Form 202

Skip information indexHow to report additional data to the 2015 and 2016 tax return

To provide additional information for the Model 202 declaration for the 2017 and 2018 fiscal years, you can use the online form available in the Model 202 procedures.

Press "Form 202. Fiscal years 2017 and 2018. Submission of communication of additional data to the declaration".

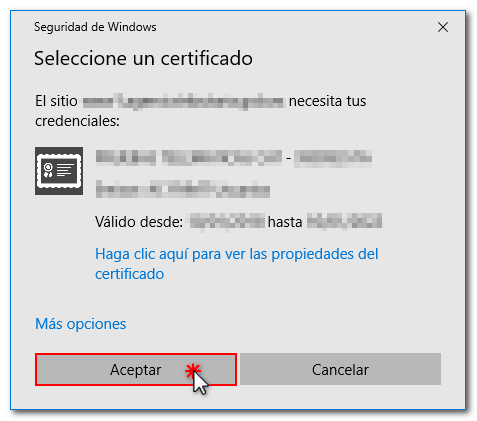

This procedure requires identification with an electronic certificate.

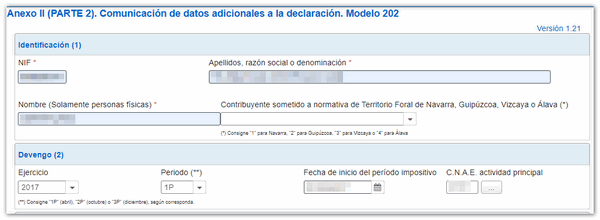

Enter your identification details and complete the form with any additional information you need to provide. To indicate the " CNAE "main activity" press the button with the ellipsis and to select the start date of the tax period you can use the calendar icon.

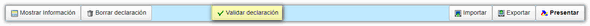

Before submitting the declaration, check if there are any warnings or errors using the " Validate declaration " button. Remember that the notices provide relevant information to take into account but do not hinder the filing of the declaration. If the declaration contains errors, these must be corrected. Clicking "Go to Notice" or "Go to Error" will take you to the appropriate box that you need to correct.

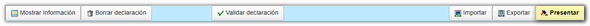

To file the return press " File ".

In the next window, check the "I agree" box and click "Sign and Send" to complete the submission.