Income 2022

Skip information indexFiling by Income Tax 2022 file

You can submit the 2022 Income Tax Return prepared with a help program by importing a file with the return with the data adjusted to the registration layout published on the website in "Help", "Registry layouts", "Previous years", "Models 100 to 199".

Access the presentation from the Electronic Office, on the procedures page of model 100, and use the link "Renta 2022. Filing returns using a file generated with a help program" located in "Previous years", "Fiscal year 2022".

Identify yourself with a digital signature (certificate or electronic DNI ), Cl@ve Mobile by scanning the QR with the APP Cl@ve or the Income reference for the current campaign.

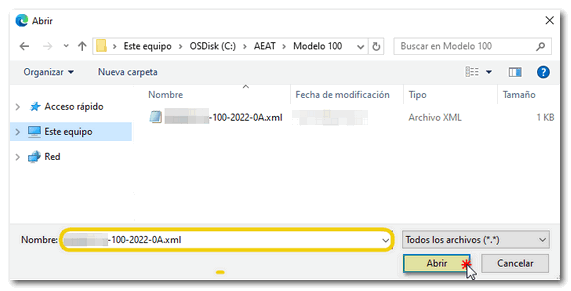

On the next page, click the button "Import XML " and locate the file with the declaration data.

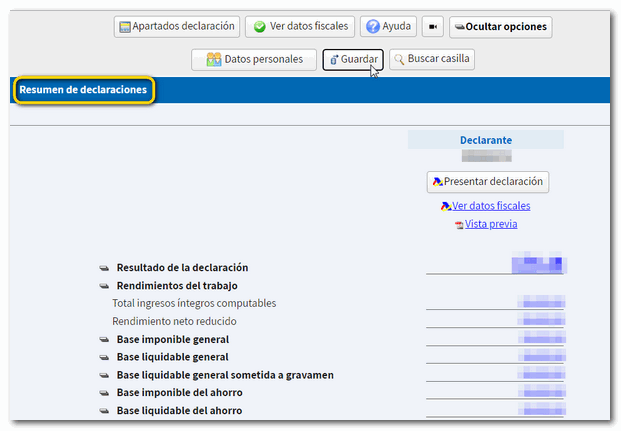

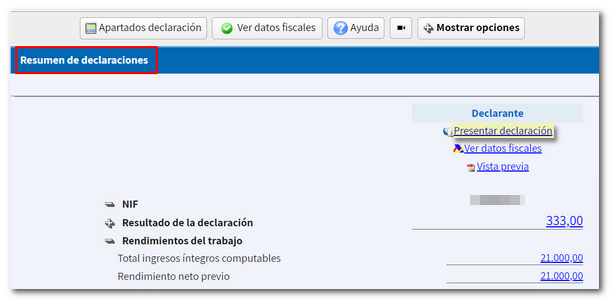

The summary of the declaration will then be displayed with the declaration data of the declarant(s). From this window you can:

- " Submit declaration " if you agree with the result.

- " View tax data " to view the data entered.

- Make a " Preview " of the statement where you get a PDF that serves as a reference but is not suitable for presentation.

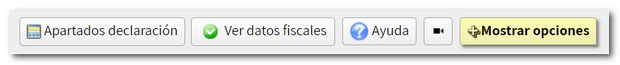

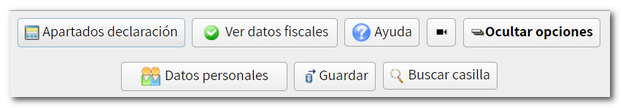

In addition, using the buttons at the top, you can check the tax data that has been transferred for each declarant and access the different sections to check all the data. By clicking " Show options ", more buttons will be displayed that will allow you to consult the identification data, save the declaration on the AEAT server or search for a specific box in your declaration.

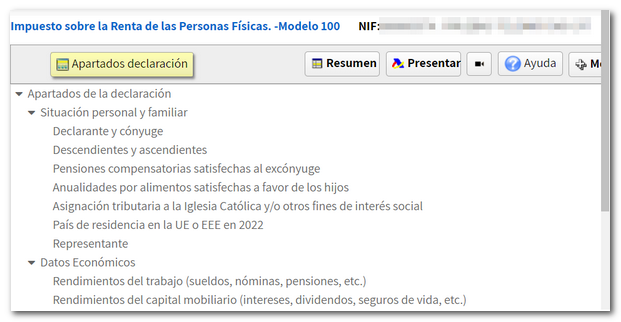

From " Declaration sections ", you can access the different pages to check all the data and continue completing the declaration.

