Companies WEB. Form functionalities

Skip information indexHow to access or generate a declaration from the model 200 form

After identifying yourself with an electronic certificate, DNIe either Key (both only for individuals) to access WEB Companies, the "Identification Data" window will appear with these options:

-

Import a file with format BOE (.200) generated with the same form and obtained through the "Export" button or generated with an external program that complies with the registration design published on the web.

-

Accept to create a declaration.

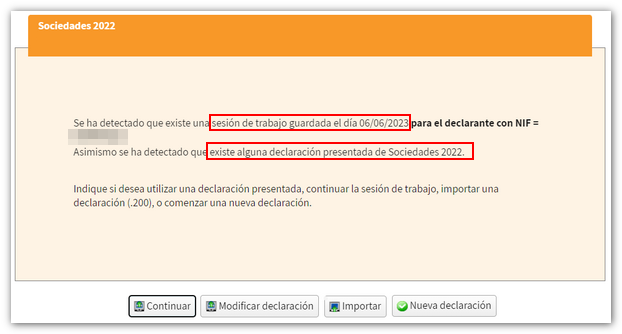

If you have previously accessed Sociedades WEB, the following options may appear in the start window, as well as informing you of the existence of a previous session or a declaration submitted:

-

"Continue session" : If a previous Sociedades WEB session is detected for that declarant, the data saved on the server can be recovered and work can continue with the declaration.

-

"Modify declaration" : If it is detected that there is already a declaration submitted for that NIF , it goes to the initial page of characters for the declaration and retrieves the declaration submitted for the purpose of submitting a supplementary declaration.

-

"New statement" : if you want to start a declaration from scratch for that NIF .

-

"Import" : allows you to import a file of model 200 (same function as the "Import" button in the previous window). The "Import" button in this second window only appears if you access on your own behalf or with a proxy. Social partners must use the "Import" button in the initial "Identification data" window.

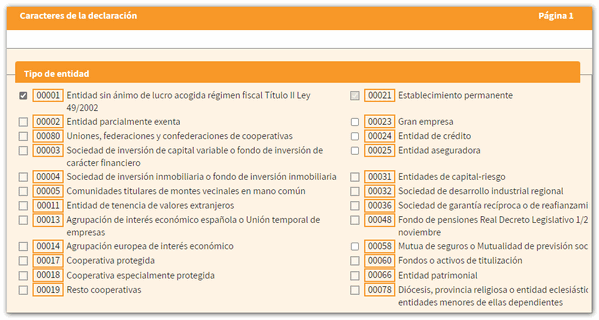

When registering a new declaration, the first page accessed is "Declaration characteristics" which conditions the rest of the completion of form 200 and which, once accepted, cannot be modified. Please note that depending on the type of NIF indicated, different boxes in this window may already appear checked or blocked. Additionally, checking any of the available boxes may automatically block or check other boxes.

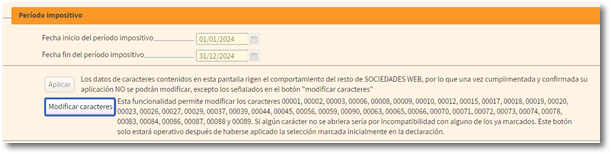

However, you will have the "Modify characters" button so that, once the initial characters of the declaration have been defined and applied, some of these can be changed without having to start a new declaration. This option is only available for characters that appear in the list attached to the "Modify characters" button, requiring them to be compatible with those already marked.

Check the boxes for the type of entity and applicable regimes that apply.

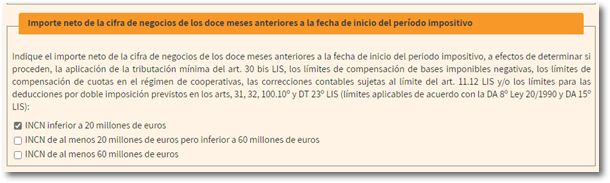

Check the corresponding box in section "Net turnover..." which will determine the application of the minimum taxation. This section is mandatory.

