Form 655

Skip information indexPaper submission of Form 655 for non-residents

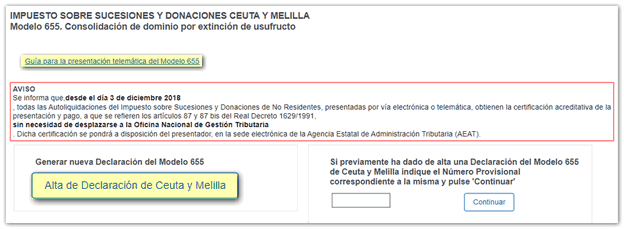

When accessing the pre-declaration, a screen will appear with two options:

- "Pre-declaration registration", to generate a new pre-declaration.

- "Consult" to view the details of a completed Pre-declaration. It will be necessary to indicate the NIF of the presenter, and the number of the pre-declaration obtained.

Click "Pre-declaration Registration" to start the pre-declaration.

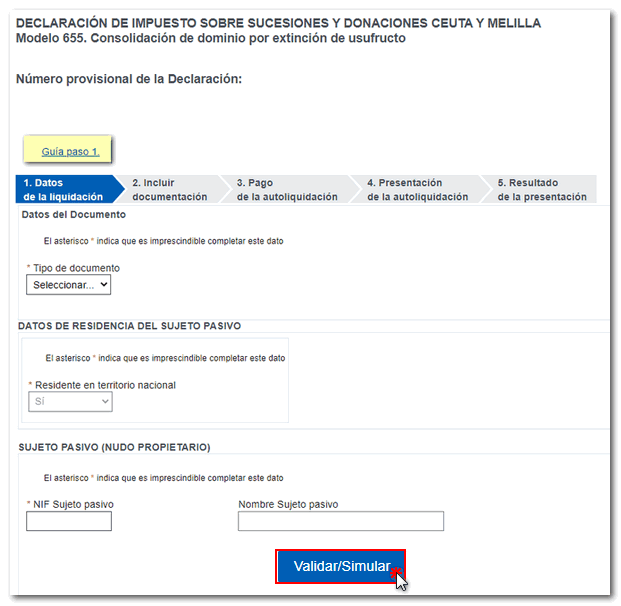

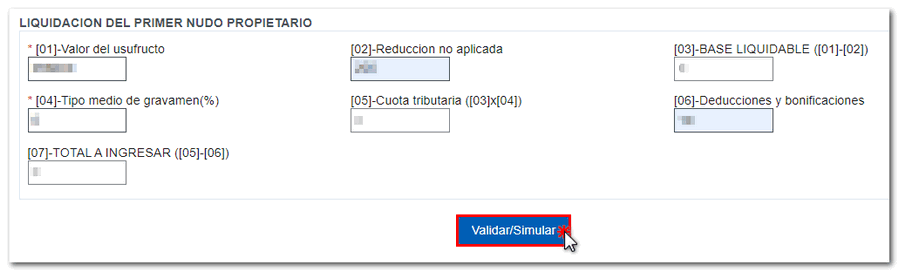

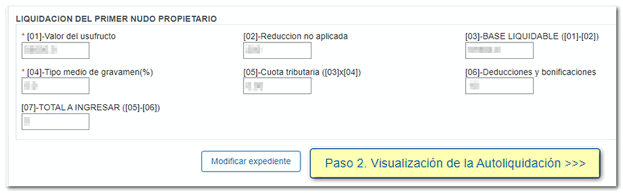

1 Settlement data

Fill in the settlement details. Fields marked with an asterisk are mandatory.

Once all the data has been entered correctly, click on "Validate/Simulate".

If the completion of the first step is not correct, the errors detected will be reported at the top with the "Go to error" button. If there are no errors, you can access Step 2. Viewing Self-Assessment .

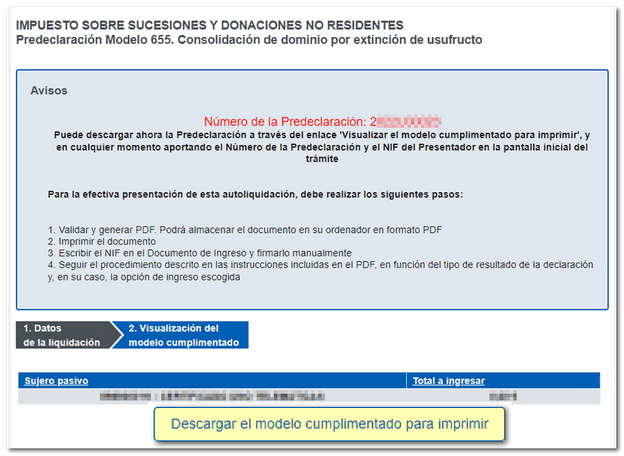

2 Viewing the completed model

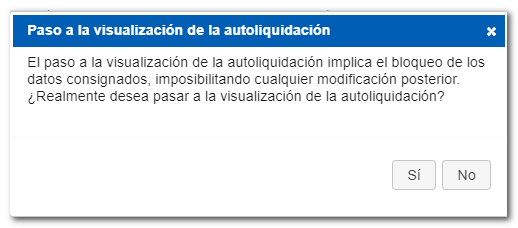

The program will display a warning indicating that the data entered up to this point will be blocked, preventing any further modification. Click "Yes" on the prompt to continue.

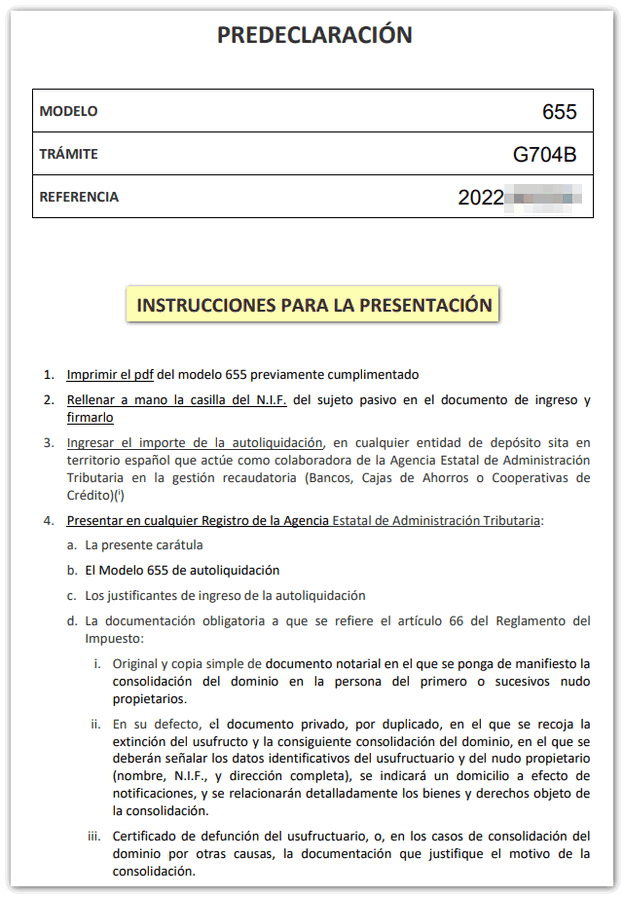

You will obtain a Pre-declaration Number that will be used to view the document at any time from the initial window of model 655 in the "Consult" section. The same window includes a series of instructions to correctly generate the document in PDF , as well as the option "Download the completed model to print".

You will get document "Instructions for Filing" which includes the complete declaration.