Fiscal year 2018

Skip information indexWEB companies for employees in the 2018 financial year

For the processing of model 200 for the 2018 financial year, the service Sociedades WEB has been developed, in different versions, depending on the type of access carried out.

The link "Declaration processing service (WEB Companies) 2018 for collaborators" available on the procedures page for model 200 of the Electronic Office, in "Presentation", "Presentation of declarations from previous years", will be used by social collaborators whose agreement allows them to submit model 200. The presenter must access with an electronic certificate or DNIe .

Select the electronic certificate and press "OK".

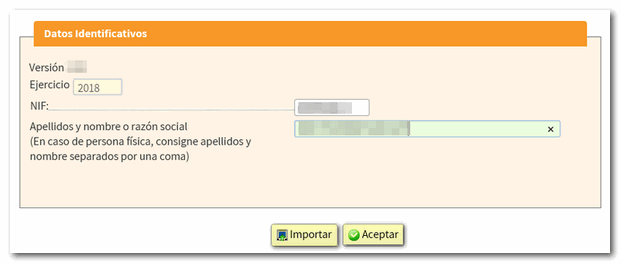

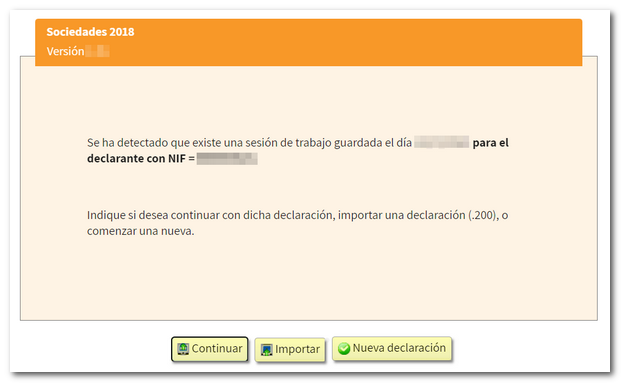

Once the electronic certificate has been selected, the first window that appears in Sociedades WEB allows you to register a new declaration or import a file of model 200 that conforms to the current registration design. In this case, you will have to indicate the NIF and the name and surname or company name of the declarant to confirm whether there is authorization to manage the declaration as a social collaborator.

In addition to these two options, the following may also appear in the start window:

-

In the event that a previous WEB Companies session is detected for that declarant, the option to "Continue" with this declaration is provided. There is no need to select any file as the last declaration is saved in the cloud.

-

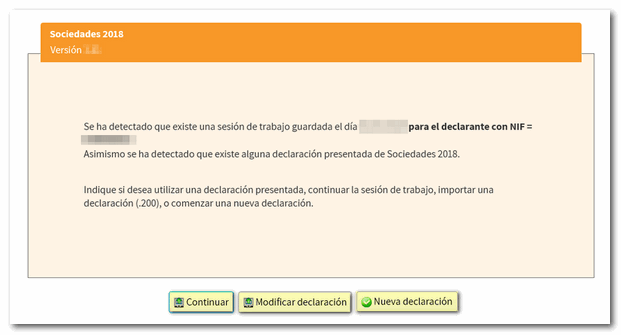

If it is detected that there is already a declaration submitted for that NIF , the button "Modify declaration" appears, which directs to the declaration characters page and retrieves the declaration submitted for the purpose of submitting a supplementary declaration.

