Request for a tax certificate of tax residence

The application for a tax residence certificate is available online from the "All procedures", "Certificates", "Census" section. You can identify yourself with Cl@ve or with certificate or electronic DNI .

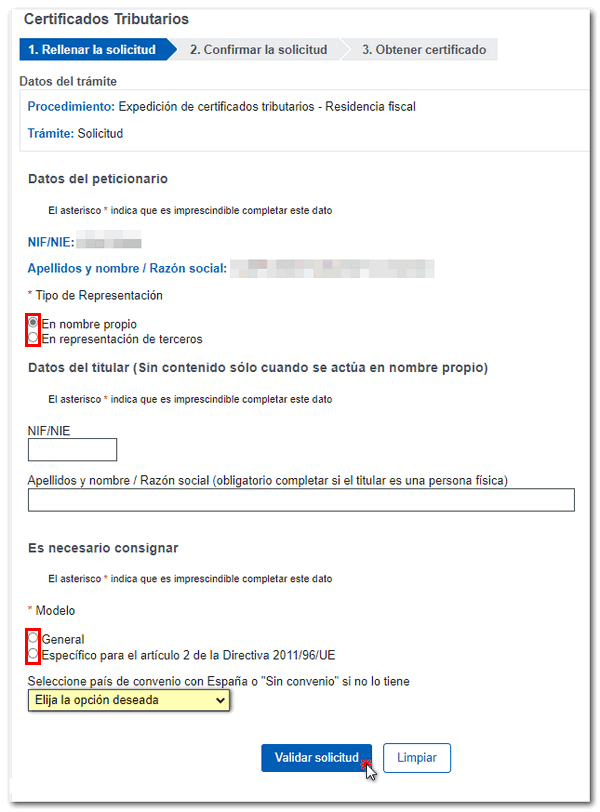

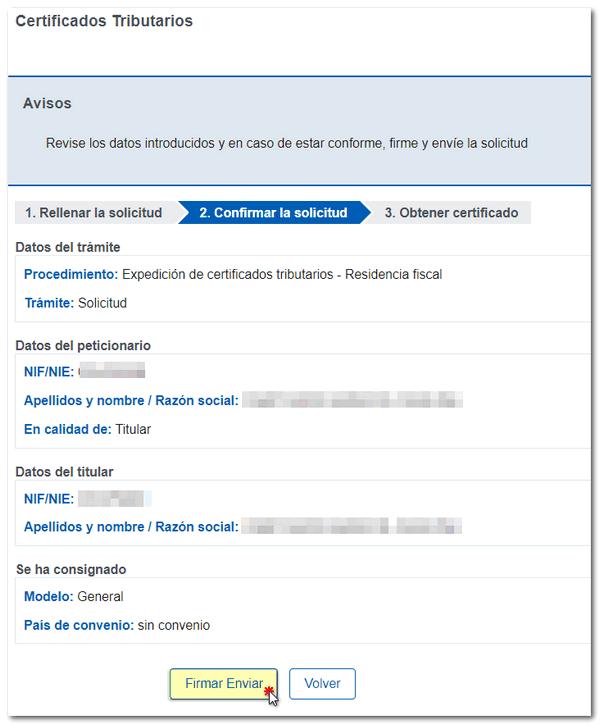

Enter the requested data in the form. If you are acting on behalf of a third party, check the corresponding box and provide the requested information. Click on "Validate request"; Next, check that the information is correct and click "Sign and Send."

Finally, check the "I agree" box and click "Sign and Send."

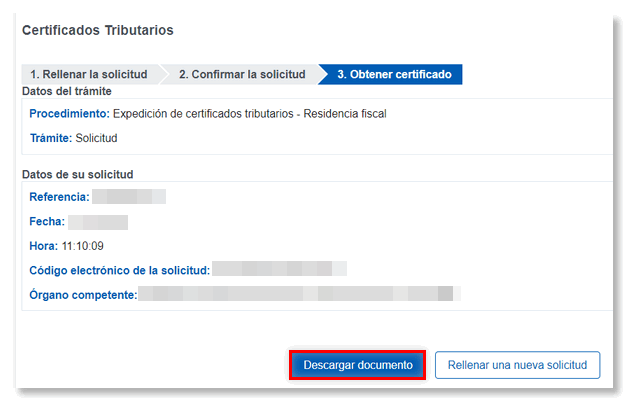

Whenever possible, the certificate will be obtained immediately, although it will always be available if accessed with the same electronic certificate with which it was requested, through the "Check issued certificates" option, within the procedures related to "Certificates". In addition, with the CSV associated with said presentation, the document can be recovered from the "Document verification using secure verification code ( CSV )".

