Form 202

Skip information indexHow to report additional data for the 2024 and subsequent years

To provide additional information for Form 202 for the years 2024 and later, you can use the online form available on the website.

To correctly view all parts of the form, before accessing it, check the zoom and font size set in the browser (once the declaration has been submitted, you can return to the previous zoom and font size).

-

In Microsoft Edge , access the three horizontal dots, in zoom select 100% with the "+" and "-" signs. Go back to the three horizontal dots to enter "Settings", select "Appearance" and under "Fonts", "Font size" select "Medium (recommended)", under "Page zoom" select 100%.

-

In Google Chrome , go to "Settings" (from the three vertical dots), "Appearance", "Font size" and select "Medium (recommended)", in "Page zoom" select 100%. You can also select 100% zoom from "Zoom In/Out".

-

In Mozilla Firefox , access the three-stripe icon, in "Size" select 100% with the "+" and "-" signs, press "Options", "General", "Language and appearance" and in "Fonts and colors" select a size smaller than the current one, if you do not see the form correctly.

-

In Safari , go to "View," "Enlarge," or "Reduce."

Press "Model 202. Exercises 2014 and following. Submission of the communication of additional data to the declaration" of section "Annex 202"

This procedure requires identification with electronic certificate eIDAS and Cl@ve .

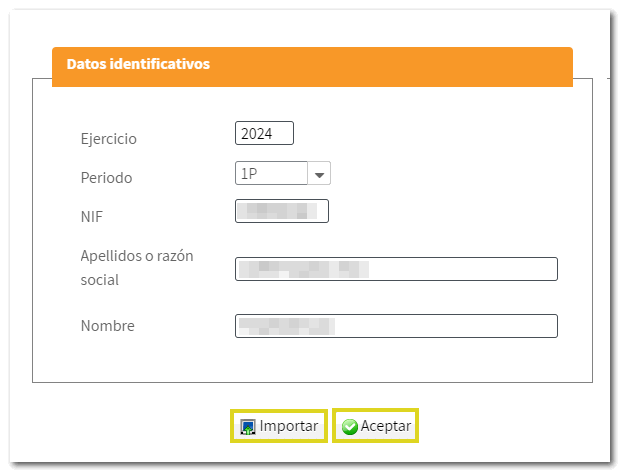

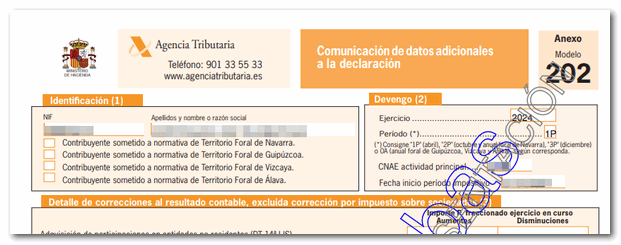

In the identification data window, select the period and enter your identification data, NIF , surname and first name or company name. If you want to import a file generated with the form or with a program other than AEAT you have the "Import" option in this same window. Please note that this file must be text and must conform to the published record layout. You can find the registration design of model 202 for electronic submission in the direct access "Registration designs. Models 200 to 299" and in the "Help" section, "Registration designs" at the bottom of the web page.

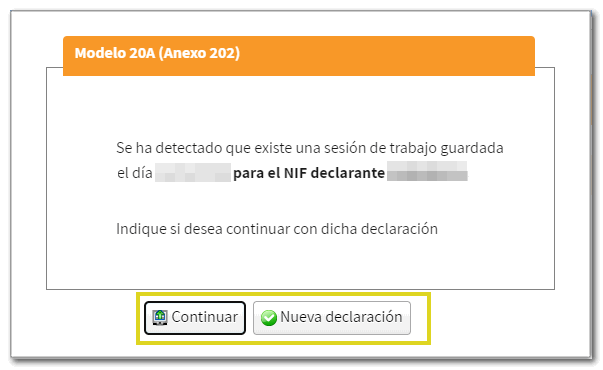

The system detects whether you have been working on the declaration in a previous session, giving you the option to continue with it by clicking the "Continue" button, if you have submitted the declaration or if you wish to create a new declaration.