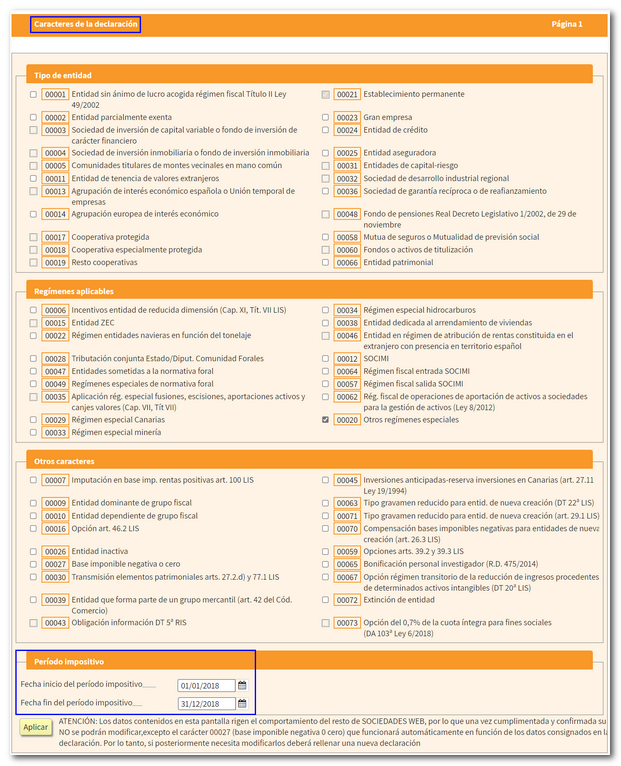

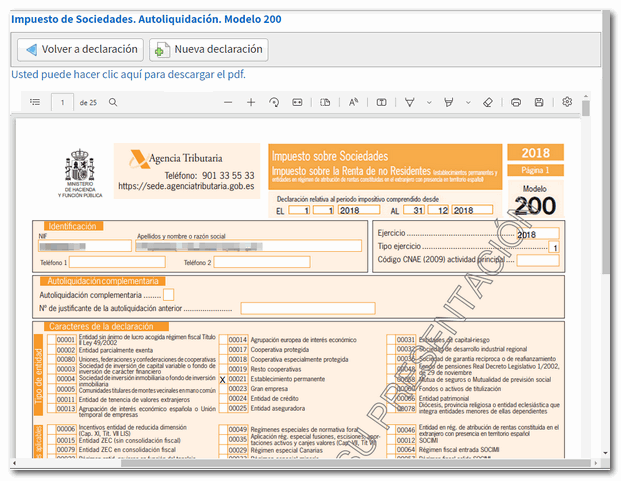

If you generate a new declaration, the first page you access is "Declaration characteristics" which conditions the rest of the completion of form 200 and which, once accepted, cannot be modified. Please note that, depending on the type of NIF indicated, different boxes in this window may already appear checked or blocked.

Check the boxes for the type of entity and applicable regimes that apply. Then, scroll down to the bottom of the page and indicate the start and end dates of the reporting entity's tax period. Finally, press the "Apply" button.

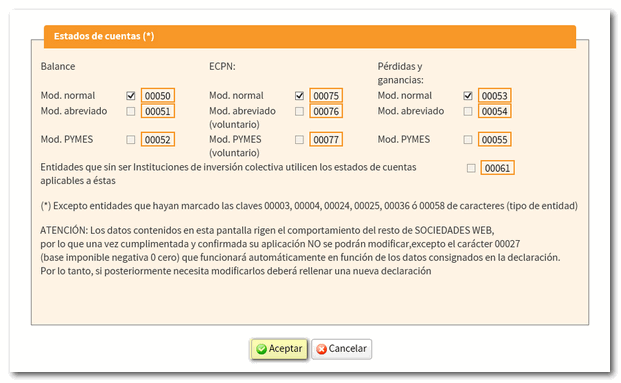

Next, in a new window, the boxes corresponding to the account status will be checked.

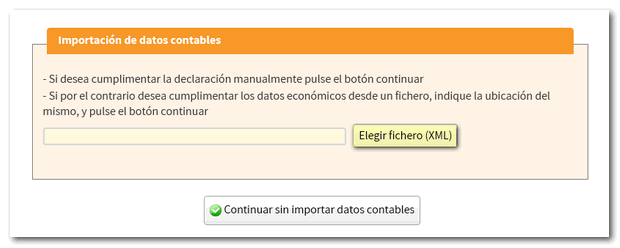

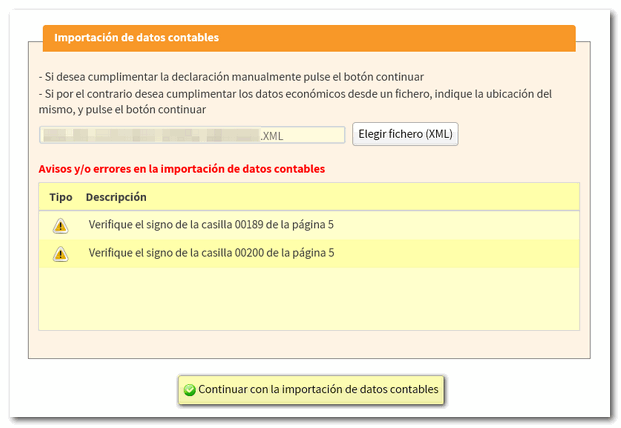

Before accessing the declaration, a new window allows you to import a XML file to incorporate accounting data. Click the "Choose file ( XML )" button to choose your file or "Continue without importing accounting data" to continue completing the declaration.

If the XML file does not contain errors and the data it contains is compatible with that established in the character and account status register when registering the declaration, the "Continue with the import of accounting data" button will be displayed. Please note that this import is optional and automatic for information relating to the balance sheet, the profit and loss account and the statement of changes in equity. It may be carried out for entities subject to the accounting standards of the Bank of Spain, insurance entities, collective investment institutions, mutual guarantee companies, and those not subject to specific regulations.

The completion of Form 200 will then be done from the "Declaration Characteristics" page, although no changes can be made to it, unless a new declaration is generated.

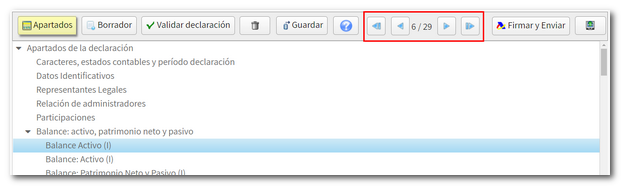

To locate the different pages of the declaration you can use the "Sections" button on the top bar or the arrows to navigate between its pages.

