Model 147

You can access by identifying yourself with Cl@ve , certificate or DNIe . If you have questions about how to obtain an electronic certificate or how to register in the Cl@ve system, consult the information available in the related content.

If the declarant does not have an electronic certificate, it is necessary that the person making the submission be authorized to submit declarations on behalf of third parties, either by being registered as a collaborator or by being authorized to carry out this procedure.

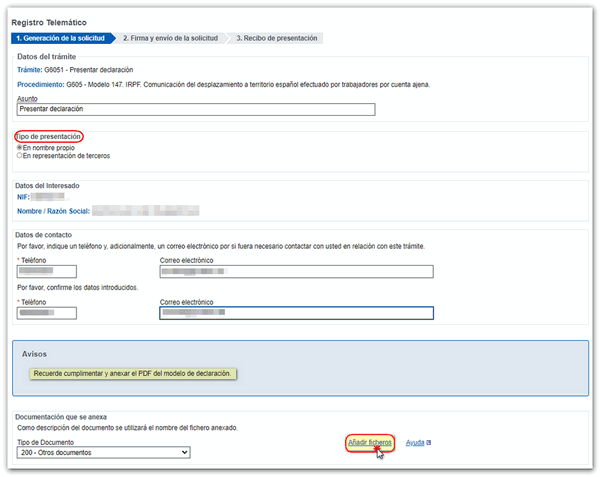

Fill in the "Subject" box, the type of declaration: on your own behalf or on behalf of a third party (in this case it will be necessary to indicate the NIF of the interested party) and contact details in case it is necessary to contact you in relation to this procedure.

Click the "Add file" link to select the file containing the documentation you wish to submit. In the "Help" link you can check the list of formats accepted for the presentation of files for this procedure, the maximum size allowed for each file being 64 MB.

In addition, as indicated in the notice, it is necessary to complete and attach the PDF of the declaration model.

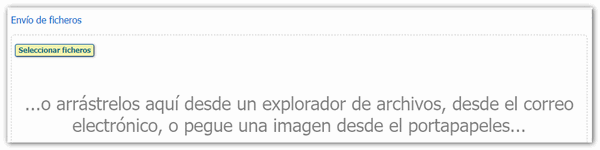

Press "Select files" to access the file you want to attach. It is preferable that the file name does not have punctuation marks and is saved on your local disk, in the folder " AEAT ". Another option is to drag it from File Explorer or from an email.

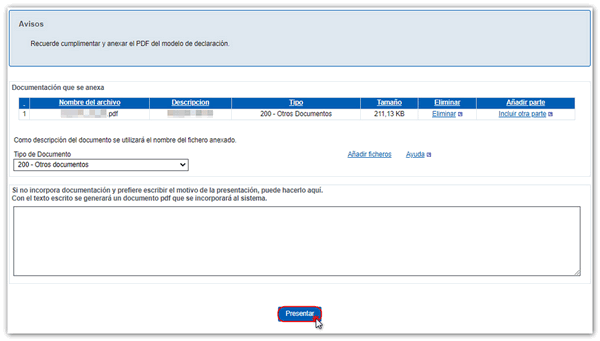

The added file will appear in the "Attached documentation" section. If you need to add another part to this file, click "Include another part".

If you need to add new files, and not as part of the previous one, press "Add file" again. Finally click on the "Submit" button.

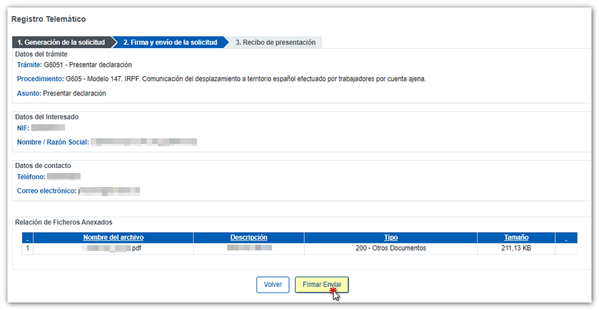

Once all the files have been attached, click "Sign and Send".

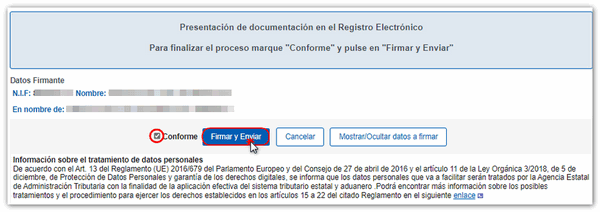

Check "I agree" and press "Sign and Send".

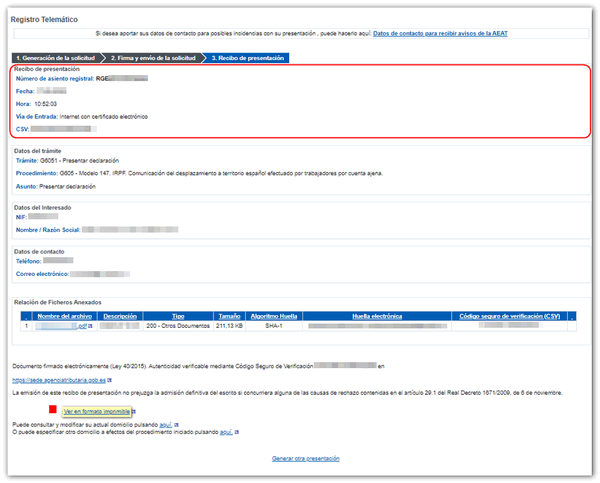

If everything is correct, you will get the response screen with a link to "View printable format" containing the PDF with the presentation information.