Request for an IRPF tax certificate

To obtain a tax certificate of PIT you can use one of these ways:

-

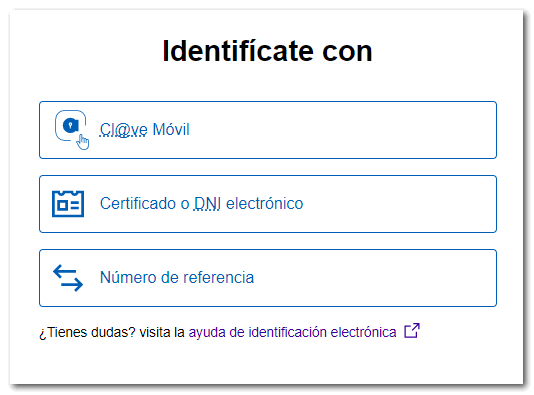

Electronically on the website, for which it is necessary to have one of the following electronic means of identification: Electronic certificate, electronic DNI or Cl@ve . You can also identify yourself using the current campaign reference number, previously provided by the Tax Agency.

-

Through the Tax Agency APP.

-

By telephone, requesting an appointment. To request the certificate via this means you must identify yourself with Cl@ve .

-

In person at the Tax Agency's Delegations and Administrations, by appointment.

To request a tax certification online PIT containing all the information related to the Income Tax return, go to the section "All procedures", "Certificates", "Tax Returns", "Tax certificates. Issue of tax certificates. PIT", "Application".

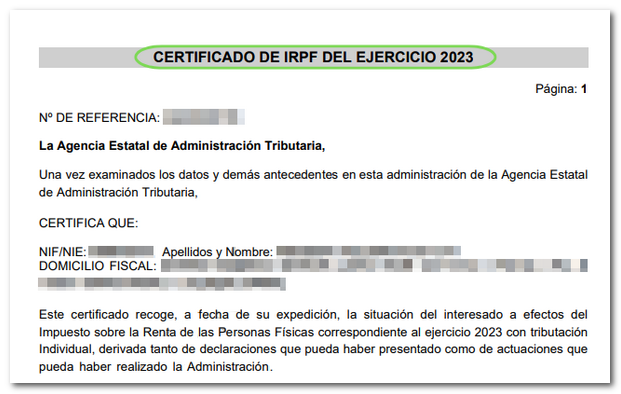

In the event that the taxpayer has not filed an Income Tax return and is not required to file it, according to the data in the possession of the AEAT, a negative Income certificate will be issued, which includes the imputations that are recorded by the Tax Agency, except in cases where there is no information relating to income or earnings attributable to the PIT stating this circumstance.

If the taxpayer filed Income Tax Return the tax type under which it was filed will be indicated, individual or joint, and the economic and personal data relating to the return will be broken down.

The tax certificate will be generated automatically, provided that the requirements for obtaining it are met.

Note: If you choose access by reference, regardless of the fiscal year for which you request certification of PIT, you must identify yourself with the last reference obtained from the current Income campaign.

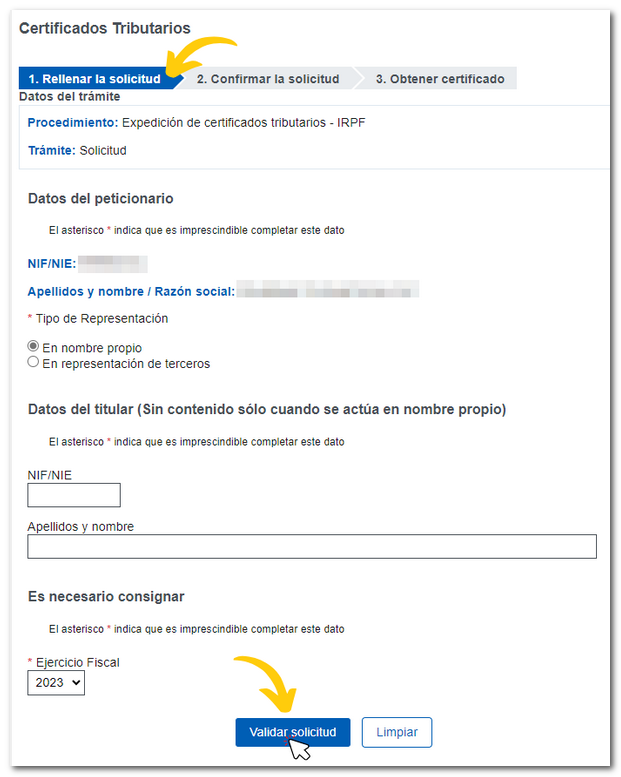

After identifying yourself using any of the enabled means and accessing the application form, select the fiscal year for which you are requesting the certificate from the drop-down menu. It will only be necessary to complete the DNI / NIE and the surnames and first name if requesting the certificate on behalf of third parties. Finally, press "Validate request" .

