Companies WEB. Form functionalities

Skip information indexHow to save, export and import Model 200 returns from the Model 200 form

The 2024 Corporate Web Form allows you to export, import, and save declarations.

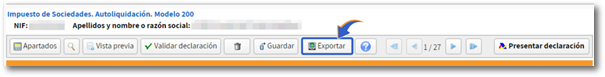

Export

Once the declaration has been completed and validated without errors, the declaration can be exported to obtain a file with the format BOE that conforms to the registration design published on the website.

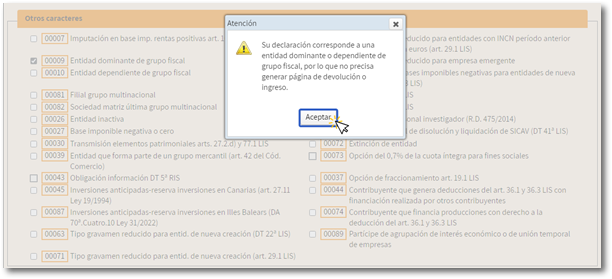

This option appears in the menu bar of WEB Companies in the case of entities belonging to a tax consolidation group, which corresponds to the characters [00009] and [00010] of the declaration). When filing a return in this case, no income/refund document is generated.

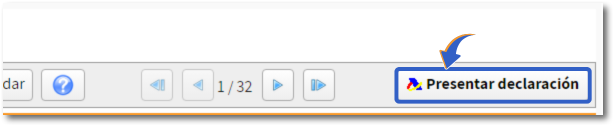

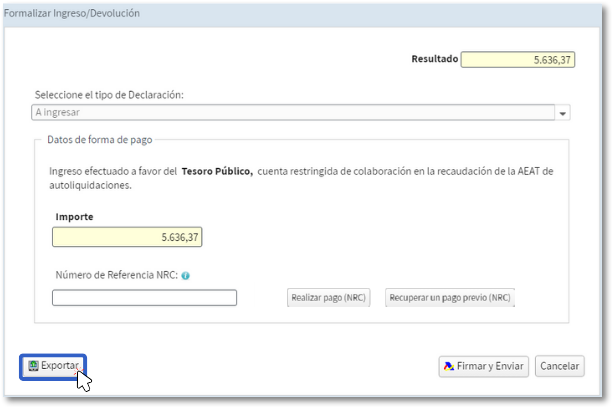

In the rest of the cases this option does not appear on the button bar but you must press "Submit declaration" in the window "Formalize payment/Refund" you will find this option.

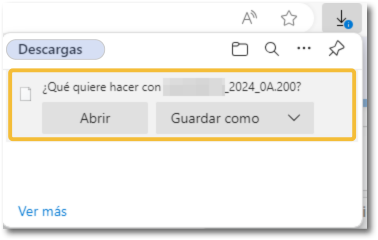

The file obtained in the export has the name NIF of the declarant, the fiscal year (2024) and period (0A) with the extension .200. It is saved by default in the folder that the browser has set as default for its downloads, although you can select a different directory.

You can recover this file by accessing the web form again by clicking "Import" in the initial window.

Matter

Using the "Import" option, you can recover a file with format BOE (.200) that contains a declaration already prepared and that has been generated with an external program, that complies with the registration design published on the web or generated with the WEB form and obtained using the "Export" button.

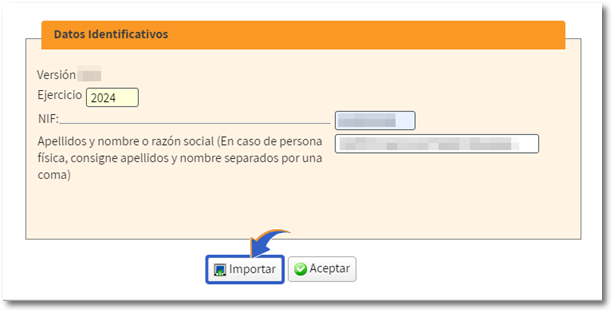

This option is available in the initial "Identification data" window.

