WEB Societies: Access, processing of model 200 and WEB Open Companies version

Skip information indexHow to file a supplementary declaration for Form 200

When should a supplementary declaration for Form 200 be submitted?

If you have filed a declaration of form 200 for the year 2023 and earlier, and then need to make corrections (for the same form, NIF, exercise and period) which represent a higher income or a lower refund, you can file a supplementary declaration.

The supplementary declaration must include all the following information: both those of the new self-assessment and those included in the original self-assessment and in subsequent ones, where applicable.

In other cases (when the result does not change, it represents a lower income or a higher refund), you can submit a correction to the declaration.

Steps to file the supplementary declaration from Sociedades WEB

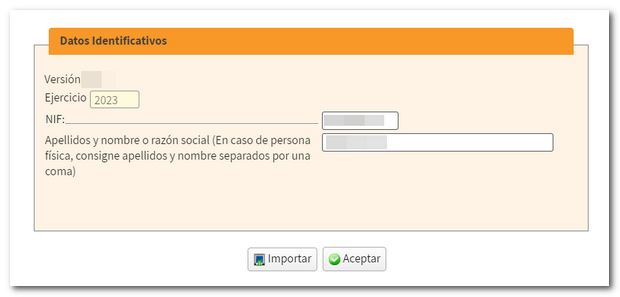

Access Declaration processing service (WEB Companies) . Enter the declarant's identification data and press Accept .

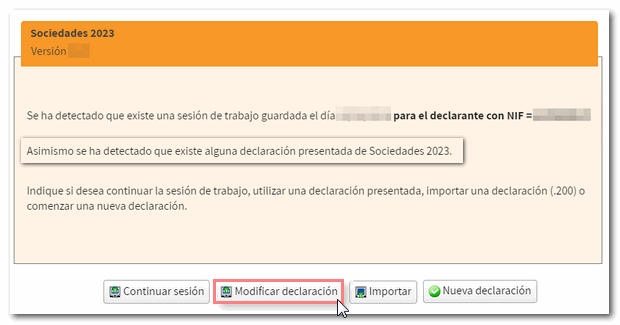

It will be detected that a declaration has already been submitted and the button Modify declaration will be displayed. If there is more than one previous declaration submitted, you must choose which one you want to recover.

Note: The Modify declaration button is only displayed if the NIF identified is the holder of the declaration, the social collaborator who submitted the original declaration or a person or entity authorized by the holder.

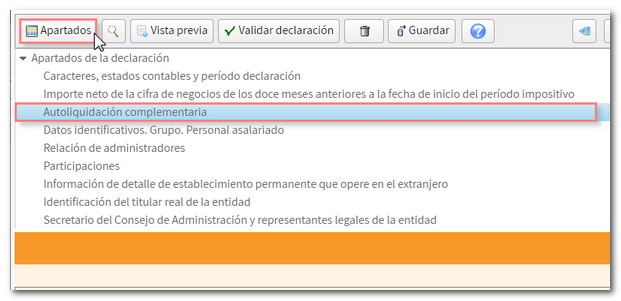

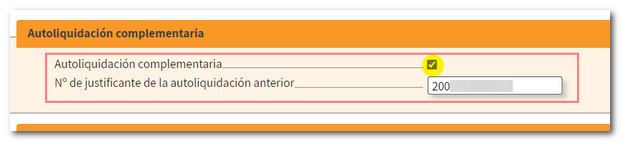

All data from the submitted declaration will be loaded into the form. From Sections , go to page Supplementary self-assessment , check the box Supplementary self-assessment and enter the receipt number of the previous declaration.

Note: The "Supplementary self-assessment" field and the receipt number will already appear filled in if the declaration that has been recovered was already supplementary. In this case, to modify the declaration and submit a new supplementary one, you must correct the receipt number and indicate the number of the last declaration submitted.

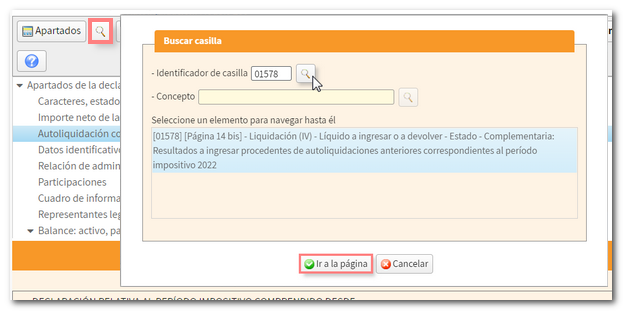

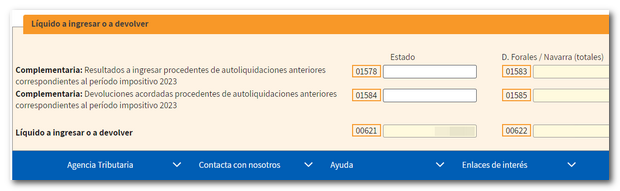

On page 14 BIS, within section Liquid to be entered or returned the amount of the previous declaration must be reflected in boxes 0621/0622 Liquid to be entered or returned. You can use the box finder (magnifying glass icon) to easily locate these boxes.

- If the original self-assessment resulted in being paid, also complete boxes 01578 and 01583 "Supplementary: Result to be entered from previous self-assessments corresponding to the 2023 tax period" of the same section.

- If was returned, fill in boxes 01584 and 01585 "Supplementary: "Agreed refunds from previous self-assessments corresponding to the 2023 tax period." If the refund has not been agreed or made, zero must be entered in the corresponding box.

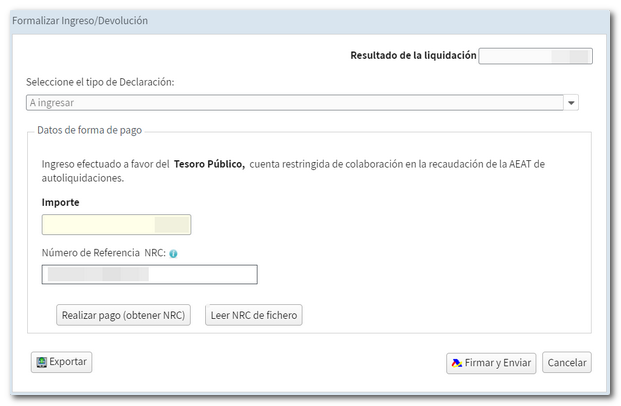

Next, make the necessary corrections to Form 200, check the result to be entered and submit the declaration with the corresponding income.

Note: Direct debit of supplementary declarations is not possible.