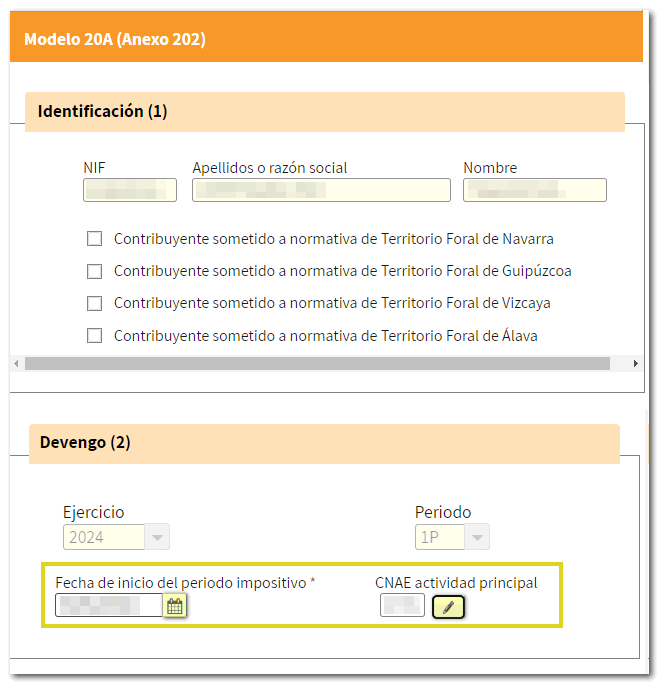

If you are accessing this site for the first time, please fill in the additional information requested. You can indicate the " CNAE "main activity" by clicking the button with the pencil icon and selecting the start date of the tax period from the calendar icon.

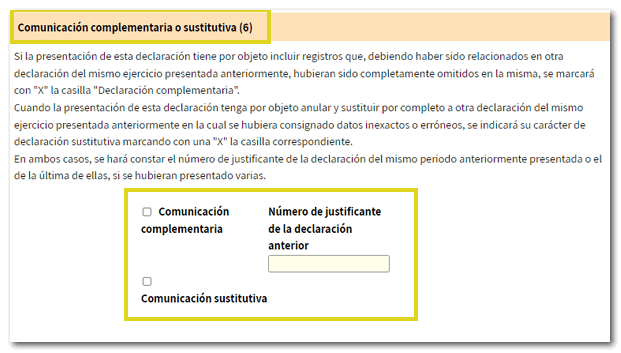

If you need to submit a supplementary or substitute declaration, check the corresponding box below and enter the supporting document number of the previous declaration.

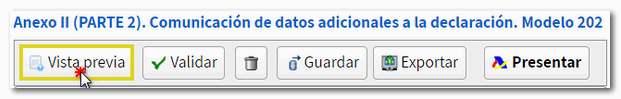

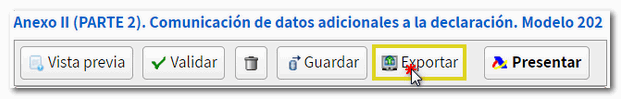

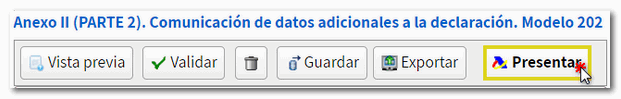

At the top of the form is the button bar with the available functions:

-

You can use " Preview " to review how your return will look before you file it. You get a draft not suitable for presentation.