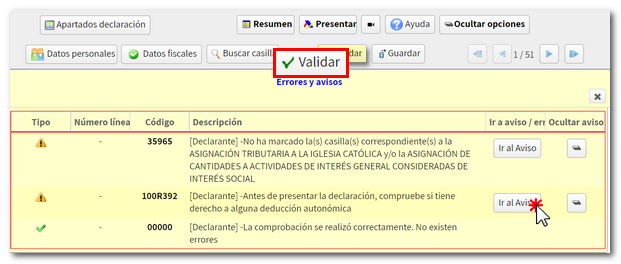

Before filing the declaration, check if there are any errors in the completion by pressing the " Validate " button.

Notices do not prevent you from filing your return and are indicated to review your completion. If the message is an error, you must correct it so that the declaration is considered valid at the time of filing. To review the warnings or errors, press the "Go to Warning" or "Go to Error" button.

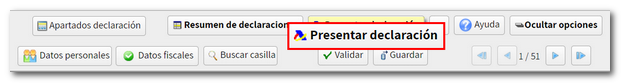

Once you have checked that it does not contain errors, review the data and, if it is correct, click " Submit declaration " from the declaration sections or from the declaration summary.

If the return has a result to be returned, check the code IBAN of the account to which you want the refund to be made. By default, the account IBAN indicated in the previous exercise will appear; However, you can modify it on this screen. You can also select an account IBAN opened abroad ( EU / SEPA ) for the refund.

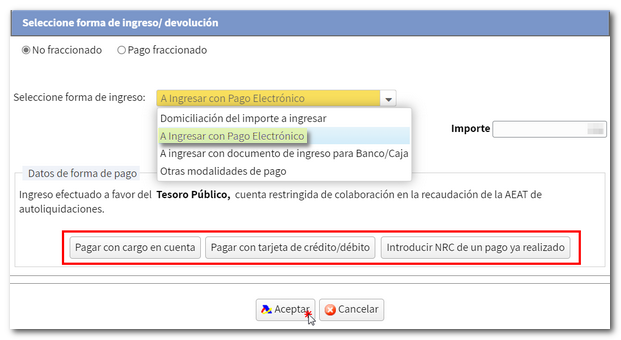

If the return results in income, you can select one of these payment options:

-

To pay:

-

"Electronic payment". In this case you can choose from three payment methods:

-

Payment by direct debit from account . It will connect to the payment gateway to obtain the NRC at that time, charging the amount to the account indicated.

-

Payment by credit/debit card . You will be connected to the payment gateway to obtain the NRC at that time using a credit or debit card.

-

Enter NRC if you have paid by your e-banking . You must make the full payment from your Bank, generating the NRC proof of payment, either at their offices or through electronic or telephone banking. You will then need to enter the NRC in the "Reference number NRC " box.

-

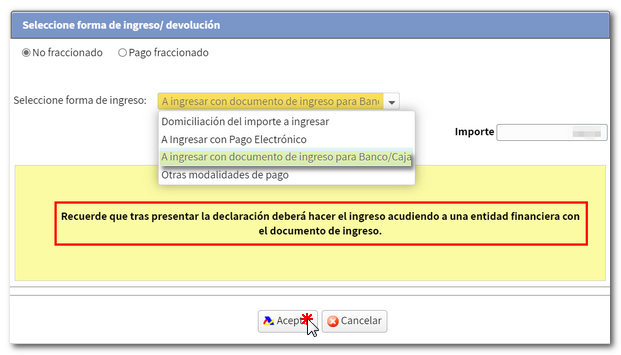

-

"Document to be deposited in Bank/Cashier". Allows you to obtain the payment document to pay at the Bank or Cash Register. With this option, the declaration will be submitted electronically but pending payment at the financial institution.

