Companies WEB. Form functionalities

Skip information indexWhere do I find the Company Reference Number NRS

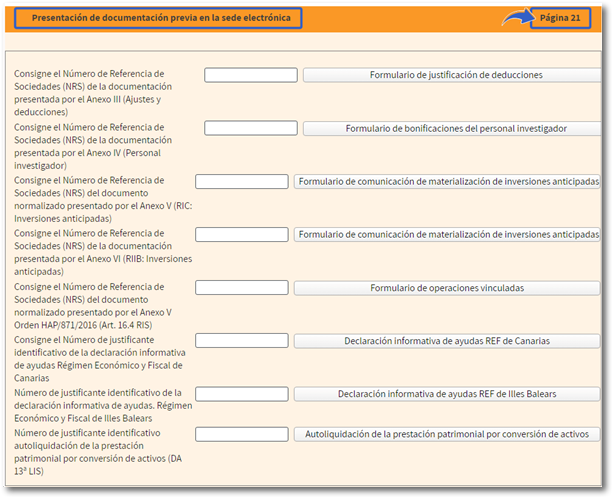

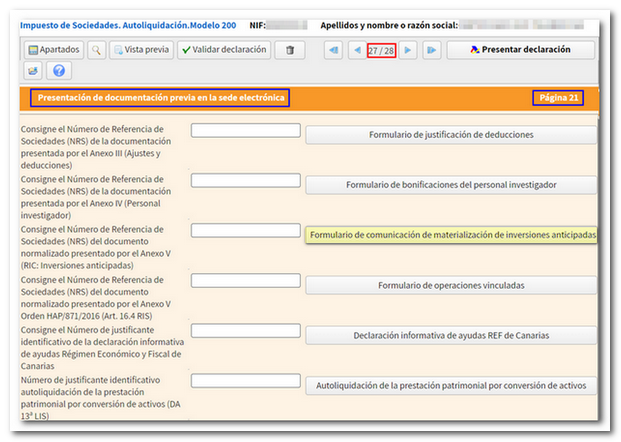

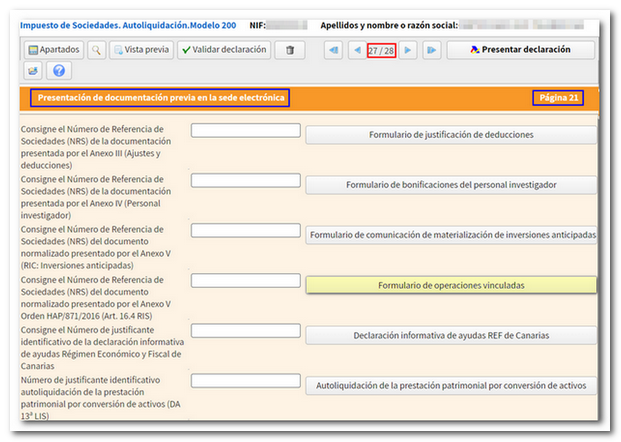

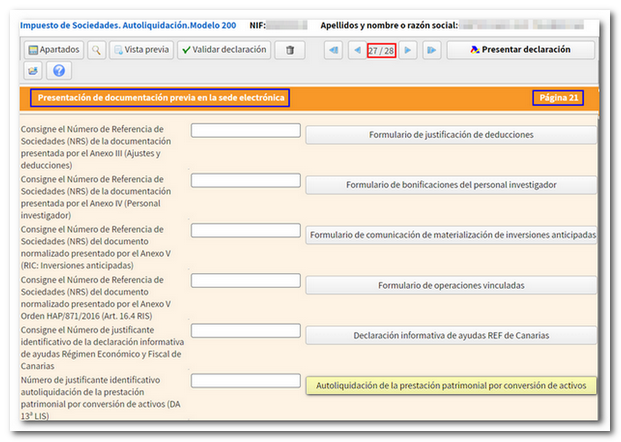

On page 21 of the form 200, corresponding to the "Presentation of prior documentation in the electronic office", it is necessary to enter the Company Reference Number (NRS) or the identification receipt number of the corresponding declaration (forms 221, 282 and 283) that has been previously submitted.