-

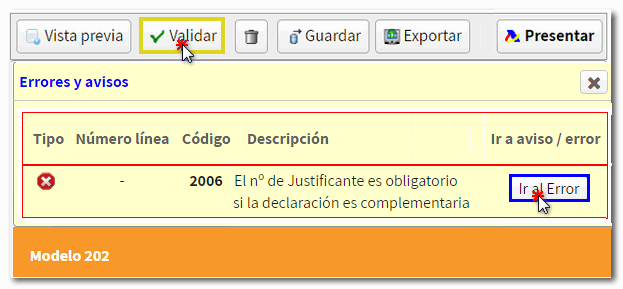

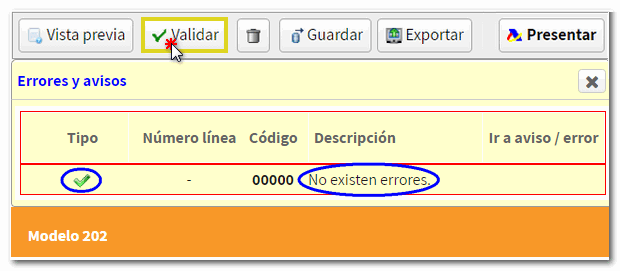

Using the " Validate " button, check if you have any warnings or errors. Remember that the notices provide relevant information that should be reviewed but do not prevent the filing of the tax return. If the declaration contains errors, these must be corrected. Click "Go to Error" or "Go to Notice" and the cursor will be activated in the corresponding box.

-

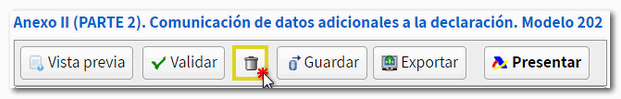

"Delete Return", identified by a trash can icon, deletes the data from the return you are working on in order to start a new one.

-

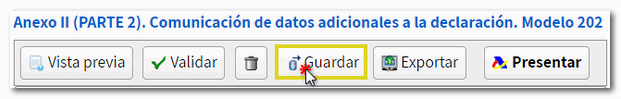

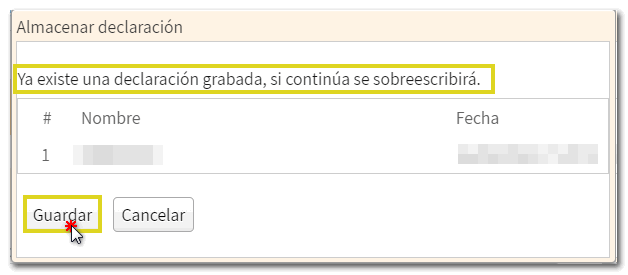

The " Save " button allows you to store the declaration data on the AEAT servers even if it is incomplete and contains warnings or errors. If a tax return has been saved previously, it will be overwritten. When you access the model again, in the initial window, if the application detects that there is a saved declaration, it will give you the option to recover the data using the "Continue" button.

-

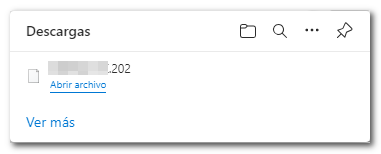

The form allows you to generate a file in BOE format from the " Export " option, provided that the declaration has been validated correctly and there are no errors. You can choose the path where you want to save the file, by default in the "Downloads" folder and it will have the name NIF of the declarant and the extension .202. You can recover the declaration using the option " Import " in the initial identification data window when you access it again.

-

Use the " Submit declaration " button to submit the declaration once it has been completed and validated.

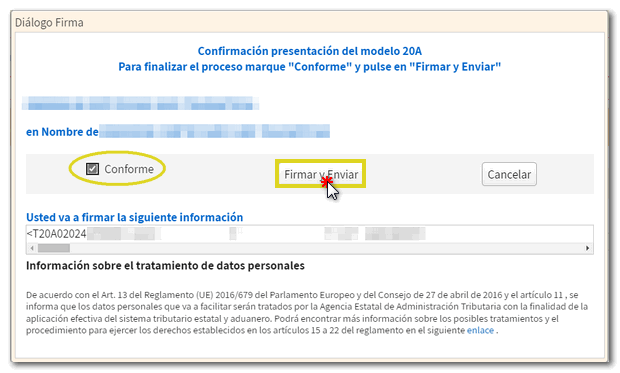

Then check the "I agree" box and press "Sign and Send" to finish the submission.