Form 228

Skip information indexForm 228 for paper submission

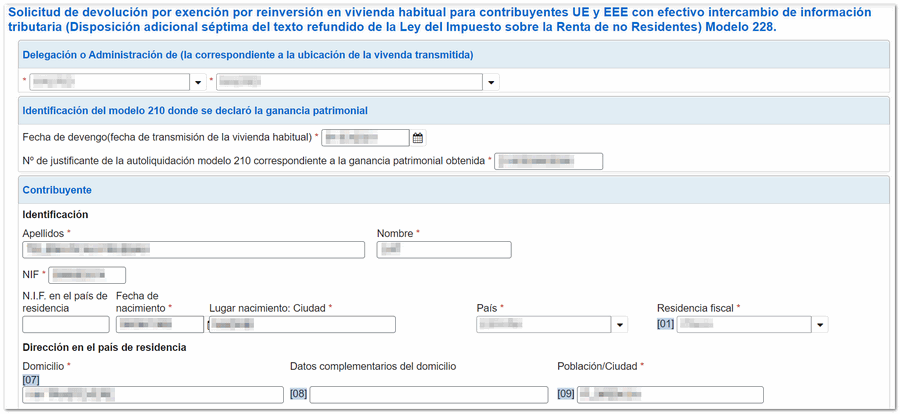

For the paper submission of "Model 228. Request for refund for exemption for reinvestment in habitual residence for taxpayers of the European Union and the European Economic Area with effective exchange of tax information", you have a form to fill out online and obtain the PDF with the declaration, previously validated by the AEAT server.

Please fill in all the requested information, especially those corresponding to the fields marked with an asterisk, which must be completed.

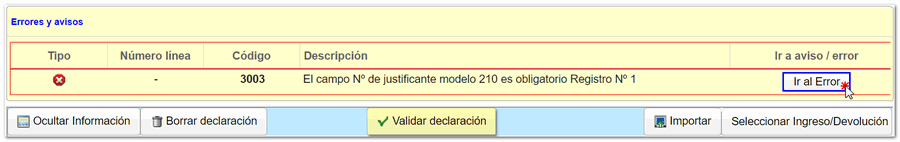

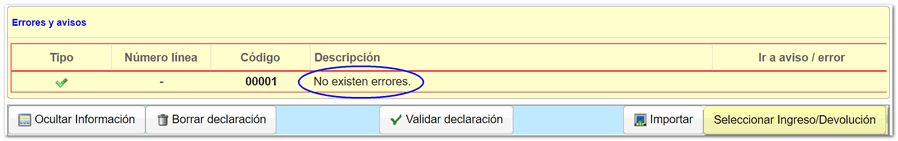

Before generating the pre-declaration, check if there are any warnings or errors by clicking on the " Validate declaration " button, located on the button bar at the bottom of the form. Information will be displayed with the warnings and/or errors detected. Remember that the notices provide relevant information to take into account, but do not prevent the filing of the declaration. However, if the declaration contains errors, these must be corrected in order to generate the pre-declaration.

Once completed correctly and without errors, click on the button " Select Income/Refund " located in the bottom button bar, to generate document PDF with the content of the declaration.

