Form 695

Skip information indexElectronic filing of form 695

Form 695, "Request for refund of court fees", can be submitted online, so a certificate or electronic DNI is required.

In addition to the holder of the declaration, it may also be submitted by a third party acting on his or her behalf, whether it be a social collaborator or a representative to carry out the procedure.

If the form provided by the Tax Agency is not being used, the file must conform to the approved record design for form 695.

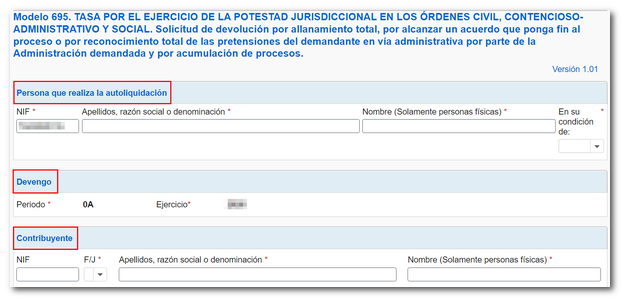

Fields marked with an asterisk are mandatory.

Once the data has been completed, the declaration can be validated using the " Validate declaration " button, located in the options menu below.

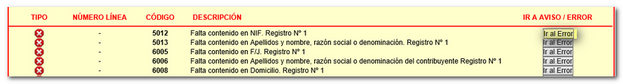

When validating the declaration, the list of errors and warnings detected will be displayed, which can be accessed for correction from the "Go to Error" button next to the description of the fault.

If no errors are detected in the declaration, the description will state that there are no errors.

You can "save" the generated .ses file so you can continue later or transfer it to another device.

To recover it, click on "Load" and locate the file to retrieve the data.

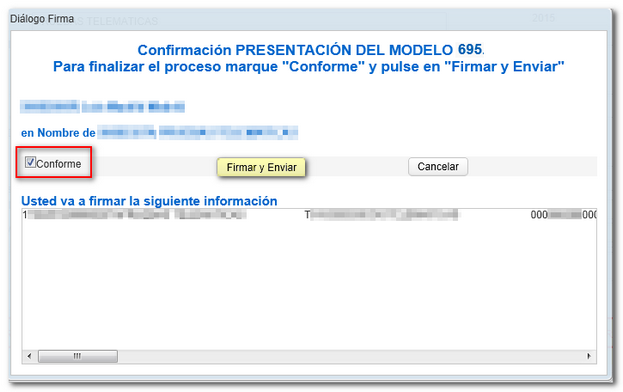

Once the declaration has been validated, you can submit it using the "Sign and Send" option.

In the new window, select "Agree" and click "Sign and Send".

The result of a successful filing will be a pop-up screen with the message "Your filing has been successfully completed" with a PDF embedded information containing the filing information (Secure Verification Code, receipt number, date and time of filing and presenter details).