Equity benefit for asset conversion self-assessment - Form 221

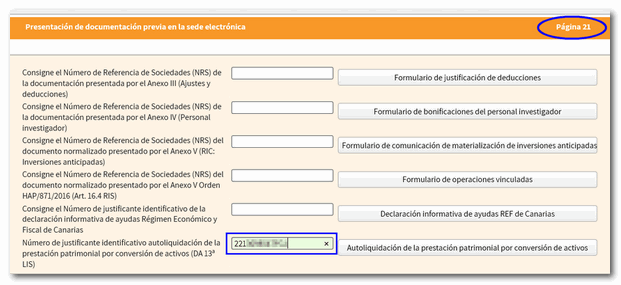

Form 221 "Equity benefit for conversion of deferred tax assets into credit payable to the Tax Administration" is submitted electronically with an electronic certificate, providing an online form for completion. The proof number for filing Form 221 will be included in the corresponding field on page 21 - " Submission of prior documentation to the electronic office " of Form 200, provided that the rest of the completion of the declaration requires it.

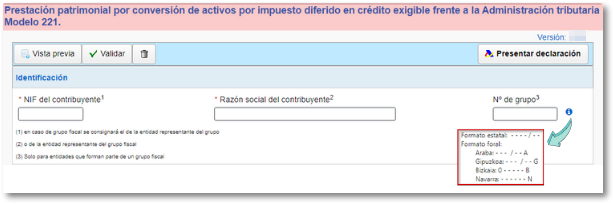

In the "Identification" section, fill in the taxpayer's NIF , Company name and Group number (if applicable). You can check the format in which you should enter the group number by placing your mouse over the information icon symbol.

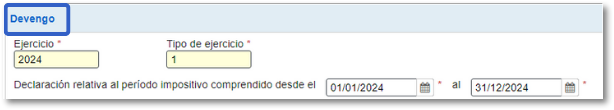

In the "Accrual" section, indicate the start and end tax period. Depending on what is filled out in these boxes, the fiscal year and type of fiscal year will be automatically filled in. The date format will be DD / MM / YYYY ; However, you can select the date from the calendar enabled on your side. In the "Type of exercise" box, 1, 2 or 3 will be reflected according to the following detail:

-

Financial year lasting 12 months, coinciding with the calendar year.

-

Financial year lasting 12 months, which does not coincide with the calendar year.

-

Financial year lasting less than 12 months.

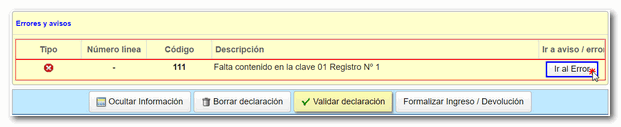

Fill in the tax settlement details and check if it contains any warnings or errors by clicking the button. "Validate statement" at the top. The "Errors and Warnings" box will appear with any warnings or errors detected. Remember that the notices provide relevant information that should be considered but do not prevent the filing of the declaration. If the declaration contains errors, these must be corrected.

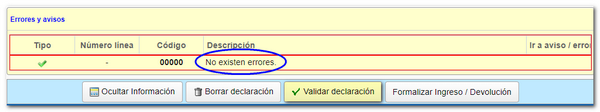

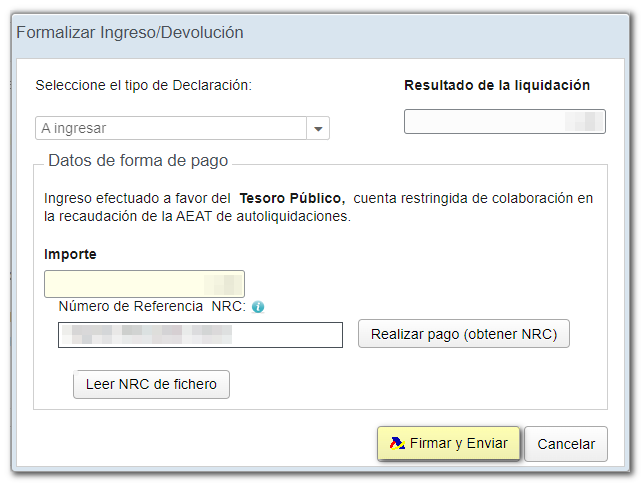

If there are no errors, you can file the return.

If the result is to be paid and you do not direct debit the income, you must first obtain the NRC and then submit the self-assessment. The NRC is the Full Reference Number, a 22-character code provided by banking entities that serves as proof of payment. If you have the NRC saved in file, click "Read NRC from file". If you have not yet made the payment, you can link to the tax payment gateway of the AEAT from the button "Make payment (get NRC)".

If you select "Direct debit of the amount to be paid" you will only need to enter the code IBAN of the account where you wish to direct debit the payment. However, you have the option of requesting full recognition of the debt or making a partial payment and processing the remaining amount as debt. In this case you must obtain the NRC proof of partial payment made and indicate the amount recognized as debt.

This model also has the option of payment by transfer to an account opened in a credit institution that DOES NOT COLLABORATE in the collection of taxes of the AEAT . To access this option, select "Debt recognition and payment by transfer." Payment will be considered made on the date the transfer is received by the AEAT .

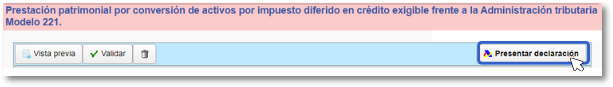

Finally, click on "File a statement" to proceed with the submission of the declaration.

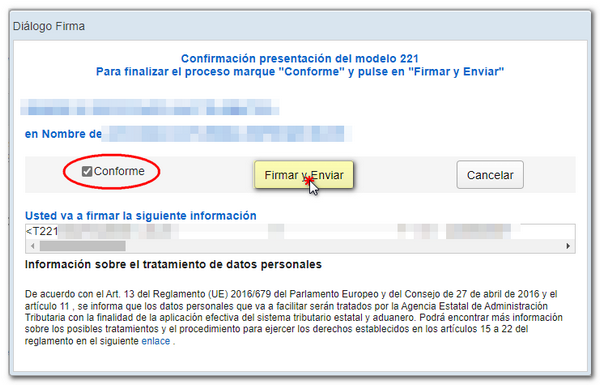

A window will appear with the encoded declaration information and the data of the filer and the declarant. Check the box "According" and press "Sign and Send" to conclude the presentation.

If everything is correct, you will get the answer sheet that shows "Your presentation has been successful." and a PDF embedded containing a first page with the submission information (registration entry number, Secure Verification Code, receipt number, day and time of submission and presenter details) and, on subsequent pages, the full copy of the declaration.

The receipt number, which begins with 221, is the one you must enter on page 21 of the WEB 2024 Company form.

In cases where there is recognition of debt, a link to submit the deferral or compensation request will be displayed on the response sheet for successfully submitting the request. Click "Process debt". The details of the settlement will appear below with the debtor's data and the settlement key. You will have to choose between one of the available options: defer, compensate or pay.