2019 fiscal year

Skip information indexQuery of tax data for Corporate Tax 2019

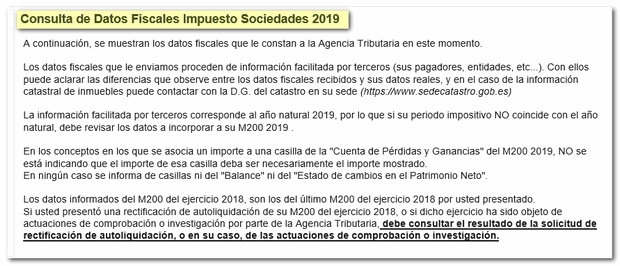

The online consultation of the 2019 corporate tax data is a service for the purposes of completing the tax return for the 2019 financial year, regardless of the type of entity, the settlement period or whether the tax self-assessment was submitted in the 2018 financial year.

For taxpayers whose tax period does NOT coincide with calendar year , declaration types 2 and 3, please note that the data provided corresponds to calendar year 2019.

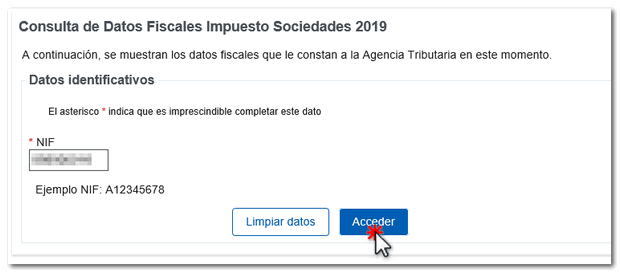

To access you need to identify yourself with an electronic certificate. This query is available only for legal entities and allows access with power of attorney ( NOT social collaboration). The specific power of attorney required is: DFIS (Fiscal Data Consultation for Corporate Tax) or the general one for consulting personal data GENERALDATPE.

Once identified with the electronic certificate, verify the NIF . By default, the NIF of the selected electronic certificate appears, but you can modify it, then click "Access".

Please see the information provided above.

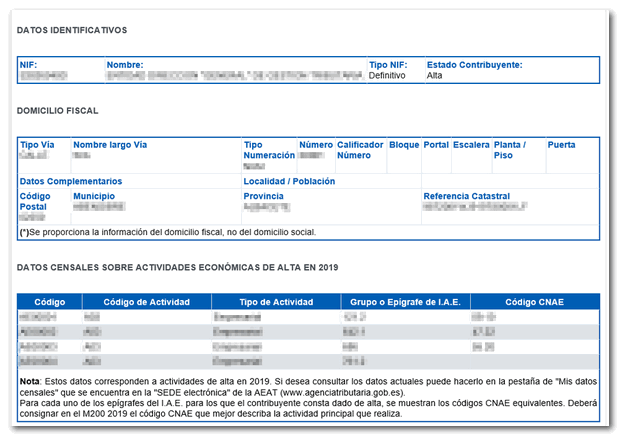

Below you will find the tax data for the 2019 financial year. This service only displays on screen the information provided by third parties corresponding to the calendar year 2019, so if the tax period does NOT coincide with the calendar year, you must review the data to be incorporated into Form 200 for 2019.

The data provided can be grouped into the following categories:

-

Data available at the Tax Agency from information returns or other sources of information from third parties .

- Data from self-assessments and information returns of the taxpayer (M202, M190, M390 or M303).

-

Data declared in model 200 for the 2018 financial year corresponding to amounts pending application in future financial years, indicating the box of model 200 for the 2019 financial year in which they should be entered. The information included on pages 1 and 2 will also be provided.

-

Information to be taken into account in the declaration, such as that relating to penalties and surcharges issued and notified by the AEAT during the year 2019, late payment interest paid by the AEAT and by other Administrations during 2019, etc...

-

Sections of the IAE in which the taxpayer is registered, including the National Economic Activity Code ( CNAE ) equivalent.