How to import data from form 200 to form 220

In model 220 it is possible to import certain data from model 200 on some pages of the declaration. This is possible if you have the electronic submission file with format BOE and extension .200 of each of the entities comprising the group.

When using the option "Import mod. 200", the program stores the declarations of the .200 files corresponding to the entities that are part of the group. New in this exercise is the ability to move information from all imported files (from all entities) to pages 2 and 7A at once.

We explain the steps of the import procedure:

-

Once the declaration has been submitted, click on the button "Import mod. 200" located in the toolbar at the top of the form.

-

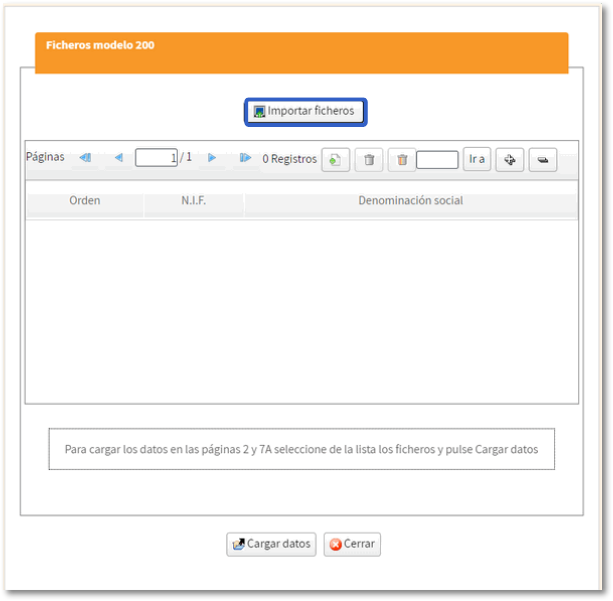

A window will open allowing you to both import .200 files and check which .200 models may have been previously imported. To select the .200 files you want to import click on " Import files".

-

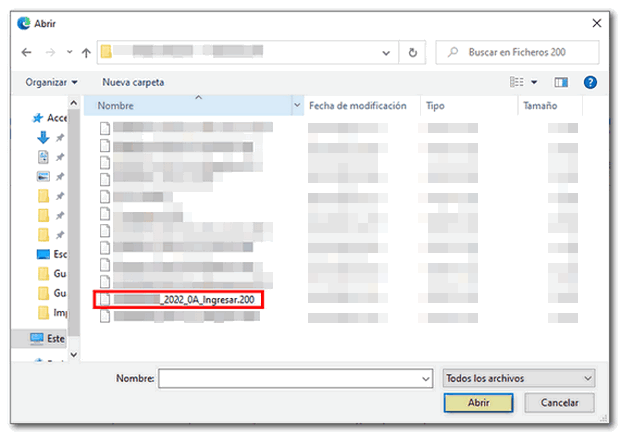

Select the .200 file stored on your computer to incorporate into the 220 model. You can select multiple files at once

-

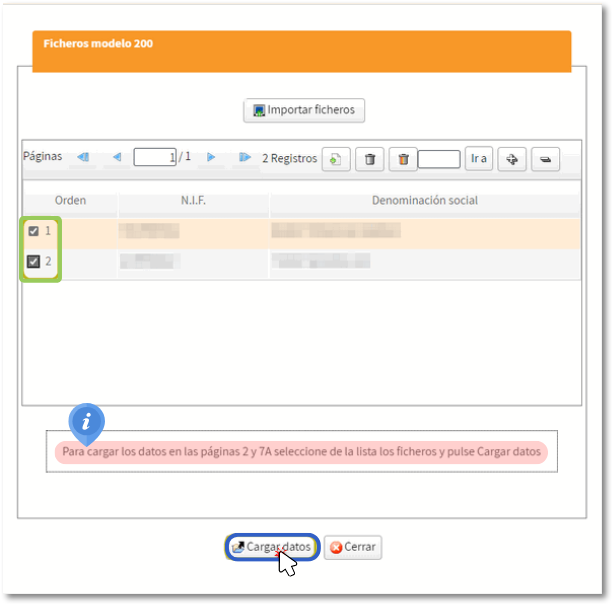

If the selected file is correct, it is stored and added to the list. If the file is incorrect, it is not incorporated and the error message(s) are displayed in the warning window. To view the warnings or errors, it is necessary to close the window with the list of .200 files by pressing the "Close" button.

