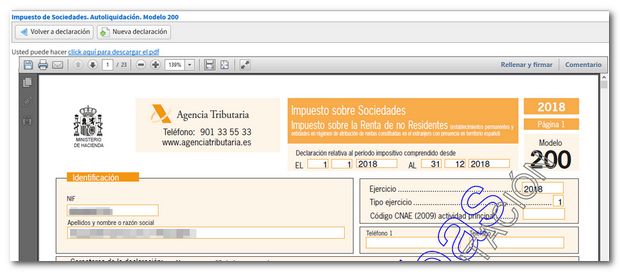

Fiscal year 2018

Skip information indexWEB Companies 2018 OPEN version

Version WEB Open Companies works as a simulator that allows you to prepare the Model 200 declaration for the 2018 fiscal year without needing to identify yourself with an electronic certificate, so it can be used to perform the necessary tests and checks prior to filing.

Access to WEB Open Companies is available on the Form 200 procedures page under "Previous years"

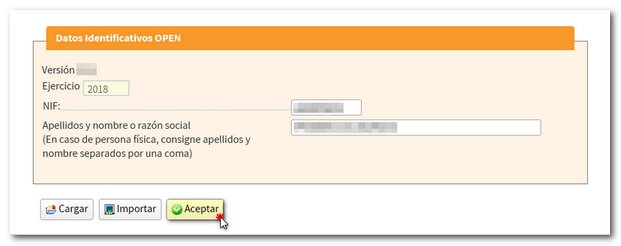

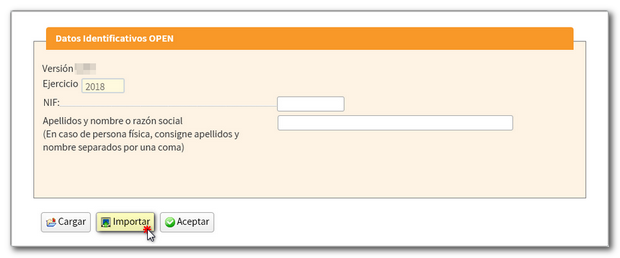

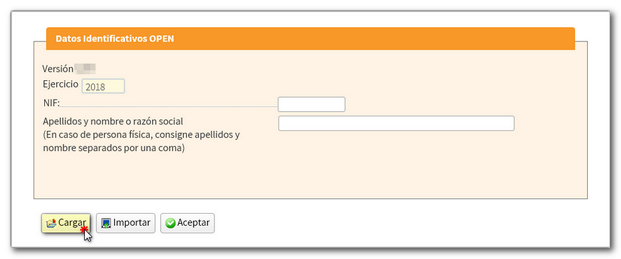

From the first window that appears in the Open version you can:

-

Create a new declaration, indicating the NIF and the name and surname or company name of the declarant and clicking the "Accept" button.

-

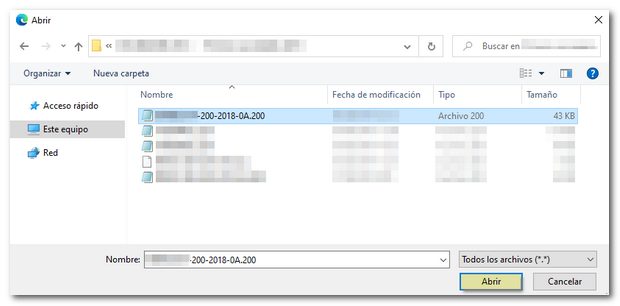

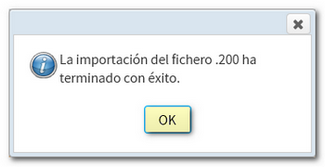

Import a file in BOE format of model 200 for the 2018 fiscal year into the form, by simply clicking the "Import" button. Select the file that fits the updated registration design for model 200 for the 2018 fiscal year. If the file is imported correctly, a notice will appear indicating this.

-

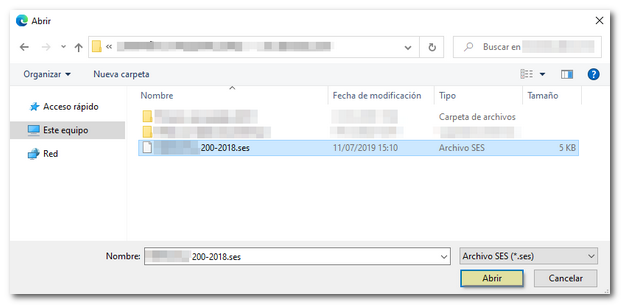

Load a .ses file that you have previously saved locally from the Open 2018 version. It should be noted that the presentation version also saves the declaration but it does so on the AEAT servers so it cannot be recovered in the Open version. Press the "Load" button and select the SES file you saved earlier.

