Form 651

Skip information indexHow to obtain the pre-declaration of Form 651 for paper submission. Ceuta and Melilla

The deadline for submitting Form 651 is 30 business days from the day after the act or contract was carried out.

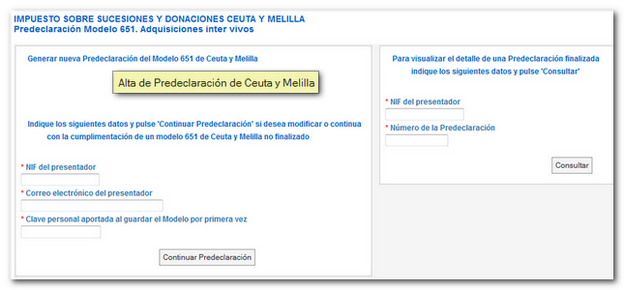

Upon access, a screen will appear with three options:

- "Pre-declaration registration for Ceuta and Melilla", to generate a new pre-declaration.

- "Continue pre-declaration", if you need to modify or continue filling out an unfinished form 651. It will be necessary to indicate the NIF of the presenter, the presenter's email and the personal key provided when saving the model for the first time.

- "Consult" to view the details of a completed pre-declaration. It will be necessary to indicate the NIF of the presenter and the number of the pre-declaration obtained. Once the requested data has been entered, the generated and completed PDF can be downloaded.

Click on "Pre-declaration Registration for Ceuta and Melilla" to start the pre-declaration.

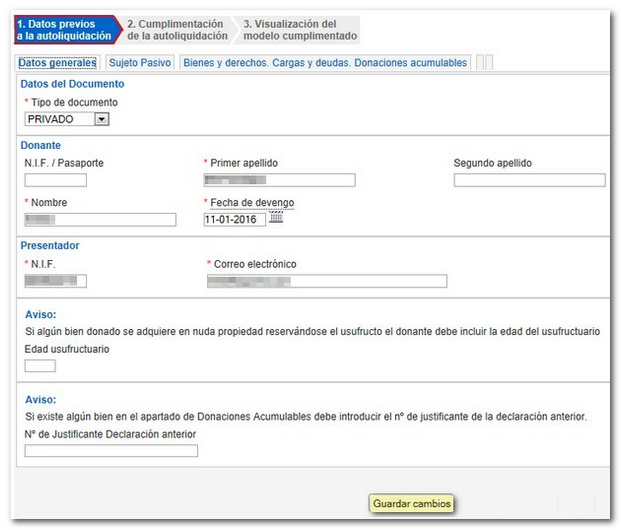

The program consists of three sections "1. Pre-assessment data", "2. Completion of self-assessment" and "3. "Viewing the completed model."

1. Data prior to self-assessment

In this first step we will find three tabs: "General information", "List of taxpayers" and "List of assets comprising the estate".

Please note that fields marked with an asterisk are mandatory.

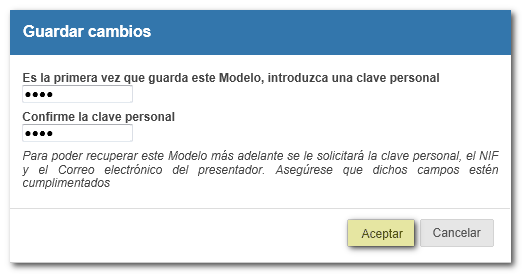

It is not necessary to enter all the data and carry out all the steps in a single session, since the "Save Changes" option allows you to recover the data entered up to that point at a later time. When saving for the first time, you must enter a personal key that will be used, together with the NIF and the presenter's email, to recover the declaration from the "Continue pre-declaration" option in the initial window. Before leaving the session, always remember to press "Save Changes".

In the first tab "General information" you must specify whether it is a public or private document, the donor's information and the presenter's information.

Complete the rest of the data requested for the taxpayer and the assets and rights, charges and debts and donations.

If this completion is not correct, the errors detected will be displayed when trying to save the data.

Once corrected, click "Save Changes". If this is the first time you press this button, you will need to enter a personal password.

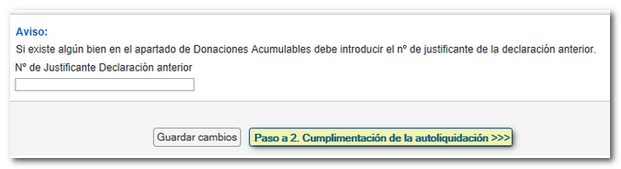

When there are no errors in step 1, you can access the next step, "Completing the self-assessment."