-

It is possible to move all imported files (from all entities) information to pages 2 and 7A at once. To do this, select all the files whose data you want to transfer and press the button “Load data”:

-

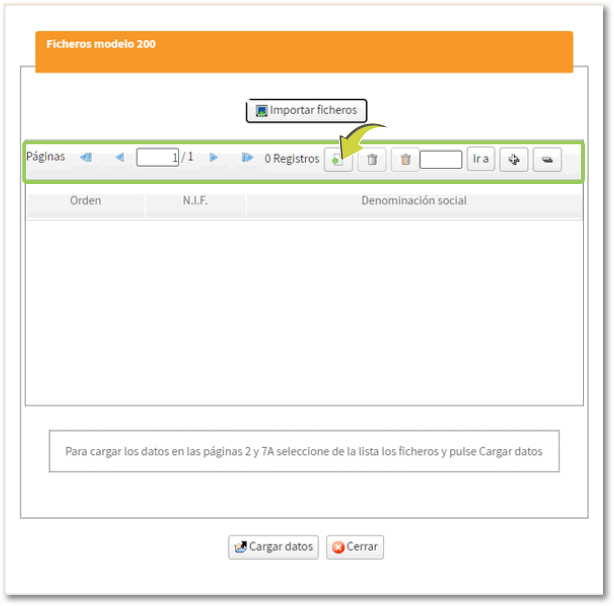

Note: It is possible to register records (NIFs) manually even if you do not have Form 200.

-

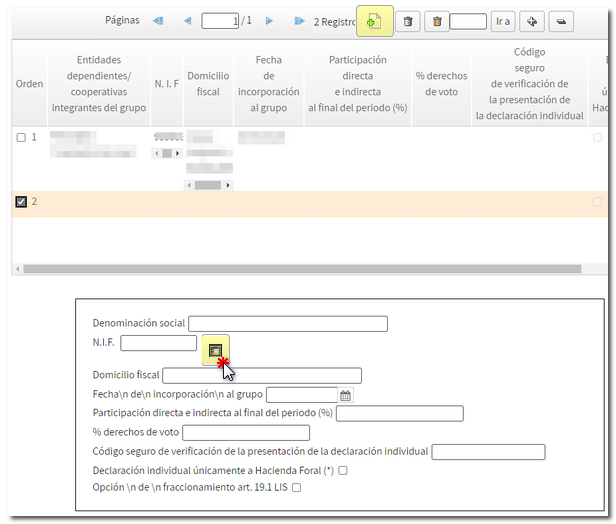

Next, check that on both page 2 and 7A, the transferable data belonging to these previously imported .200 declarations has been added.

Page 2:

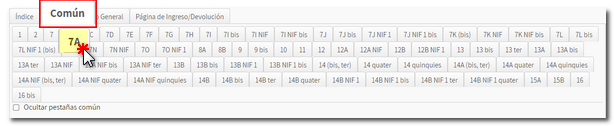

Page 7A

The data incorporated from the 200 models are:

-

On page 2:

- The company name

- The NIF

-

On page 7A:

- The company name

- The NIF

- Amount of turnover. The amounts in boxes 00255 on page 7 of Form 200 submitted by the entities comprising the group will be imported into the net business amount column on page 7A of Form 220.

If any of the following characters 003, 004, 024 or 025 have been marked in Form 200, the amounts in boxes 00989 on page 21 of Form 200 submitted by the entities comprising the group will be imported into the net business amount column on page 7A of Form 220.

If 036 has been marked, the amount in box 00166 on page 51 of form 200.

- Result of the excersice: Box 00500 on page 12 of form 200, profit and loss account result

- Net correction for corporate tax: In 200 of each entity this information will be obtained by performing the following operation: box 00301 minus box 00302, on page 12 of form 200.

- Other net corrections to accounting results: In 200 of each entity this information will be obtained by performing the following operation: box 01230 + box 00417 – box 01231 – box 00418, on pages 12 and 13 of form 200.

- Cooperative Groups: Taxable base for cooperative results. Box 00553 on page 13 of form 200.

- Cooperative Groups: Taxable base for non-cooperative results. Box 00554 on page 13 of form 200.

- Special regime for shipping companies: BI based on tonnage, before comp. From BI neg. of eg. ant.: Box 005.79 on page 13 of form 200.