Request for tax certificates from the Administration

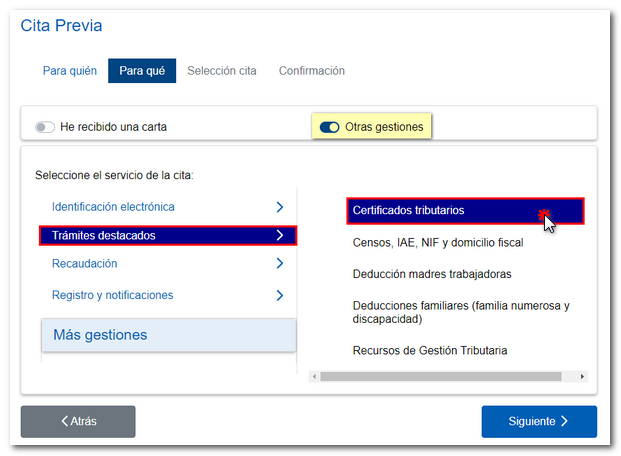

To obtain a tax certificate in person at the Administration, it will be necessary to make an appointment by selecting the "Tax Certificates" procedure, which you can access by selecting "Other procedures", "Highlighted procedures".

The electronic file that includes the generated certificate and the relevant documentation for its processing will be formalized in the Administration.

Once the certification has been issued it can be delivered immediately or sent via CIE / DEHú :

-

If submitted immediately, the applicant signs the "Acknowledgement of Receipt" which is saved in the electronic file. This acknowledgment of receipt is not delivered to the petitioner.

-

When the certification cannot be delivered at the time, it will be sent by CIE (Printing and Enveloping Center) to the address provided for notification purposes/tax address or by DEHú (Single Authorized Electronic Address) if you have subscribed to the electronic notification service. The applicant signs an "Application Receipt" which is given to him/her at the time.

In the event that the certification request is made by a representative, it will be necessary for him/her to present the corresponding documentation that accredits him/her as a representative or authorized party, with the representation/authorization documents presented remaining in the electronic file.

In the case of applications through a representative/authorized party, you can choose who will receive the certification via CIE / DEHú , and it can be sent to the address of the owner or to the address of the representative/authorized party.

It is important to note that, in relation to the format of the certification, the space dedicated to the bar code, communication number and address for notifications located in the upper right-hand part of the document may vary depending on the method of delivery of the certification, and these data may not be displayed in certain cases.

Remember that, in any case, the authenticity of the document obtained can be verified using the Secure Verification Code ( CSV ) that appears next to the electronic signature of the document, through the section "Comparison of documents using a secure verification code" available at the headquarters of the Tax Agency.