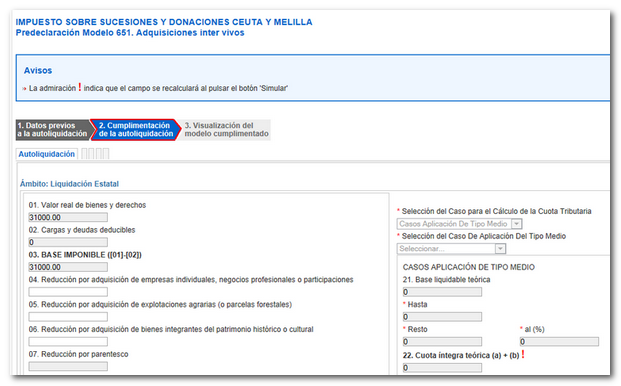

2. Completing the self-assessment

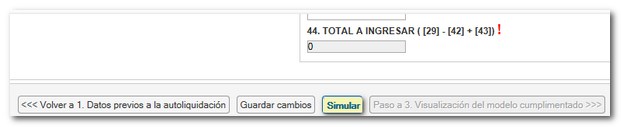

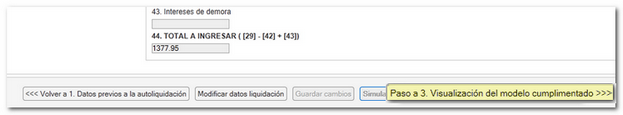

The necessary data will be entered to obtain the quota corresponding to the taxpayer; Then, you must click "Simulate" to check the calculated rate. Fields with an exclamation mark will be recalculated when you click the "Simulate" button.

When all calculations are correct, continue to the next step by clicking on "Step to 3. "Viewing the completed model."

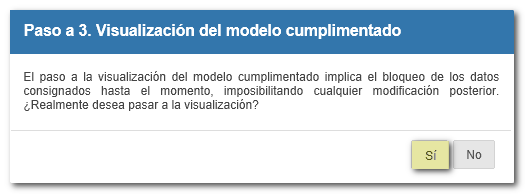

Before moving on to step 3, a notice will be displayed indicating that no further changes can be made after accepting the completions made up to that point.

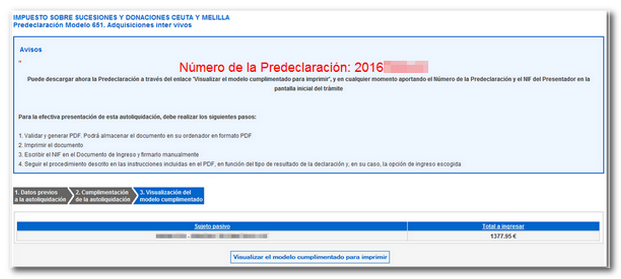

3. Viewing the completed model

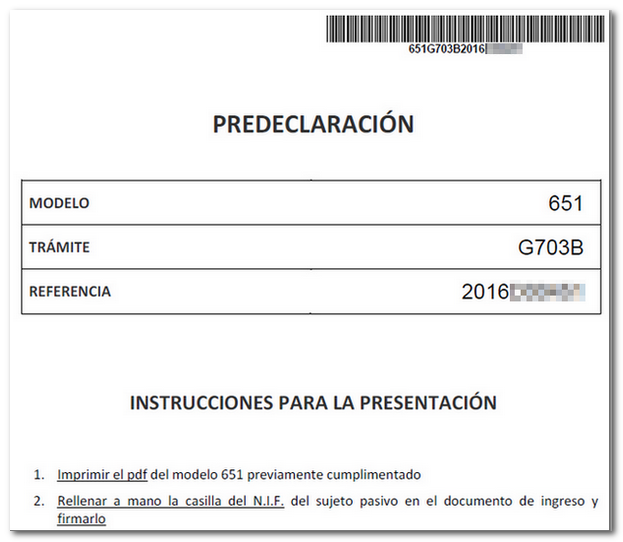

In the "Notice" box you can check the assigned pre-declaration number and the steps to follow to submit the self-assessment.

By clicking the "View the completed model to print" button, you will obtain the PDF already validated. As indicated in the notice, this self-assessment can be retrieved with the pre-declaration number and the NIF of the submitter from the "Consult" option on the initial screen of the form 651 procedure.

The document PDF can be opened directly or saved to a path of your choice. The corresponding copies will be generated for the interested party, the Administration and the entry document for the Collaborating Entity, in addition to the detailed instructions that must be followed for the effective submission of the declaration.