2021

Skip information indexCheck tax data for 2021

The online consultation of the 2021 corporate tax data is a service for the purposes of completing the tax return for the 2021 financial year, exclusively for legal entities, regardless of the type of entity, the settlement period or whether they have submitted the tax return for the previous financial year.

Taxpayers whose tax period does NOT coincide with calendar year , i.e. declaration types 2 and 3, must take into account that the data provided corresponds to calendar year 2021.

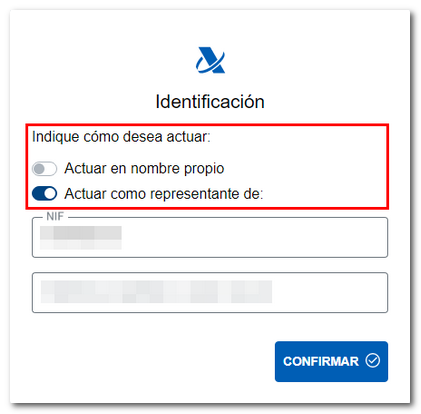

To access you need to identify yourself with an electronic certificate; Then, select the access type: "Act on own behalf" or "Act as representative of:" since this query allows access with power of attorney ( NOT social collaboration). The specific power of attorney required is: DFIS (Fiscal Data Consultation for Corporate Tax) or the general one for consulting personal data GENERALDATPE. Click on "Confirm".

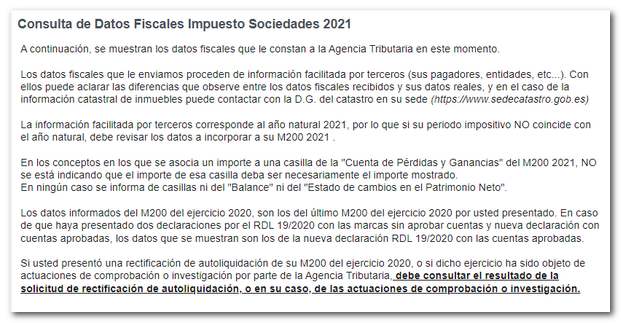

At the top of the page you can find explanatory information about the tax data that will be provided in this service.

Below you will find the tax data for the 2021 financial year. It does not have a printable format or option for downloading since it is an online consultation. This service only displays on screen the information provided by third parties that corresponds to the calendar year 2021, so if the tax period does NOT coincide with the calendar year, you must review the data that you must incorporate into your 2021 form 200.

The data provided can be grouped into the following categories:

-

Data available at the Tax Agency from information returns or other sources of information from third parties . With them you can clarify the differences you observe between the tax data received and your real data, and in the case of property cadastral information you can contact the DG of the cadastre at its headquarters (https://www.sedecatastro.gob.es)

-

Data from self-assessments and information returns of the taxpayer (M202, M190, M390 or M303).

-

In the concepts in which an amount is associated with a box in the "Profit and Loss Account" of Form 200 of 2021, it is NOT being indicated that the amount in that box must necessarily be the amount shown. In no case are boxes reported on either the "Balance Sheet" or the "Statement of Changes in Net Worth".

-

Data declared in model 200 for the 2020 fiscal year corresponding to amounts pending application in future fiscal years, indicating the box of model 200 for the 2021 fiscal year in which they should be entered. If you submitted a correction to your Form 200 for the 2020 financial year, or if said financial year has been the subject of verification or investigation actions by the Tax Agency, you must consult the result of the request for correction to the self-assessment, or, where applicable, of the verification or investigation actions. The information included on pages 1 and 2 will also be provided.

-

Information to be taken into account in the declaration, such as that relating to penalties and surcharges issued and notified by the AEAT during the 2021 financial year, late payment interest paid by the AEAT and by other Administrations during 2021, etc...

-

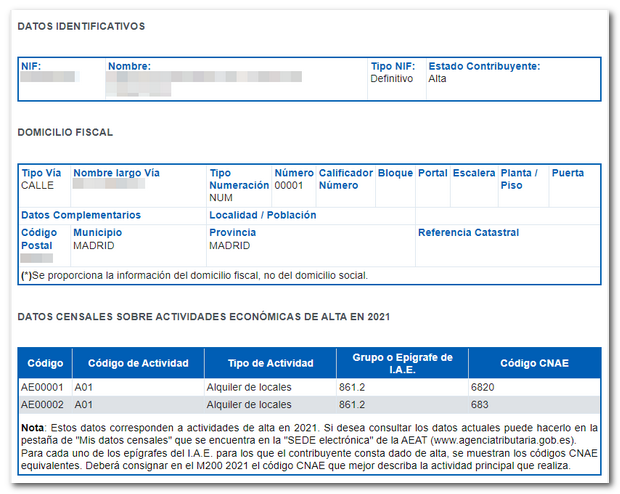

Sections of the IAE in which the taxpayer is registered, including the National Economic Activity Code ( CNAE ) equivalent.