You can submit these additional information forms from the options available on of the WEB Companies form itself.

From the links enabled in the procedures of model 200:

- Additional information form for adjustments and deductions ( FJD ).

- Social Security Bonus Form (BSS) .

- Form for communicating the materialization of early investments. Reserve for investments in the Canary Islands (RIC) .

- Communication form for materialization of early investments Reserve for investments in the Balearic Islands (RIIB) .

- Specific documentation form for operations with related persons or entities that meet the requirements of articles 101 LIS (art. 16.4 RIS ) (FOV) .

Or from its specific section in the Electronic Office:

- Patrimonial benefit for conversion of deferred tax assets into a claim against the Tax Authority (form 221) .

- Annual information statement of aid received within the framework of the REF of the Canary Islands and other State aid, derived from the application of European Union law. (PIT, ES, IRNR) (model 282).

- Annual information declaration of aid received under the Special Tax Regime of the Balearic Islands (model 283).

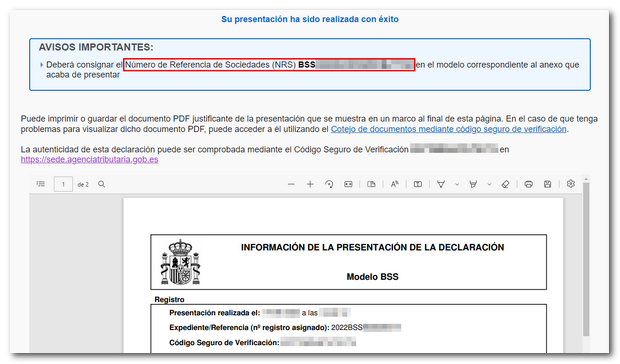

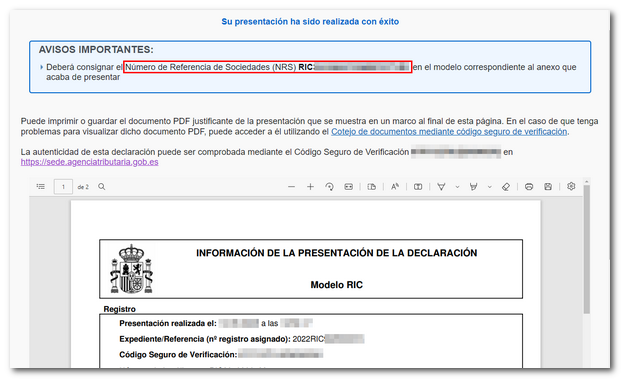

After submitting the additional information forms, you will receive a receipt that includes the PDF of the submitted return and, as applicable, the NRS or the corresponding receipt number.

Additional information on adjustments and deductions form

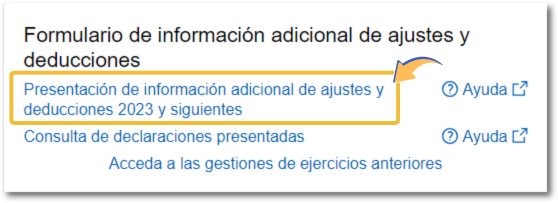

To obtain the NRS corresponding to the documentation submitted by Annex III (Adjustments and deductions) you can use the button " Deduction justification form " and thus access the form directly. Or, from the Form 200 procedures page, through the option "Submission of additional information on adjustments and deductions for 2023 and subsequent years", accessing with an electronic certificate, DNIe, Key (only natural persons) or eIDAS.

Once the form has been completed and submitted, on the response sheet confirming the submission of the declaration, locate the "Company Reference Number ( NRS )" , a 22-character reference that begins with FJD and that you must copy and incorporate into the field available on page 21 of your Model 200 declaration.

