Form 121

Skip information indexElectronic filing of form 121

You can access by identifying yourself with Cl@ve , certificate or DNIe . If you have questions about how to obtain an electronic certificate or how to register in the Cl@ve system, consult the information available in the related content.

If the declarant does not have an electronic certificate, it is necessary that the person making the submission be authorized to submit declarations on behalf of third parties, either by being registered as a collaborator or by being authorized to carry out this procedure.

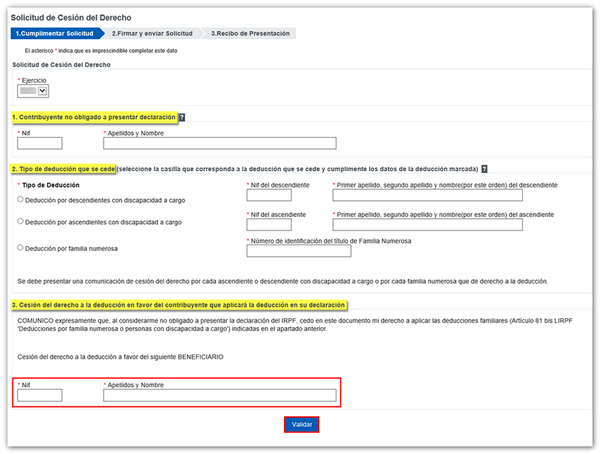

Disabled descendants or ascendants who are related must have a tax identification number. A communication must be submitted for each dependent disabled person or for each large family entitled to the deduction.

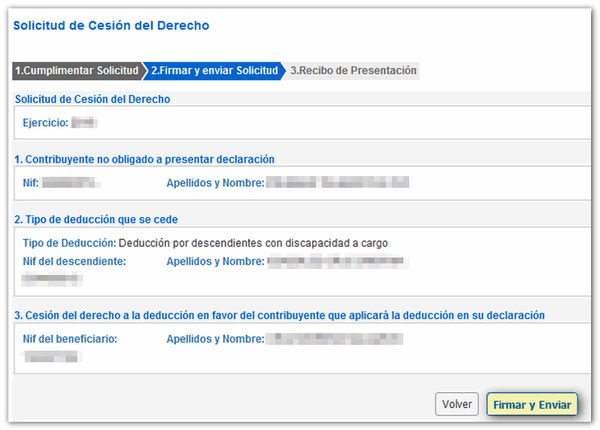

Once the form is completed, press " Validate "; If the validation is correct and there are no errors, click on the " Sign and Send " button.

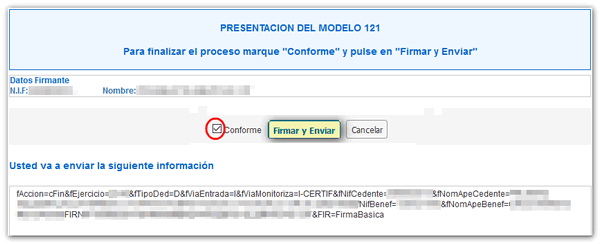

Check "I agree" and press "Sign and Send".

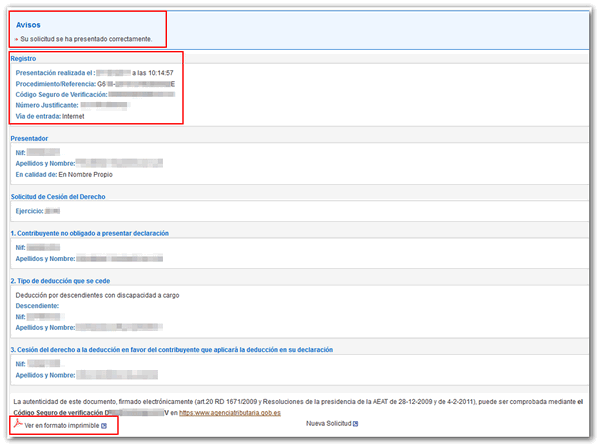

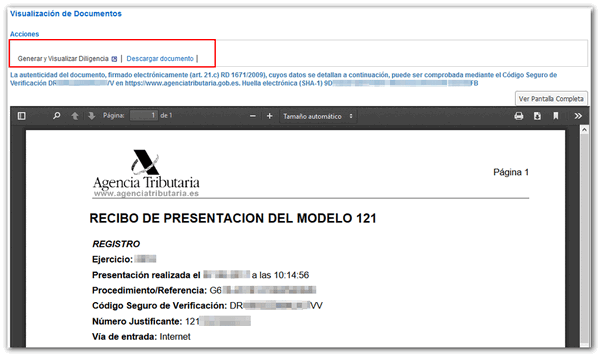

If everything is correct, you will get the response screen that says "Your submission has been successfully submitted" with a "View printable format" link that allows you to download the PDF with the submission information.

If you do not have an electronic ID, you can use the pre-declaration form to complete it and obtain the PDF to present it in person at the Administration.