-

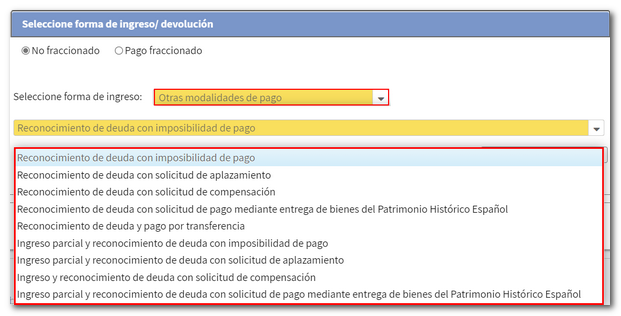

-

Other payment methods. For example, the recognition of debt with impossibility of payment or request for deferment, among others. In addition, you can opt for "Debt recognition and payment by transfer", for citizens who have accounts opened in an entity that DOES NOT COLLABORATE in the collection of taxes from the AEAT . In this case, payment will be considered made on the date on which the transfer is received by the AEAT .

After selecting the payment method, press "Accept" to submit the declaration.

Remember that in joint declarations it will be necessary to indicate the reference or the Cl@ve of the spouse, to file the declaration, regardless of the type of access of the declarant. The reference number is individual for each declarant.

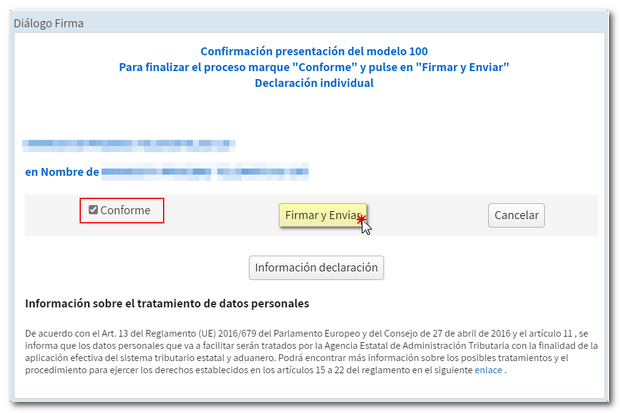

Next, if there are any warnings, you will be informed of them before continuing with the signing and sending of the declaration. Click "Accept" if you wish to proceed.

In the new window, check the "I agree" box and click "Sign and Send" to complete the filing of the declaration. The "Declaration information" button will display the encoded data of the declaration.

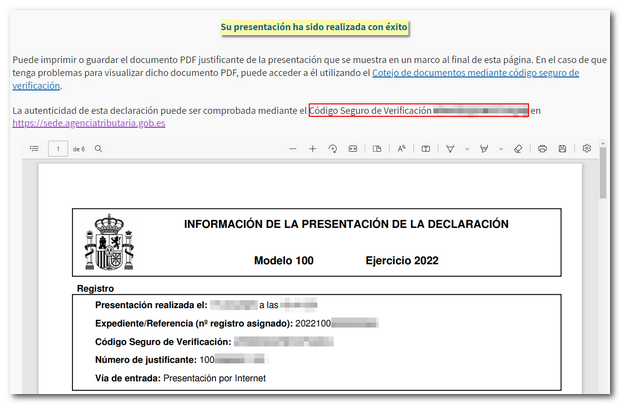

Finally, the message "Your submission has been completed successfully" will be displayed on the screen along with a Secure Verification Code and the assigned secure verification code. In addition, a PDF will be displayed containing a first page with the information on the submission (registration entry number, Secure Verification Code, receipt number, day and time of submission and details of the submitter) and on the subsequent pages, the submitted declaration.

You can print or save this page as proof of the information from your online submission. To print the page, right-click it and choose "Print" from the menu or click the printer icon at the top edge.

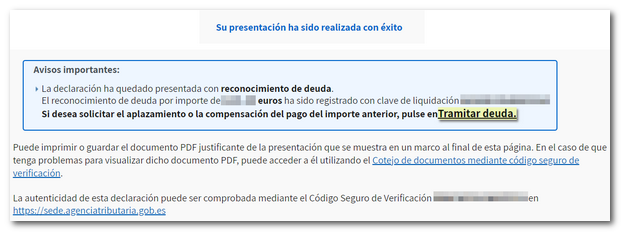

In cases where there is recognition of debt, a link to submit the deferral or compensation request will be displayed on the response sheet for successfully submitting the request. Click "Process debt".

If you selected "Debt recognition and payment by transfer" the document proving the submission will be displayed with the CSV (Secure Verification Code) along with a list of important notices about the payment, which is still pending entry. This window allows you to generate a PDF with the instructions to carry out the bank transfer.

If you access "Renta WEB" again. Draft/declaration processing service (Renta WEB)", you will see that in the "File History" section "Recording of your declaration" appears with the date on which it was made. Also check that the message "Your declaration is being processed" appears at the top.