Form 696

Skip information indexElectronic filing of form 696

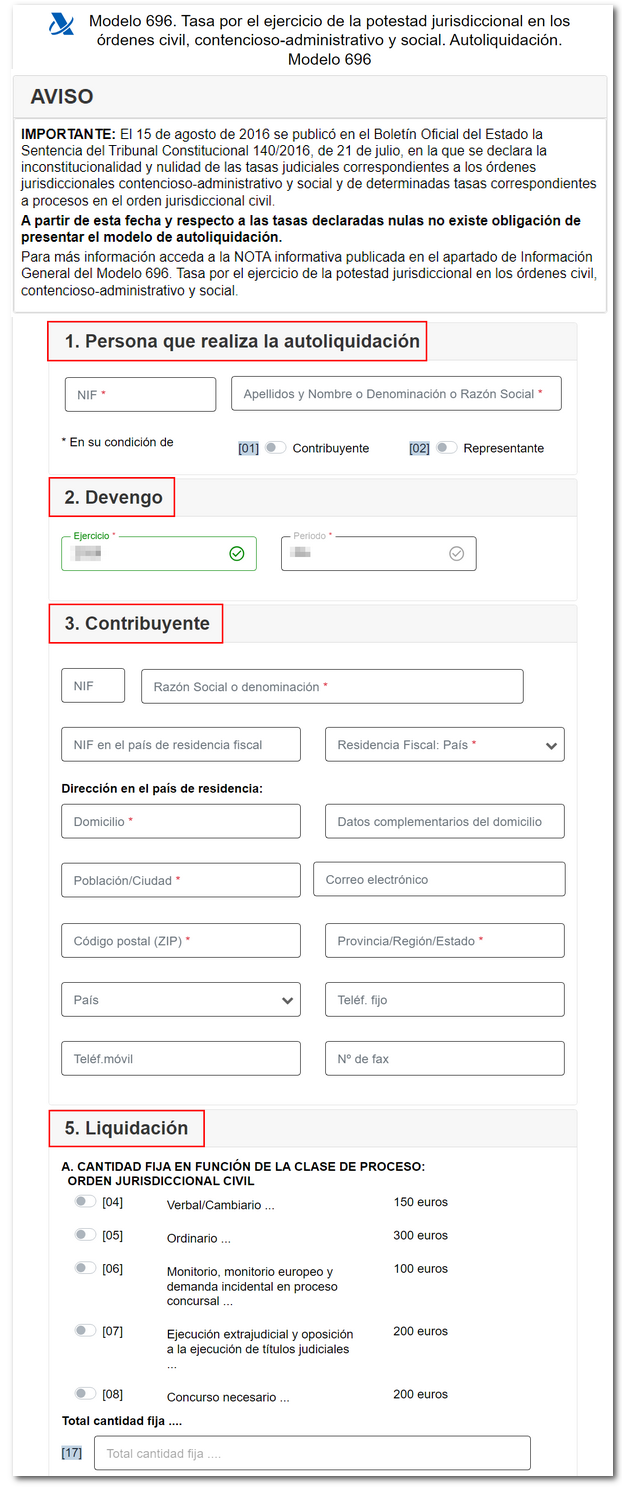

form 696 "Fee for the exercise of jurisdictional power in civil, contentious-administrative and social matters" can be submitted via the internet, therefore an e-certificate or e-DNI or ID card electronic.

In addition to the holder of the declaration, it may also be submitted by a third party acting on his or her behalf, whether it be a social collaborator or a representative to carry out the procedure.

Check the header notice which provides information about the filing of this form.

Fields marked with an asterisk are mandatory.

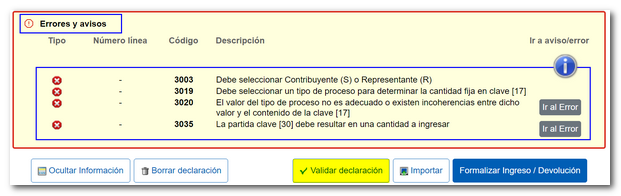

Once the relevant data has been completed, the declaration can be validated using the " Validate declaration " button, located in the options menu below.

When validating the declaration, the list of errors detected will be displayed, which can be accessed for correction from the "Go to Error" button next to the description of the error.

If no errors are detected in the declaration, the description will state that there are no errors.

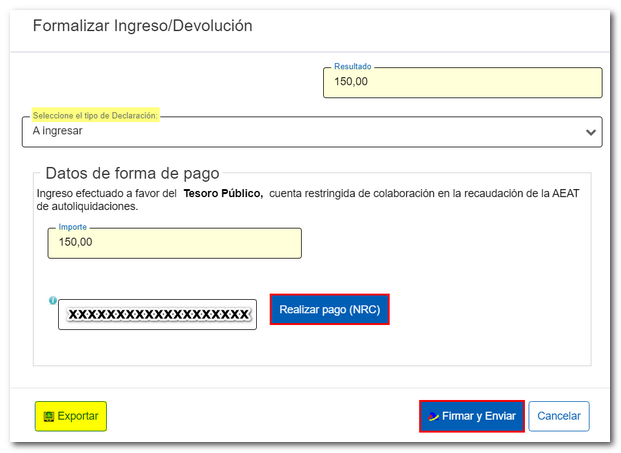

Once the statement has been validated, it can be submitted from the "Formalize Entry/Refund" option.

The payment (payment) of the rates is made by obtaining a NRC. The NRC is the Full Reference Number, a 22-character code that serves as proof of payment. From the form itself, on the "Make payment" button ( NRC)" you will be able to connect to the payment gateway to automatically generate a NRC with the data contained in the statement. If you already have a NRC provided by the bank, you can include it in the "Reference Number NRC " box.

In this same window it is also possible to obtain the statement with the format of the published logical design and extension .696 from the "Export" button. You will be able to choose the path where you want to save the file, which will be named NIF of the tax ID number of the filing taxpayer - exercise - period and the extension .696. You can retrieve the declaration using the "Import" option at any time if you close the window.

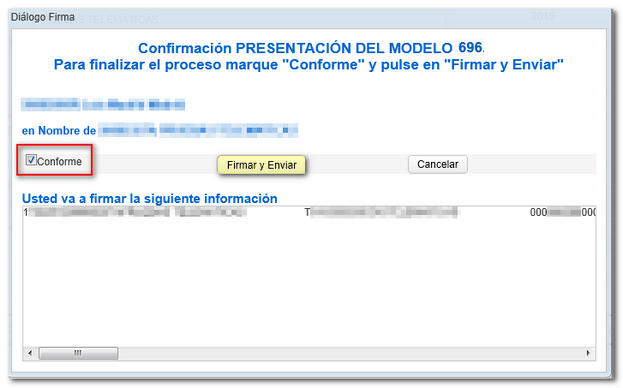

In the new window, click "Accept" to confirm the submission of the declaration. The text box will display the encoded content of the declaration. To continue filing your return, click "Sign and Send."

The result of a successful submission will be a response page showing the text "Your submission has been successfully submitted" with an embedded PDF containing the submission information (Secure Verification Code, receipt number, day and time of submission, and presenter details).