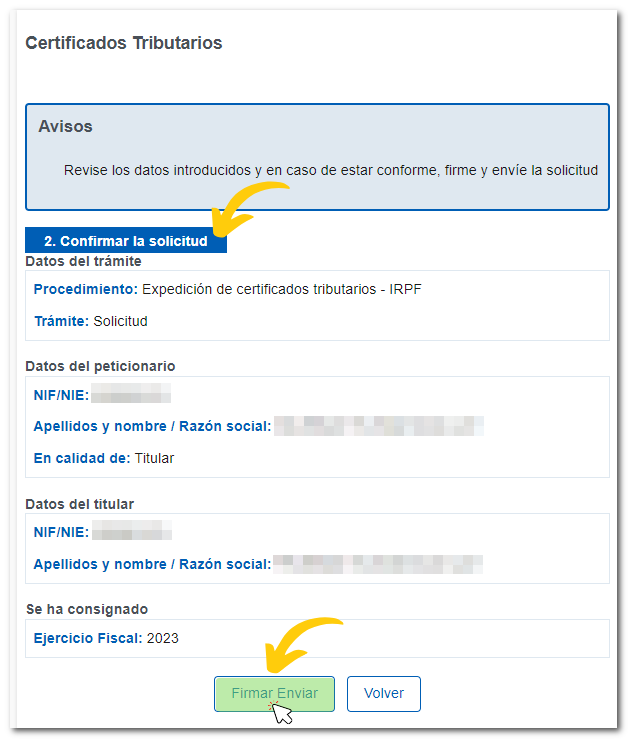

Review the application data and click "Sign Send" .

The information to be sent and the signer's details will be displayed. To continue, check the box "I agree" and press the button "Sign and Send" .

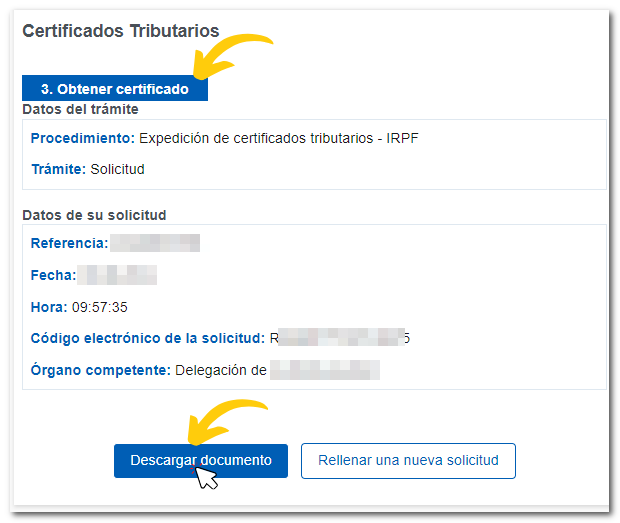

Obtaining certification is immediate. In step 3, click on "Download document" to view the tax certificate. PIT in format PDF. If you experience any display problems, we recommend installing a PDF viewer that is compatible with your operating system and up to date.

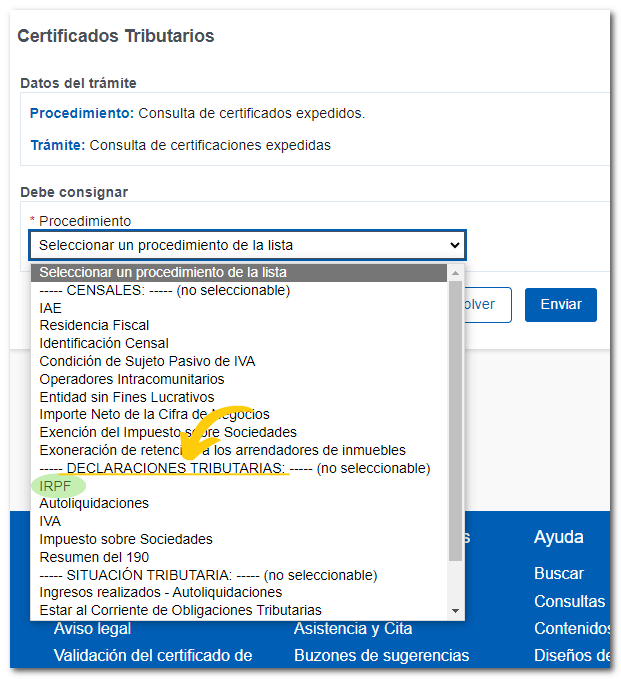

If you have not saved the PDF of the certification, you can recover it at any time through "Check issued certificates", within the procedures related to "Certificates" that you will find in "All procedures" (located at the top of the website) using the same electronic certificate or through Cl@ve .