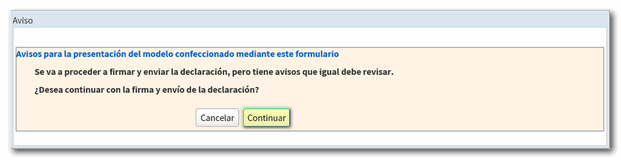

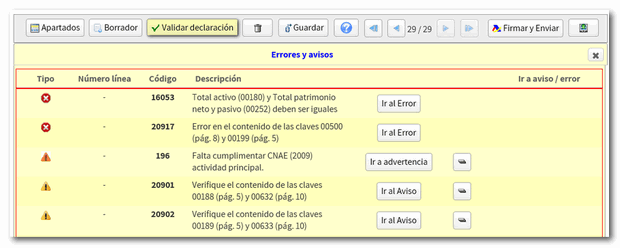

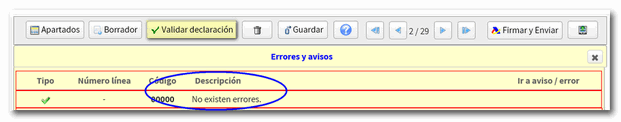

When completing the declaration, you can check whether it passes the validations by clicking the "Validate declaration" button. Just below the bar, a yellow box will be displayed with the notices, warnings and errors detected. Errors must be corrected in order to file the return, while warnings and notices allow you to continue with the submission, although it is always a good idea to review them. If they are warnings, they inform of a possible error or omission, warning that it may be necessary to correct it by request from the Tax Administration. To make it easier to correct your error, next to the description, you will find a corresponding link that takes you directly to the related box or section.

The message "There are no errors" with a green check mark indicates that the declaration can be submitted.

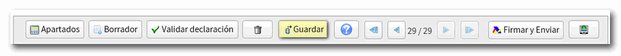

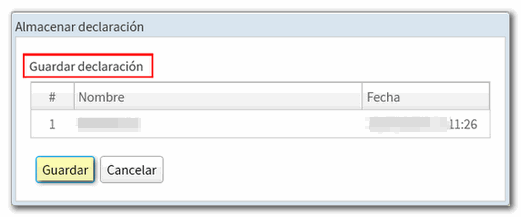

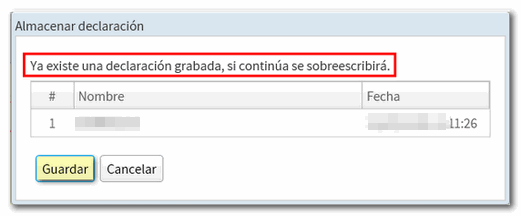

To continue with the declaration later, it is recommended to save the completed data, using the "Save" button. This option does not validate data so it can be used at any time. The declaration is stored on the servers of AEAT and the saved session can be recovered by accessing Sociedades WEB again.

Another alternative to preserve the declaration data is to save the file with the declaration adjusted to the record layout from the "Export" option. In this case, it is required that the validation is correct and that the local location where the generated .200 file will be saved is chosen.

In addition, Sociedades WEB allows you to obtain a draft of the declaration in PDF in order to review the data on paper, taking into account that it cannot be used for presentation, as indicated by the printed watermark.

Before proceeding to send the declaration, you must check the type of declaration selected on the last return or payment page.

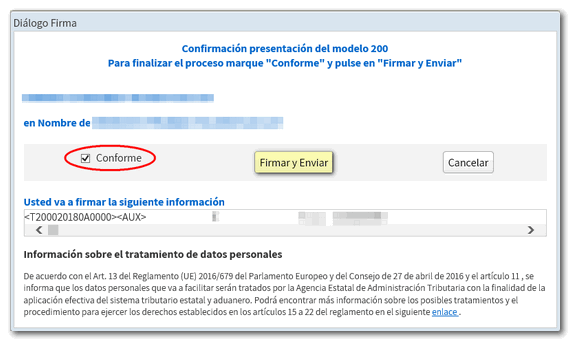

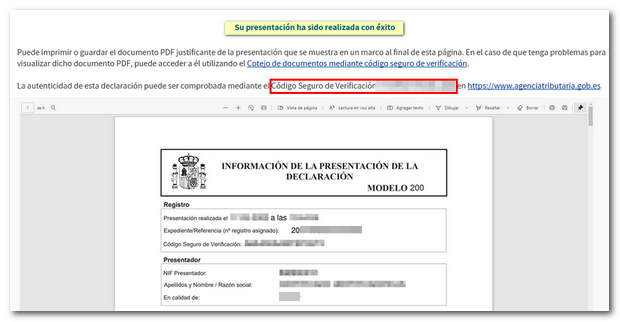

Finally, click "Sign & Submit" to finalize your submission. The "Signature Dialog" window will appear, check the "Agree" box and then "Sign and Send" again. The declaration is submitted and a document PDF is generated on the screen with a copy of it.