Consultation of Companies tax data

The online consultation of 2024 corporate tax data is a service exclusively for legal entities, regardless of the type of entity, the settlement period, or whether they have filed a self-assessment return for the previous year, for the purposes of completing the 2024 tax return.

Taxpayers whose tax period Does not coincide with the calendar year, that is, declaration types 2 and 3, must take into account that the data provided corresponds to the calendar year 2024.

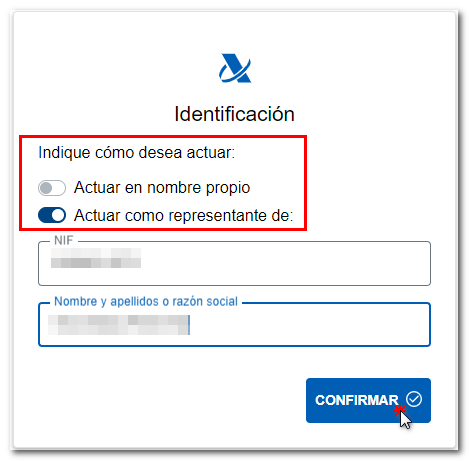

To access your own name, you need to identify yourself with an electronic certificate and eIDAS.

This query only supports access with proxy (Does NOT support social collaboration) and the specific empowerment required is DFIS (Corporate Tax Data Consultation) or the general one for personal data consultation GENERAL ATPE.

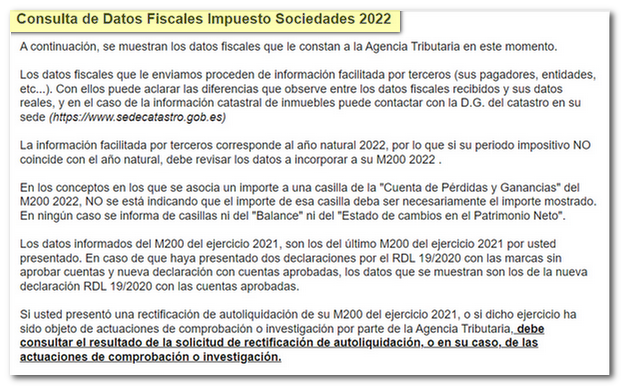

At the top of the page you can find explanatory information about the tax data that will be provided in this service.

Below you'll find the tax data for the 2024 fiscal year. It does not have a printable format or option for downloading, since it is an online consultation. This service only displays information provided by third parties for the 2024 calendar year. If the tax period does not coincide with the calendar year, you should review the information you need to include in your 2024 Form 200.

The data provided can be grouped into the following categories :

-

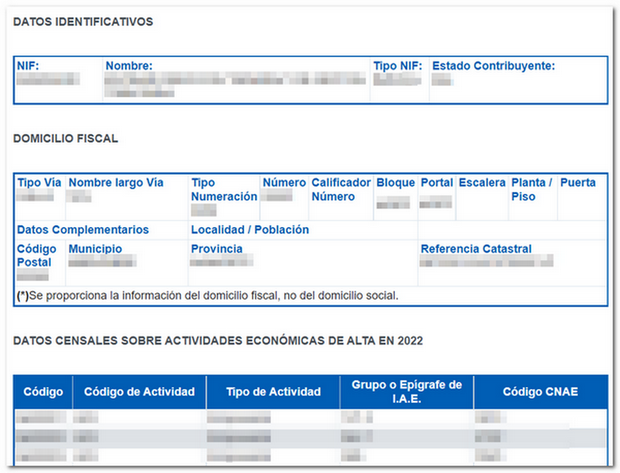

Data available at the Tax Agency from information returns or other sources of information from third parties . With them you can clarify the differences you observe between the tax data received and your real data, and in the case of property cadastral information you can contact the DG of the cadastre at its headquarters (https://www.sedecatastro.gob.es)

-

Data from self-assessments and information returns of the taxpayer (M202, M190, M390 or M303).

-

In the concepts in which an amount is associated with a box in the "Profit and Loss Account" of Form 200 of 2024, it is not indicated that the amount in that box must necessarily be the amount shown. In no case are boxes reported on either the "Balance Sheet" or the "Statement of Changes in Net Worth".

-

Data declared in form 200 for the 2023 fiscal yearcorresponding to amounts pending application in future years, indicating the box of form 200 for the 2024 financial year in which they should be recorded. If you submitted a self-assessment correction to your Form 200 for the 2023 tax year, or if the 2023 tax year has been subject to audit or investigation by the Tax Agency, you should check the results of your self-assessment correction request or, where applicable, the audit or investigation. Likewise, the information included on pages 1 and 2 will be provided.

-

Information to be taken into account in the declaration, such as that relating to penalties and surcharges issued and notified by the AEAT during the 2024 financial year, late payment interest paid by the AEAT and by other Administrations during 2024, etc.

-

Sections of the IAE in which the taxpayer is registered, including the National Economic Activity Code ( CNAE ) equivalent.