Once you have identified yourself, you must first select the type of certificate you are going to download from the drop-down menu, in this case "PIT", and press "Send".

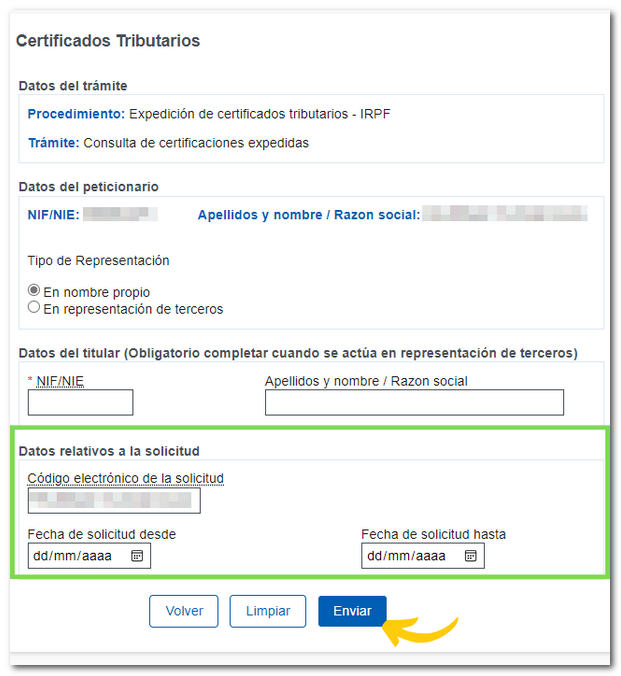

To collect the certification, it is necessary to enter one of these two data (they are mutually exclusive): the electronic application code consisting of 16 characters that appears on the application response sheet or the date range in which the certificate was requested. We recommend that you keep the electronic code that is returned when you make your request.

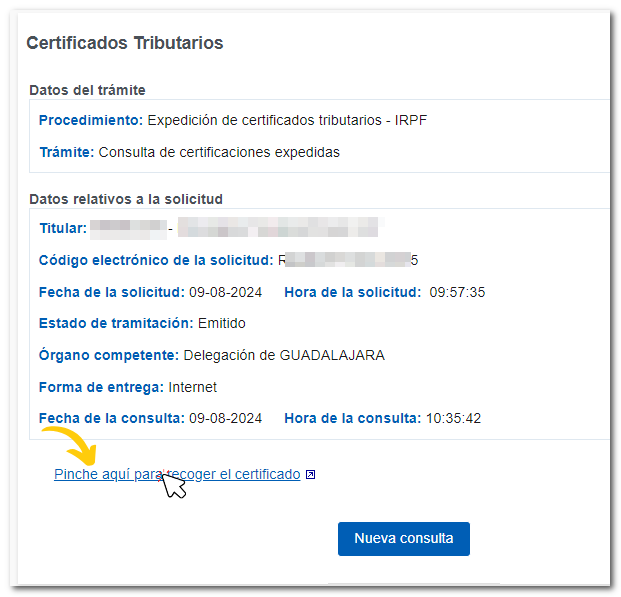

Once the data required to obtain the certification has been entered, a summary of the application data will be displayed. Click on the link below "Click here to collect the certificate" to obtain the PDF with the certification.

You can both retrieve the certification and confirm the authenticity of the document through the "Electronic document verification using a secure verification code" available in the highlighted block on the home page "Notifications and document verification".

If you cannot request certification through the website, you can go to your local Administration to obtain it. The certification may be delivered at that moment or sent by regular mail to the tax address or through DEHú and the taxpayer himself or a representative may attend.

Remember that to go to the Administration to process the certification it is necessary to request an appointment.

It is important to note that, in relation to the format of the certification, the space dedicated to the bar code, communication number and address for notifications located in the upper right-hand part of the document may vary depending on the method of delivery of the certification, and these data may not be displayed in certain cases.