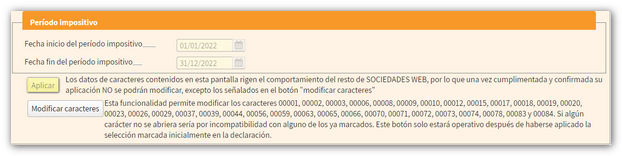

Indicates the start and end dates of the reporting entity's tax period. Click "Apply". In cases where the AEAT has sufficient tax data, the tax period fields will already be filled in.

Please note that when applying, only the content of the boxes indicated in the message next to "Modify characters" can be modified.

The characters that can be modified are established in the footer.

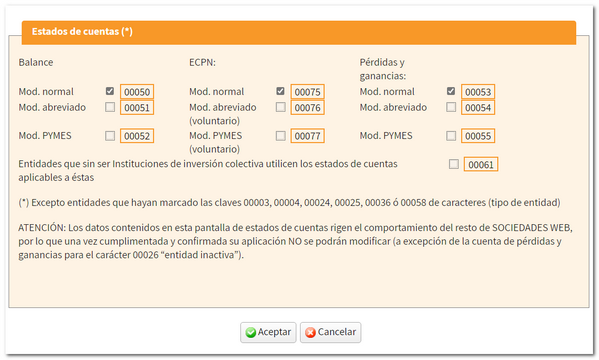

Next, in a new window, the boxes corresponding to the account status will be checked. It is also mandatory to check these boxes.

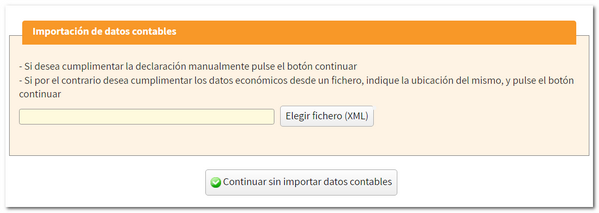

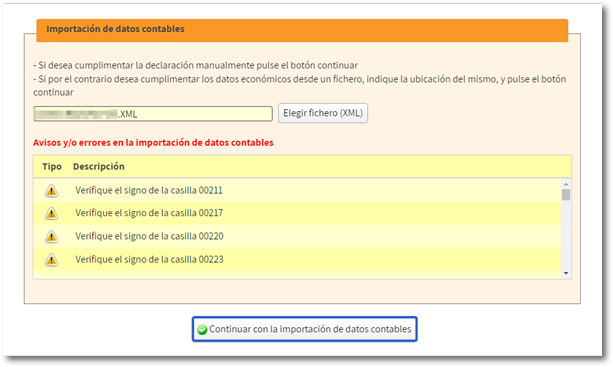

Before accessing the declaration, a new window allows you to import a XML file to incorporate accounting data. Press the button "Choose file ( XML )" to choose the file or "Continue without importing accounting data" to continue filling out the declaration. Please note that this process can only be done when filing a new return.

If the XML file does not contain errors and the data it contains is compatible with that established in the character and account status register when registering the declaration, the "Continue with the import of accounting data" button will be displayed. If you choose a XML file that returns errors during processing, you have the option to try another file, but only as long as you do not close the import window. Otherwise you will have to file a new declaration.

Please note that this import is optional and automatic for information relating to the balance sheet, the profit and loss account and the statement of changes in equity. It may be carried out for entities subject to the accounting standards of the Bank of Spain, insurance entities, collective investment institutions, mutual guarantee companies, and those not subject to specific regulations.

The import process checks that the file XML is well formed and valid according to the predefined schema "mod2002024.xsd" available in the "Model 200 Information" section available on the website. Correction of warnings or errors must be done on the XML , since once the data has been imported, it may have been processed by the form.

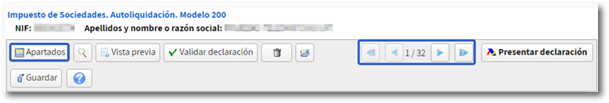

To continue completing the declaration you can use the arrows that go from page to page or the key "Sections" that takes you to the different sections of SociedadesWEB.