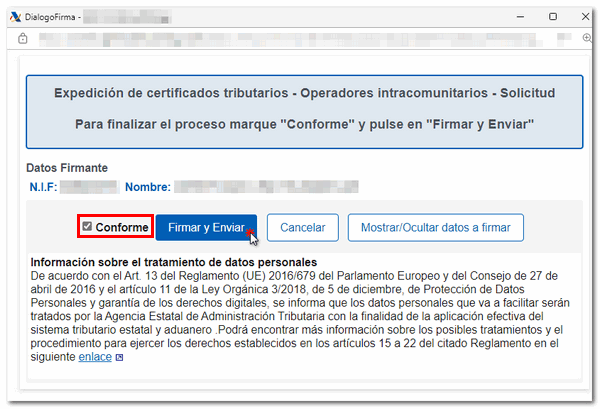

In the next window, check the box "I agree" and press again "Sign and Send".

Obtaining certification is immediate. In step 3, the certificate is displayed in PDF format. The PDF can be viewed in full screen by clicking on the available button. If you experience any display issues, we recommend installing an updated PDF viewer.

The certificate can also be collected from the "Check issued certificates" option by accessing it with the same form of identification that was used when requesting it.

The tax certificate can also be requested at the offices of AEAT by completing form 01, having previously requested an appointment to carry out the procedure. Once the certificate has been issued, it will be sent to the address provided for notification purposes/tax address, or to the electronic address (single Authorized Electronic Address).

It is important to note that, in relation to the format of the certification, the space dedicated to the bar code, communication number and address for notifications located in the upper right-hand part of the document may vary depending on the method of delivery of the certification, and these data may not be displayed in certain cases.

However, the authenticity of the document obtained may be verified at any time using the Secure Verification Code ( CSV ) that appears next to the electronic signature of the document, through the "Comparison of documents using a secure verification code" section available at the Tax Agency headquarters.