Social security rebate form

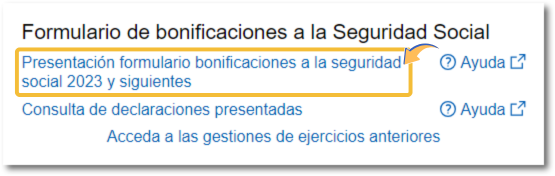

To obtain the NRS corresponding to the documentation submitted by Annex IV (Research Staff) you can use the button "Research Staff Bonus Form" and access the form directly, or from the Form 200 procedures page, enter the option "Submission of the Social Security bonus form for 2023 and subsequent years. Access is available with electronic certificate, DNIe, Key (only natural persons) or eIDAS.

Complete the form and on the response sheet confirming the filing of the declaration, locate the "Company Reference Number ( NRS )", a 22-character reference that begins with BSS that you must copy and incorporate into the field enabled on page 21 of your Model 200 declaration.

Reserve for Investments in the Canary Islands. Communication form for the materialization of early investments (RIC)

To obtain the NRS corresponding to the standardized document presented by Annex V (RIC: Early investments), you can use the button " Form for communication of materialization of early investments " and thus access the form directly, or from the procedures page of model 200, enter the option " Presentation of Reservation for investments in the Canary Islands. Fiscal year 2023 and following". Access is available with electronic certificate, DNIe,Key (only natural persons) or eIDAS.

Complete the form and on the response sheet confirming the filing of the declaration, locate the "Company Reference Number ( NRS )", a 22-character reference that begins with RIC that you must copy and incorporate into the field enabled on page 21 of your Model 200 declaration.

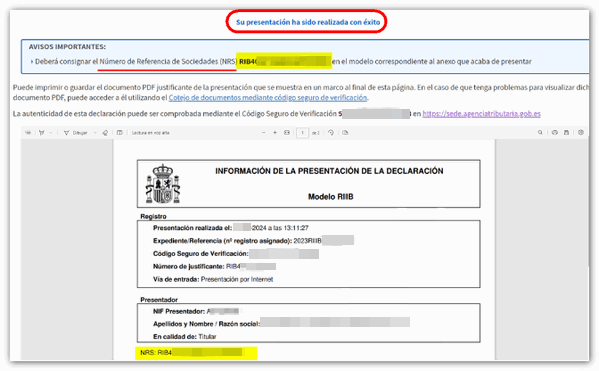

Reserve for investments in the Balearic Islands. Communication form for the materialisation of early investments (RIIB)

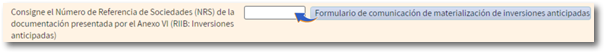

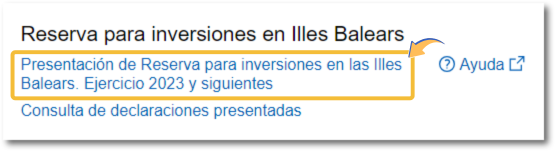

To obtain the NRS corresponding to the documentation submitted by Annex VI (Early Investments) you can use the button " Form for communication of materialization of early investments " and thus access the form directly. Or, from the Form 200 procedures page, enter the option "Presentation of a Reserve for Investments in the Balearic Islands. Fiscal year 2023 and following years". Access is available via electronic certificate, DNIe, Key (only natural persons) or eIDAS.

Complete the form and, on the response sheet confirming the filing of the declaration, locate the "Company Reference Number ( NRS )", a 22-character reference that begins with RIIB that you must copy and incorporate into the field available on page 21 of your Model 200 declaration.

