Self-assessment payment and payment of debts by direct debit. Getting a CRN

payment of a assessment/debt from the electronics Office can be made either with an electronic certificate or DNIe, as with eIDAS or be registered in the identification system Cl@ve.

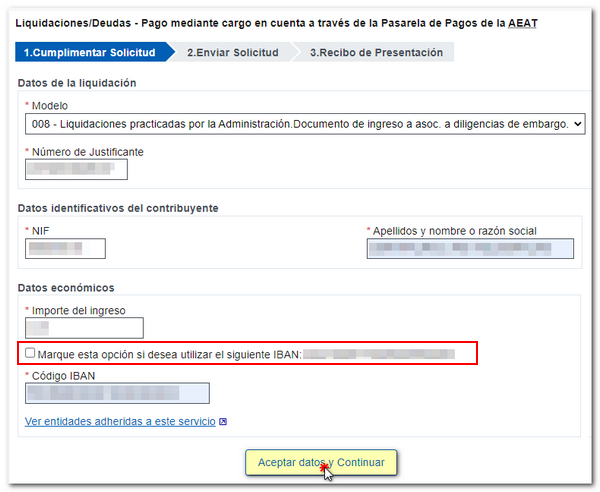

Once you access the form, indicate the settlement model and the receipt number that appear on the payment letter. The taxpayer's identification data and the amount must also be completed and reviewed. If you want the payment to be made to an account with which we have already identified you, make sure that the digits match those that appear and check the corresponding box.

If you want the payment to be made to a different account, enter the full IBAN in the corresponding field. You can check that your financial institution is a collaborating entity with the Tax Agency for payment by direct debit from the link "See Entities adhering to this service" .

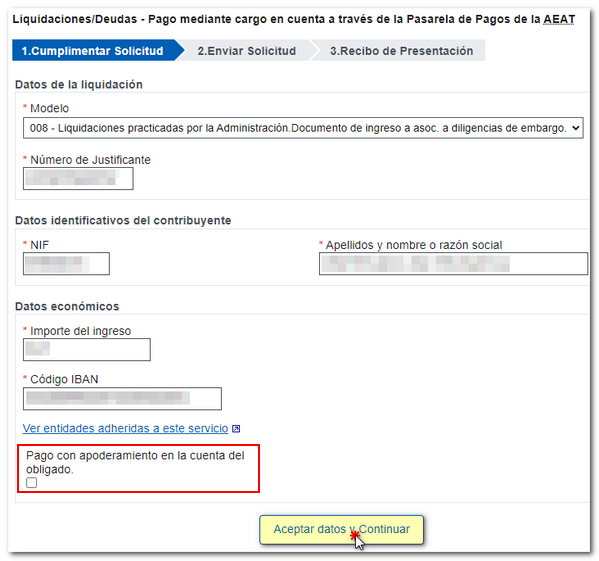

If you are making the payment on behalf of a third party using the bank account of the holder of the settlement/debt (the party obliged to make the payment), you must be authorized by the party obliged to carry out this operation. In this case you must check the box "Payment with power of attorney in the account of the obliged party." This power of attorney can be registered online provided that the grantor (who must be the taxpayer) has an electronic certificate or is registered in Cl@ve if the person is a natural person. The specific authority to carry out this type of procedure is "PAGOAPODECCC - Payment by direct debit".

After entering and reviewing the data, press the "Accept data and Continue" button.

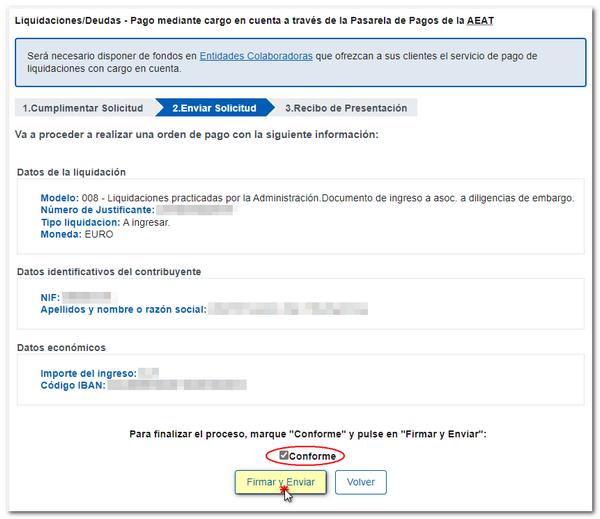

In the next step "2. Send Request", check again that the data is correct, check the "I agree" box and press "Sign and Send" to confirm the payment.

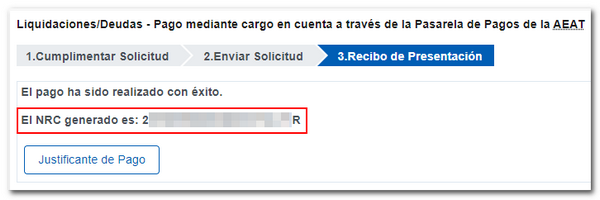

If everything is correct, the NRC or Complete Reference Number is displayed on the screen. This is a 22-character code generated as proof of payment.

You can download the proof of payment in PDF from the "Payment Proof" button as proof of the payment made. It will be downloaded to the default folder of your browser. Once the operation has been carried out and the NRC has been obtained as a response, it is not necessary to present any other document.

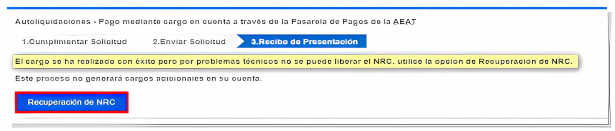

If on any occasion you have not been able to obtain the Reference Number NRC due to a specific incident, you can recover it by accessing the payment gateway again, a window will be displayed with the button "Recovery of NRC " next to the text " The charge has been made successfully but due to technical problems the NRC cannot be released, use the Recovery of NRC option. This process will not generate additional charges to your account ". This text indicates that the operation was successful and the charge exists.

This button allows you to obtain the NRC immediately and does not generate new charges.

For the " NRC Recovery" button to be displayed, these requirements must be met:

-

That you are accessing the payment or linking from a form, with the Payment Gateway of the AEAT and you are not accessing the option to consult a previous payment.

-

That you have made the payment correctly and there is a charge in the Financial Institution.

-

You have not obtained the NRC on the screen due to an incident, possibly very specific.

If you are persistently unable to recover the NRC , you can check whether the payment has been made and, if applicable, recover the NRC on the "Check debts" page in the "Check previous payments and Cancellation of NRCs" section, by clicking on "Settlements/Debts. "Inquiry about a previous payment by direct debit." You must enter exactly the same data that you provided to make the payment and, if it exists, you will receive the NRC generated to serve as proof.

If you do not have the appropriate identification system to make the payment, there are other alternatives to obtain the NRC :

-

Go to an office of your bank and provide all the information relating to the debt settlement. It is not necessary to provide any model, only the data used to generate the NRC and which are the same as those requested to make the payment through the AEAT website (model, receipt number, NIF declarant, surname and exact amount of the payment).

-

Through the electronic banking service if the Banking Entity offers this possibility.