The certification may also be requested at the Administration or Delegation of the AEAT that corresponds to the tax domicile by submitting Form 01.

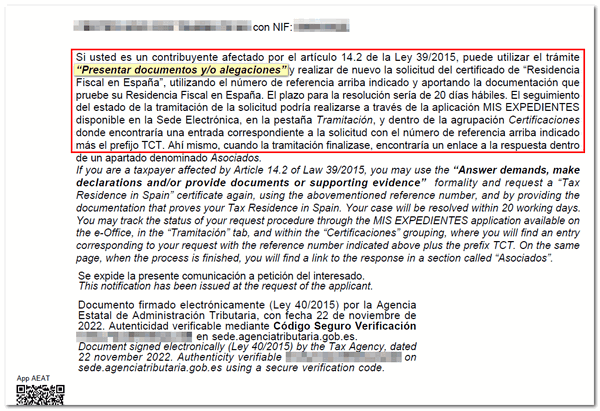

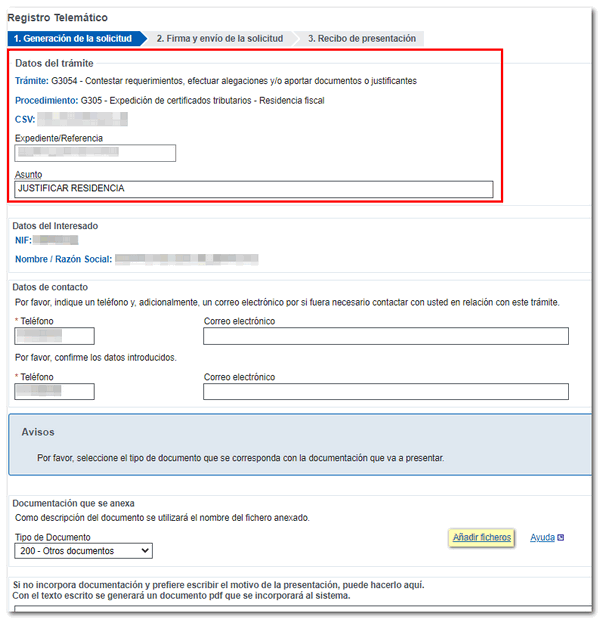

If the taxpayer requests the certificate through the Electronic Office but does not meet the requirements to issue it at the time, he or she is allowed to complete the application, a certificate denial document is generated and an alternative is offered to continue with the process without going to the Administration. To do this, you will need to access the " Submit documents and/or allegations " process for issuing tax certificates for tax residence, to provide the supporting documentation for tax residence in Spain and thus reopen the file.

The processing status of the application can be accessed through "My Files".

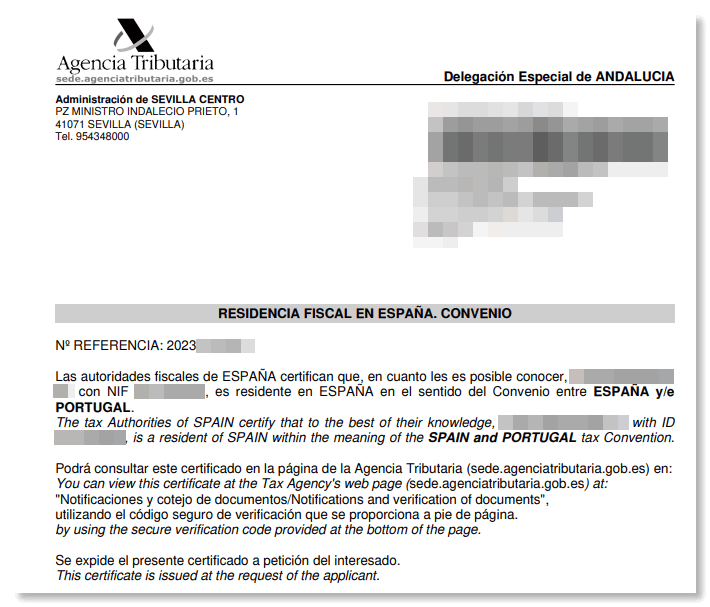

It is important to note that, in relation to the format of the certification, the space dedicated to the bar code, communication number and address for notifications located in the upper right-hand part of the document may vary depending on the method of delivery of the certification, and these data may not be displayed in certain cases.

However, the authenticity of the document obtained may be verified at any time using the Secure Verification Code ( CSV ) that appears next to the electronic signature of the document, through the "Comparison of documents using a secure verification code" section available at the Tax Agency headquarters.

The certificate of tax residence can also be requested at the Administration or Delegation, requesting an appointment in advance, or by telephone; In the latter case, you will have to make an appointment and the AEAT will contact you at the telephone number you indicate to make the request.