Companies WEB. Form functionalities

Skip information indexHow to import accounting data into Form 200

The 2024 Companies WEB form allows the automatic incorporation of economic data to certain sections of the declaration, avoiding manual completion.

The import of this data is done using a file in format XML, which must be adjusted to the predefined scheme "mod2002024.xsd" available in the "Model 200 Information" section.

The information that may be included in the form will be that relating to the balance sheet, the profit and loss account and the statement of changes in net worth.

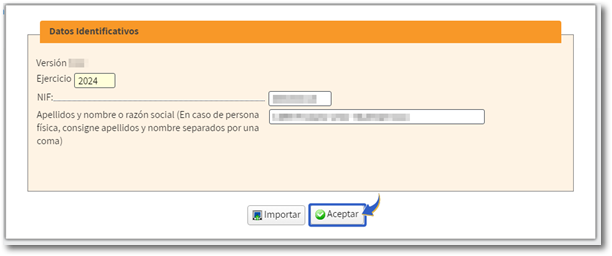

The process of incorporating accounting data is only applicable when registering a new declaration . Access Sociedades WEB, in the "Identification Data" window, provide the declarant's details and click "Accept".

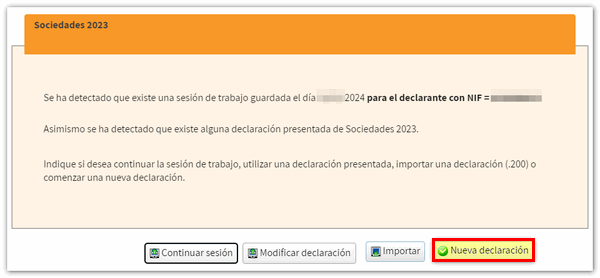

If a previous session is detected, click "New Statement" .

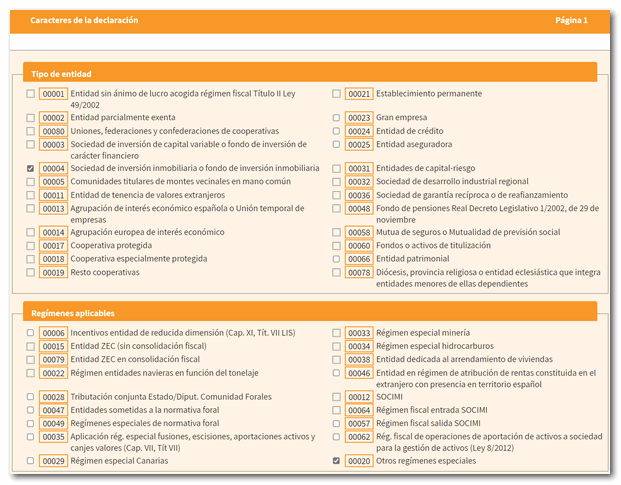

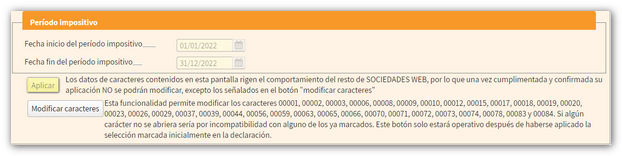

Next, page 1 "Declaration Characters" will be displayed, and special attention must be paid to completing it, since the screens and data that can be accessed will vary depending on the options selected on this page. Furthermore, after application, these data cannot be modified except for those indicated next to the modification key.

Once this page is complete, press the "Apply" button.

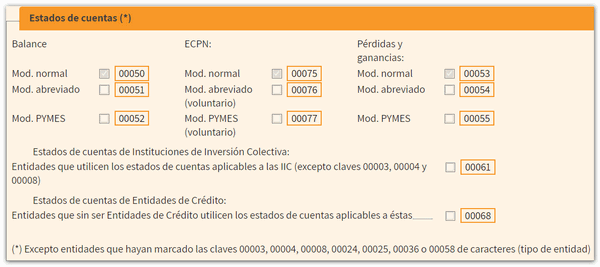

By clicking on "Apply" you will have to check the boxes corresponding to the account status associated with the entity. The requirement for using the import of financial statements is that they must be entities subject to the accounting standards of the Bank of Spain, insurance entities, collective investment institutions, mutual guarantee companies, and those not subject to specific regulations.

