The certificate selected to connect to the AEAT HEADQUARTERS differs from the certificate selected to perform the signature

Skip information indexIf you use Safari or Google Chrome on Macintosh

Access certificate details from Mac Keychain: "Finder", "Applications", "Utilities", "Keychain Access".

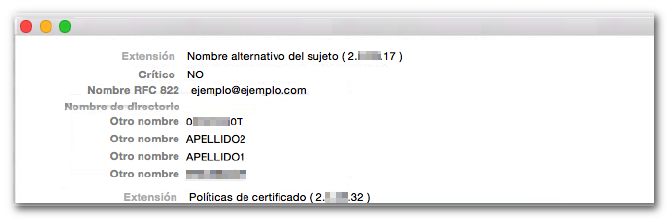

In the "My Certificates" section of "Login", the certificate must be installed. Double-click on the certificate name and in the new window select the "Details" tab. In the "Public Key Information" section, locate the "Directory Name", "Other Name" group.

Example of certificate FNMT of a natural person.

The order in which the data is displayed is: NIF of a natural person, second surname of a natural person, first surname of a natural person, first name of a natural person.

For certificates FNMT of legal entity:

-

Certificate of representative for sole and joint administrators. The order in which the data is displayed is: information on the commercial register, type of administrator, NIF of the entity, company name of the entity, NIF associated natural person, second surname of natural person, first surname of natural person, first name of natural person.

-

Certificate of representative of a legal entity. The order in which the data is displayed is: information NIF of the entity, corporate name of the entity, NIF associated natural person, second surname of natural person, first surname of natural person, first name of natural person.

-

Certificate of representative of an Entity without Legal Personality. The order in which the data is displayed is: RA, information NIF of the entity, corporate name of the entity, NIF associated natural person, second surname of natural person, first surname of natural person, first name of natural person.

Once this is done, you will have to check on our website how this data appears in the census of the AEAT , accessing the section "Verification of a NIF of third parties for census purposes", within the procedures of the "Form 030. Census of taxpayers - Census declaration of registration, changes of address and/or changes in personal data."

If the census data ( NIF , surnames and first name or company name) do not match the data on the electronic certificate, it will be necessary to obtain a new certificate.