Companies WEB. Form functionalities

Skip information indexIncorporation and consultation of tax data in WEB Companies

WEB Companies automatically incorporates tax data into the program; However, the information that is automatically completed may be modified later in the form if it is considered to be incorrect.

For tax data to be automatically transferred to the declaration, the declarant must be a legal entity and its tax period must coincide with the calendar year (01/01/2024 - 31/12/2024), fiscal year type 1. In addition, access must be made in one's own name or as a representative of the holder of the declaration.

If you log in as a collaborator, this option does not appear and you will have to enter the data manually.

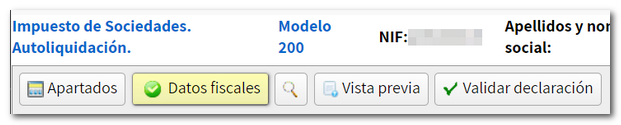

To consult the data that has been transferred to the declaration, click on the button "Tax data" , available in the button bar at the top of Sociedades WEB.

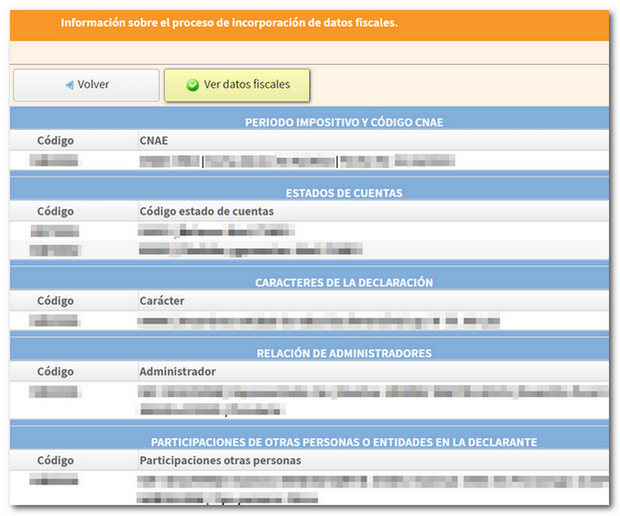

You will be able to see the codes of the sections where the information has been incorporated in a schematic way.

To see the breakdown of the data, press the button "View Tax Data" which will take you to the query at our headquarters, in a new tab.

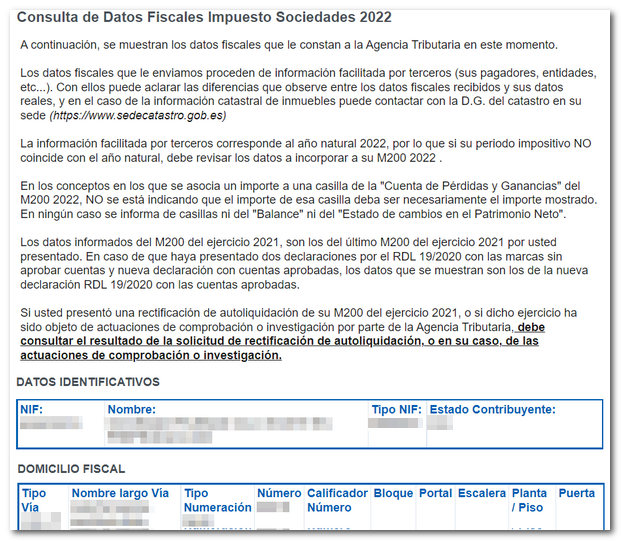

The information is displayed on the screen, it does not have a printable format or specific option for downloading.

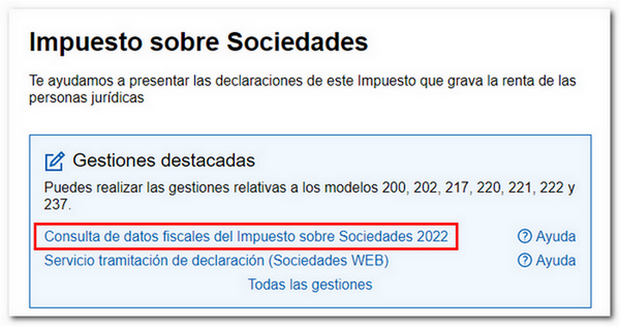

You can also view tax data from the service available on the Electronic Office, accessing the Corporate Tax procedures in "Corporate Tax Data Query for 2024". The query is only available for legal entities with an electronic certificate or eIDAS of the declarant or through the specific power of attorney DFIS (Query of Corporate Tax Tax Data) or the general one for querying personal data GENERALDATPE .

As clarified in the information at the top of this consultation, it is important to keep the following in mind:

-

The tax data we send you comes from information provided by third parties (your payers, entities, etc.) With them you can clarify the differences you observe between the tax data received and your real data, and in the case of property cadastral information you can contact the DG of the cadastre at its headquarters (https://www.sedecatastro.gob.es)

-

The information provided by third parties corresponds to the 2024 calendar year, so if your tax period does not coincide with the calendar year, you should review the data to be included in your Form 200 for the 2024 tax year.

-

In the concepts in which an amount is associated with a box in the "Profit and Loss Account" of Form 200 of 2023, it is NOT indicated that the amount in that box must necessarily be the amount shown. In no case are boxes reported on either the "Balance Sheet" or the "Statement of Changes in Net Worth".

-

The data reported on Form 200 for the 2023 fiscal year are those of the last one submitted. In the event that you have submitted two declarations under RDL 19/2020 with the new brands without approving accounts and a new declaration with approved accounts, the data shown is that of the new RDL 19/2020 declaration with the approved accounts.

-

If you submitted a self-assessment correction for Form 200 for the 2023 tax year, or if the 2023 tax year has been subject to audit or investigation by the Tax Agency, you should check the results of your self-assessment correction request or, where applicable, the audit or investigation.