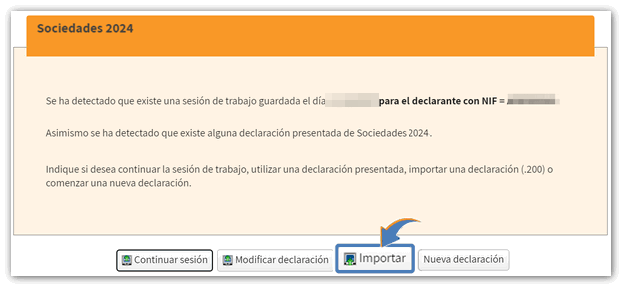

And in the next window after clicking "OK". The Import button in this second window only appears if you access it on your own behalf or with a power of attorney. Social partners must use the "Import" button in the previous "Identification data" window.

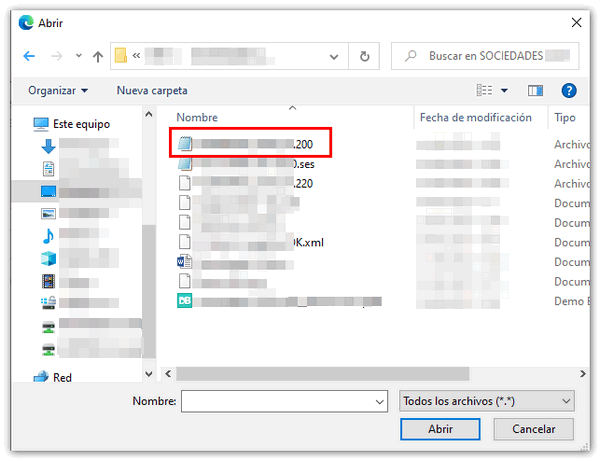

Click the "Import" button, accept the warning and select the file you want to recover.

If the file meets the specifications of the record layout, it will be indicated in a pop-up window: "The import of file .200 has completed successfully" along with a notice about the imported data; Click "Accept" to access the form with the completed declaration. Please note that if the file does not conform to the registration layout, it will be rejected.

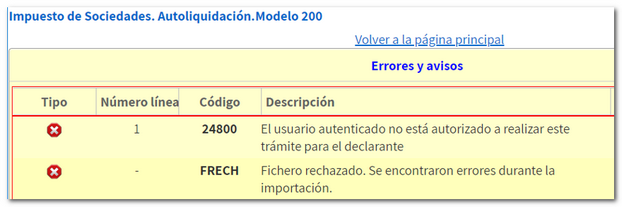

If you access Sociedades WEB as a representative, after identifying the declarant, if you try to import a file corresponding to a NIF for which you are not authorized to file the declaration, the file cannot be imported into the form either.

Save

The "Save" button allows you to store the data completed up to that point on the server, even if the declaration is not validated (it may contain errors or be incomplete). This way you can exit the form without losing any information.

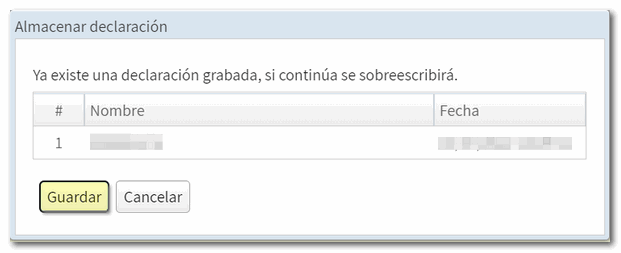

When you click "Save" a window is displayed with the NIF of the declarant and the date/time of the last existing work session. Please note that only the last session you were working in is saved, if a previously saved statement already exists it will be overwritten.

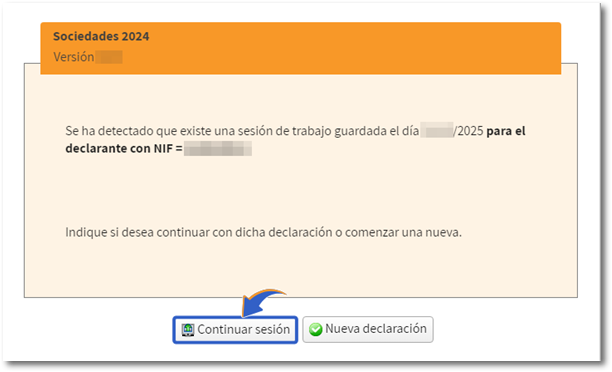

When accessing Sociedades WEB again, if a previous session is detected and you want to recover it, use the button "Continue session" and you will recover the completed data.