Cancellation of an NRC for models 576 and 696

In order to cancel a NRC corresponding to models 576 and 696, it is necessary to present to the Financial Entity the cancellation request receipt previously generated by the AEAT .

This receipt can be obtained on our website by accessing with Cl@ve or digital signature (certificate or electronic DNI ) to "Cancellation of NRC 's (models 576, 696)" .

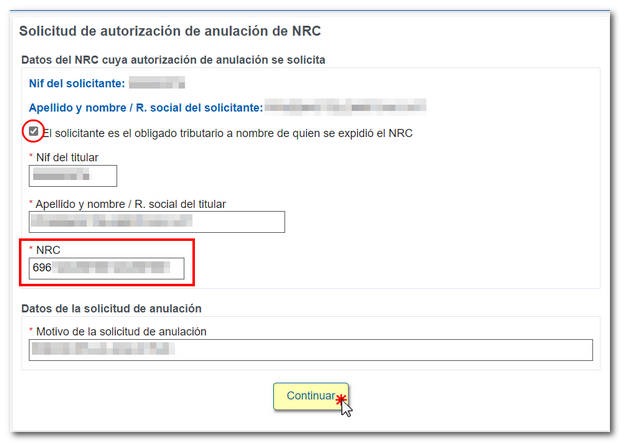

In the application form, if you are accessing as the taxpayer in whose name the NRC was issued, check the corresponding box. If you are accessing on behalf of a third party, please fill in the details of the owner. Fill in the NRC that you wish to cancel.

By pressing "Continue" and signing the request, the document will be generated that expressly authorizes the immediate cancellation of the NRC improperly generated.

Once you have obtained the receipt through this means (or directly at the corresponding Administration or Delegation), you must deliver it to the Collaborating Entity so that it can proceed to cancel the NRC and refund the corresponding amount. Refunds for cancellations should be immediate, although depending on the bank, it may take a few days to appear in your account.

Typically, a NRC is cancelled if it has not been used in a submission; Otherwise, the status of NRC would prevent cancellation by the Financial Institution and a request for refund of undue income would have to be submitted, presenting the allegations and documentation that may justify the request.

You can also check if the NRC has been cancelled via option "Checking a NRC cancellation" .

Deadlines for cancellation of NRC

The date on which the NRC was generated is essential to be able to request the Financial Institution to cancel it. The cancellation of a NRC can only be carried out until the day following the end of the collection fortnight in which the NRC was generated.

The tax collection fortnight comprises two cycles: One covers from the 5th of the current month to the 20th of the same month. The next cycle, from the 21st of the current month to the 5th of the following month (and so on). It doesn't matter if they are months with 28, 29, 30 or 31 days. The collection fortnights do not necessarily have fifteen days. Therefore, it can be cancelled up to the next business day after the last day on which the fortnight ends, inclusive. Normally on the 6th or 21st of each month. However, if the day on which the fortnight ends falls on a Saturday or national holiday (including Sundays), then it is also extended until the next business day.

The EEFF have the obligation to cancel the NRC when duly requested within these deadlines.

Alternatives to cancellation

If it is not possible for the Financial Institution to cancel the NRC , it will be necessary to submit an application for the refund of undue income to the AEAT .

It is not possible to guarantee the refund period, as this depends on the time required for processing, whether additional information is requested by the AEAT and whether the request is accepted and the refund of the amount is authorized.

It is also possible to submit the application in paper form if preferred or if you do not have a certificate/ electronic DNI or Cl@ve .