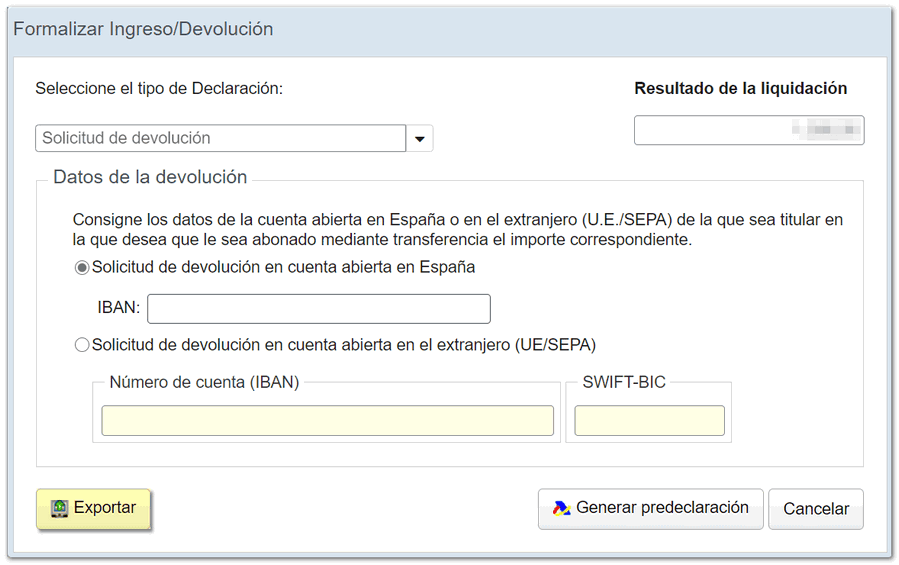

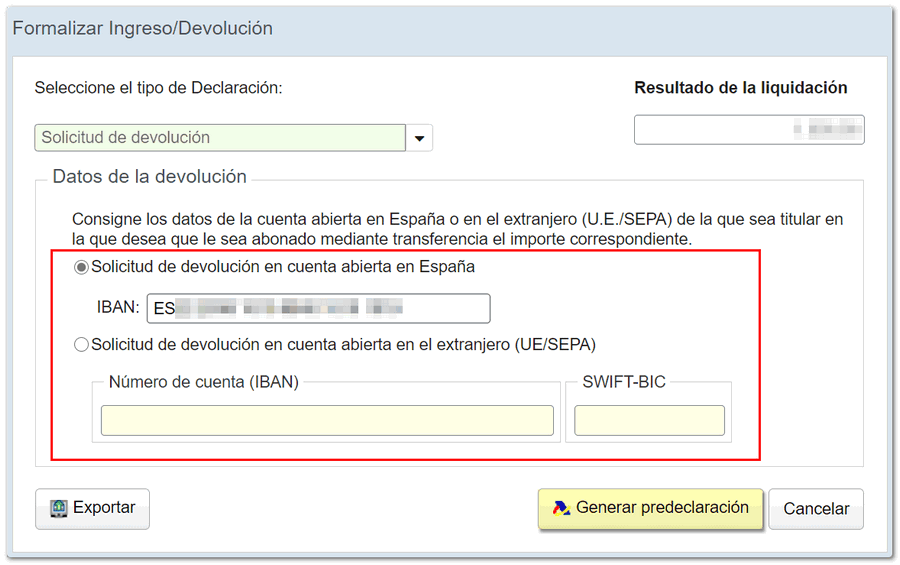

A new window will appear from which, on the one hand, you can generate a file with the declaration data in BOE format, by clicking on the " Export " button. The name of the resulting file is formed by the NIF of the declarant, the fiscal year and the period, and the extension, by the model number ( NIF _ejercicio_periodo.228). The file is saved by default in the folder you have set as default for downloads.

At any time you can recover the data from the downloaded file by accessing a new declaration and clicking on the " Import" button .

In this same window, you must indicate the code IBAN of a bank account in which you appear as the account holder, so that the refund can be deposited. If you have a bank account opened in Spain, select the option "Refund request to an account opened in Spain" and indicate the IBAN . If it is an account opened abroad, check the option "Request for refund on account opened abroad ( EU / SEPA )" and complete the IBAN and the SWIFT - BIC .

Once the refund account has been indicated, press " Generate pre-declaration " to obtain the PDF of the pre-declaration.

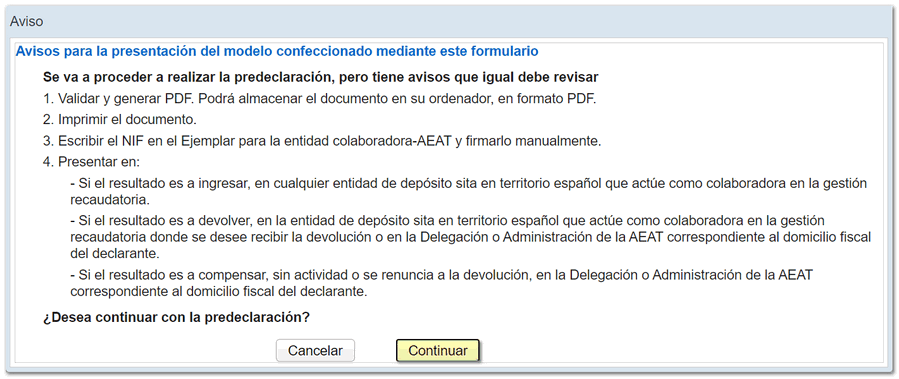

In the next window, review the notices and click "Continue."

A PDF will open with two copies, one for the taxpayer and another to be submitted at the Tax Agency's registration offices, in person or by certified mail, along with the corresponding documentation.

Remember that you must manually fill in the taxpayer's NIF information, as well as the "Date and signature" section.