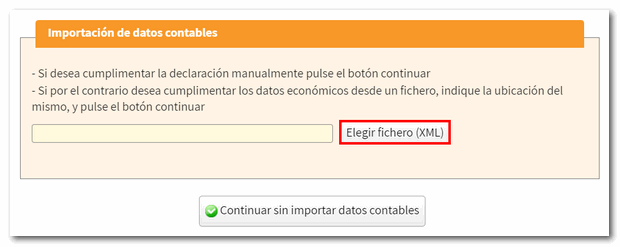

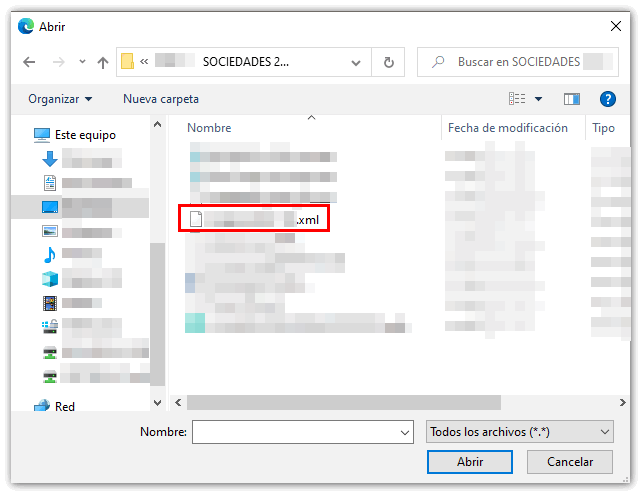

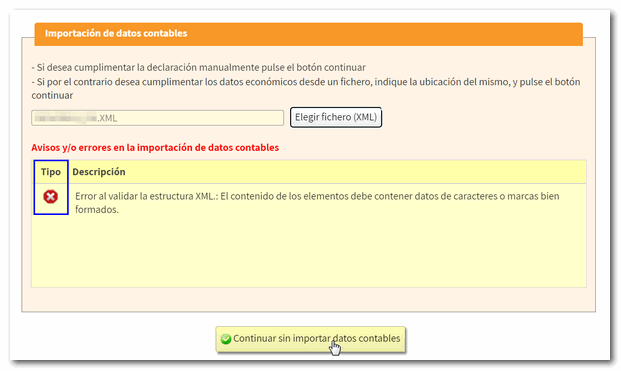

Next, the "Import accounting data" window will be displayed, from which you can incorporate accounting data into certain sections of the declaration, by selecting an XML file that contains this information. Press "Choose file ( XML )".

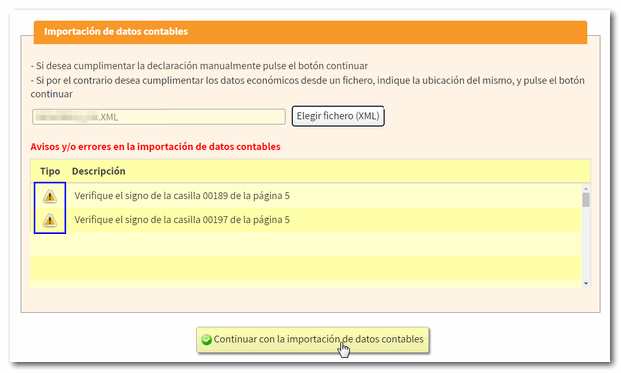

When reading the XML file , it will be checked whether it corresponds to the entity type selected on the character page and to the account status associated with it, provided that the latter data has been requested. If the file fits the layout, the button "Continue with importing accounting data" will be activated; You can also continue with the integration if the import process has generated warnings or alerts about the file XML that do not prevent the import of the data.

If there are errors, no data will be incorporated into the declaration. Correction of warnings or errors must be done on theXML. If you want to continue completing the declaration without importing data from the file, you can press the button "Continue without importing accounting data" .

If you access the pages of the declaration corresponding to the balance sheet, the profit and loss account and the statement of changes in equity, you can see that the accounting data contained in file XML has been imported.

To move through the different pages of the declaration, use the arrows on the button bar or click on "Sections" to access the different sections of the declaration.