Consultation and modification of informative tax returns. Authorised representatives. Exercises prior to 2019

Skip information indexAccess by power of attorney

Enter the fiscal year and the form for which you are the authorised person for the declaration submitted and click "Access". You can also select the fiscal year and form by clicking on the question mark icon.

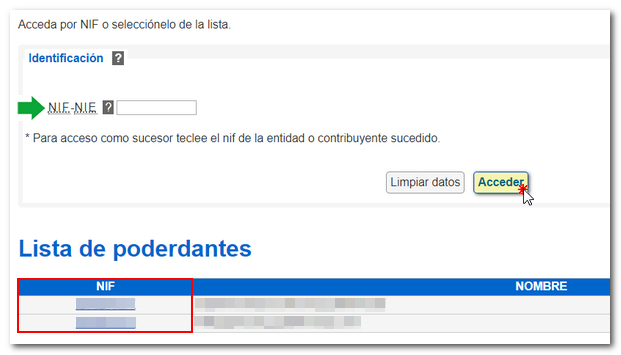

Click on the NIF of the power of attorney or write the NIF in the field provided for this purpose. Click "Login".

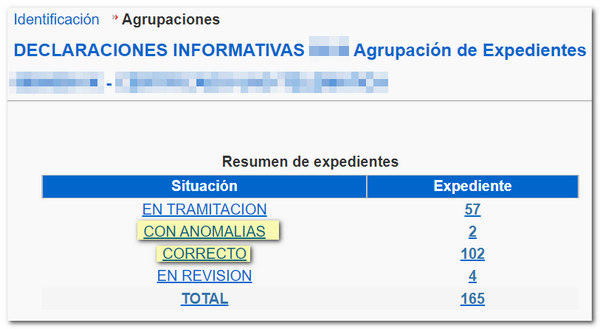

Please note that you will only be able to modify files with “Correct” or “With anomalies” status. For files being processed or under review, you can only consult the file history and anomalies detected following initial file review.

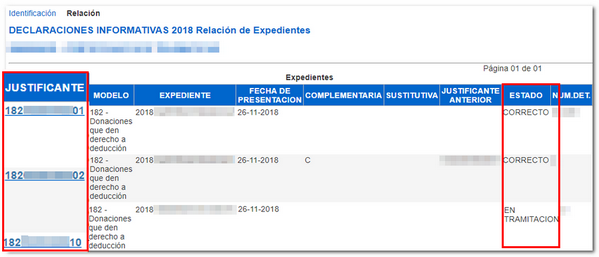

Then, click on the number in the "Receipt" column for the file you want to consult or correct.

Depending on the processing status of the declaration and the model, different options will appear in the "Available Services" menu: Detailed anomaly query, Modify detail records, Modify summary sheet, Deregister detail record, Add detail record and Deregister by substitution. Specifically, the Income Tax return models no longer have the options "Modify summary sheet" and "Add detail record" available for the 2018 financial year, since with the new system all returns will be presented as correct and it is not necessary to adjust the totals between the Type 1 record and the detail records.