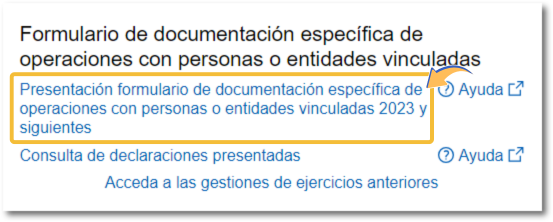

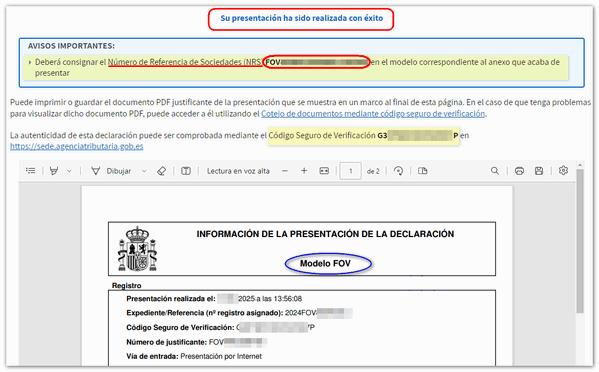

Form for specific documentation for operations with linked people or entities

To obtain the NRS corresponding to the documentation submitted by Annex V (Transactions with related persons or entities) you can use the button " Related party transactions form " and thus access the form directly. Or, from the Form 200 procedures page, enter the option "Presentation of specific documentation form for transactions with related persons or entities 2023 and subsequent years". Access is available via electronic certificate, DNIe, Key (only natural persons) or eIDAS.

Complete the form and, on the response sheet confirming the filing of the declaration, locate the "Company Reference Number ( NRS )", a 22-character reference that begins with FOV that you must copy and incorporate into the field available on page 21 of your Model 200 declaration.

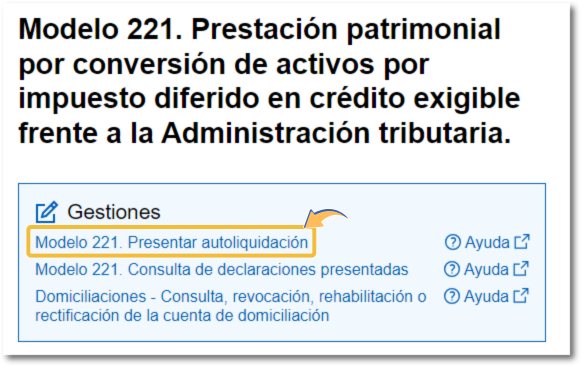

Form 221. Self-assessment of the patrimonial benefit for conversion of assets

To obtain the identification document of the Self-assessment of the patrimonial benefit for conversion of assets (DA 13 Lis), you must access with a certificate or DNI electronic to the list of procedures for Form 221 (Corporate Tax) and use the link "Form 221. Submit self-assessment. Access requires identification by electronic certificate or DNIe.

Once the self-assessment has been submitted, copy the submission receipt number that begins with 221, to include it on page 21 of the declaration.

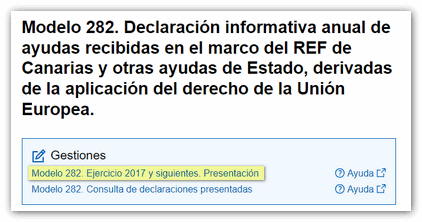

Form 282. Informative Declaration of aid REF of the Canary Islands

To obtain the identification document of the Annual information declaration of aid received under the Canary Islands Economic and Tax Regime, you must access the list of procedures for information declarations, locate form 282 and use the link "Form 282. Fiscal year 2018 and following years. Presentation". Access is available via electronic certificate, DNIe or Cl@ve (natural persons only).

Once the declaration has been submitted, copy the filing receipt number that begins with 282 to include it on page 21 of the declaration.

Model 283. Informative Declaration of aid received from the Special Tax Regime of the Balearic Islands

To obtain the identification document for the Annual Information Declaration for aid received under the Special Tax Regime of the Balearic Islands, you must access the list of information declaration procedures, locate Form 283, and use the link "Form 283." Exercise 2024. Presentation". Access is available via electronic certificate. DNIe either Key (only natural persons).

Once you have filed your return, copy the filing receipt number beginning with 283 and include it on page 21 of your return.