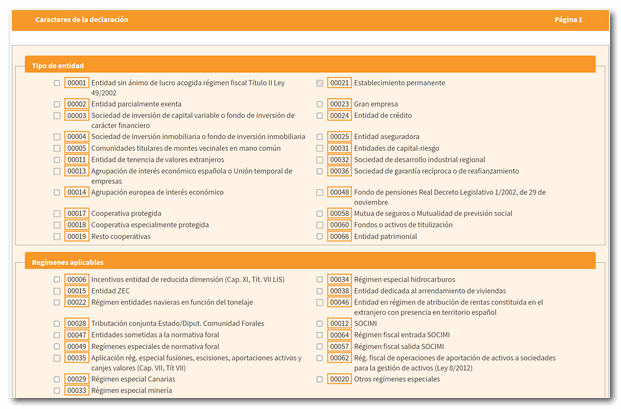

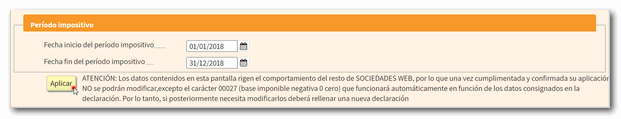

If a new declaration is generated, the "Declaration characteristics" page must first be completed, which conditions the rest of the completion of form 200 and which, once accepted, cannot be modified. Check the appropriate boxes and indicate the start and end dates of the reporting entity's tax period. Scroll down to the bottom of the page to press the "Apply" button.

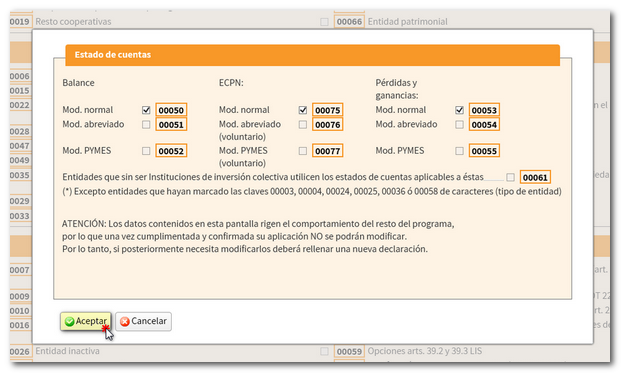

Next, in a new window, the boxes corresponding to the account status will be checked.

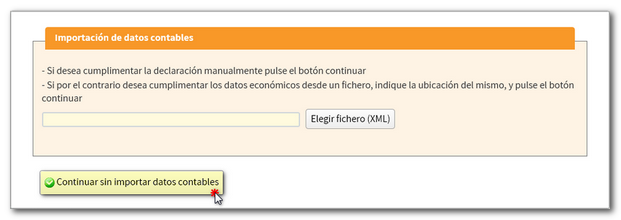

Before accessing the declaration, a new window allows you to import a XML file to incorporate the financial data. Click the "Choose file ( XML )" button to choose your file or "Continue without importing accounting data" to proceed with completing the return.

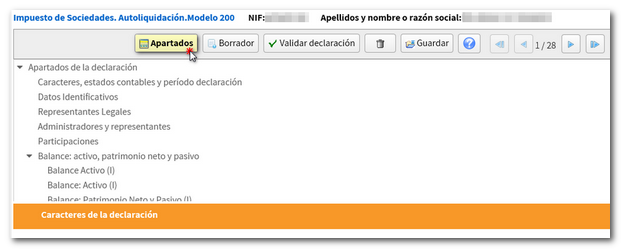

Once all the pages of the declaration are opened, the Open version of Sociedades WEB has a toolbar at the top with the following functionalities:

-

The "Sections" button displays the different sections of the declaration to quickly access each of them.

-

"Draft" generates a draft in PDF not valid for presentation.

-

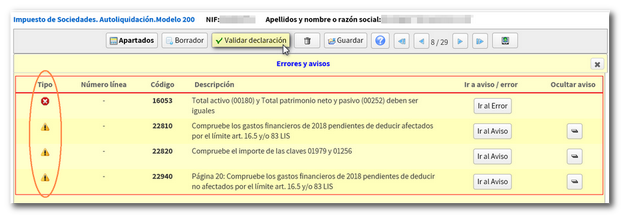

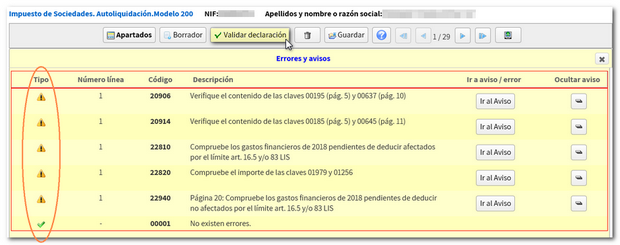

"Validate declaration" checks the completion of the declaration, displaying any notices, warnings and errors that are detected so that they can be corrected if necessary. The corresponding button is available to go to the error, warning or notice to correct it. We remind you that only errors would prevent the filing of the declaration.

-

"Delete declaration" , using the button with the trash can icon.

-

"Save" generates a .ses file that is saved locally with the declaration completed up to that point. This .ses file can only be retrieved in the Sociedades WEB Open version using the "Upload" button in the first identification window. By default, the file name will be NIF -200-2018 and the extension .ses.

-

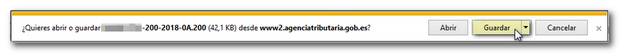

"Export" generates a .200 file that conforms to the model's record layout. It is essential that the declaration does not contain errors, otherwise the export is not allowed (when you click the export icon, nothing will happen). The .200 file can be imported into the WEB Companies version with electronic certificate identification to proceed from here to its presentation. By default, the file name will be NIF -200-2018-0A and the extension .200.