Additional information on adjustments and deductions form

Prior to submitting Form 200 for Companies, it will be necessary to submit the Additional Information Form for Adjustments and Deductions, provided that certain circumstances are met and this has been reflected in the declaration.

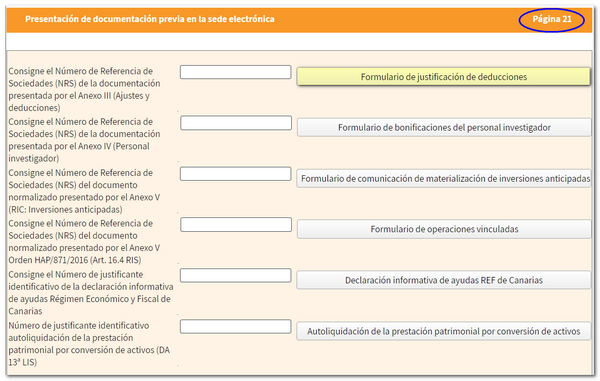

You can access the form from the "Declaration Processing Service (WEB Companies)", on page 21 "Submission of prior documentation at the electronic headquarters" by clicking on the button "Deduction Justification Form".

Access requires identification using an electronic certificate, eIDAS or in the case of natural persons, also with Key

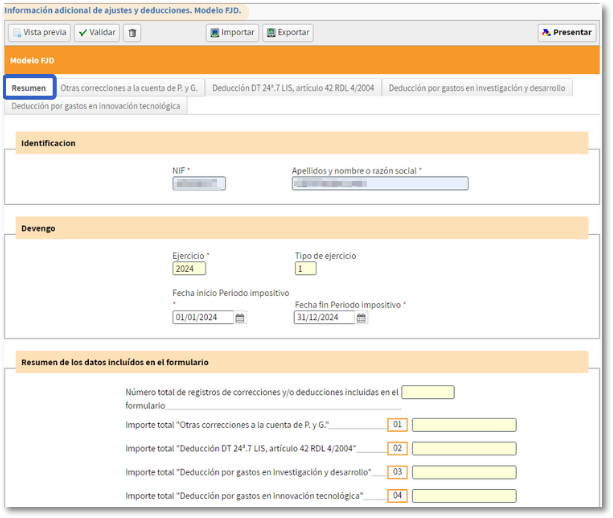

In the "Summary" tab, fill in the identification data and the start and end tax period. The date format is DD / MM / YYYY ; However, you can select the date from the calendar button next to the box. In the "Type of exercise" field, 1, 2 or 3 will be automatically reflected according to the following detail:

-

Financial year lasting 12 months, coinciding with the calendar year.

-

Financial year lasting 12 months, which does not coincide with the calendar year.

-

Financial year lasting less than 12 months.

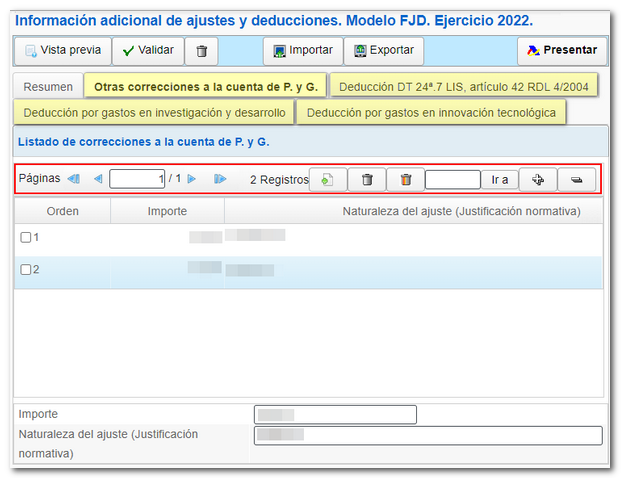

You will also find various tabs for entering data. In each tab you have a button panel with options for registration, deregistration and navigation through the records. To create a new record, click on the icon of the blank sheet with the green "+" sign. If you need to delete a specific record, click the trash can icon. You can navigate through the different records using the navigation arrows. To go to a specific record, type the order number in the box and press "Go to".

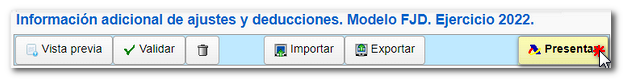

At the top are the options available in the form:

-

Using the " Preview " button you can obtain a draft of the declaration that is not suitable for filing but can be used for reference. From this same window you can download a PDF by clicking "You can click here to download the PDF" and return to the declaration or start a new one.

-

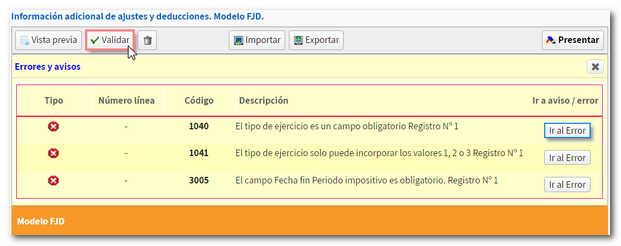

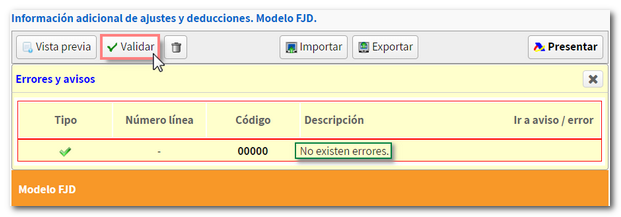

Once you have completed the data you can use the " Validate " button. The list of errors and warnings detected will be displayed, which you can access for correction from the "Go to error" or "Go to warning" button, next to the descriptive text.

If no errors are detected in the declaration, the text "No errors exist" will appear in the description.

-

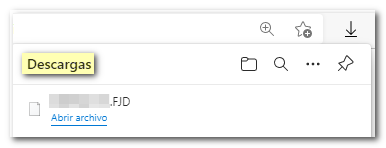

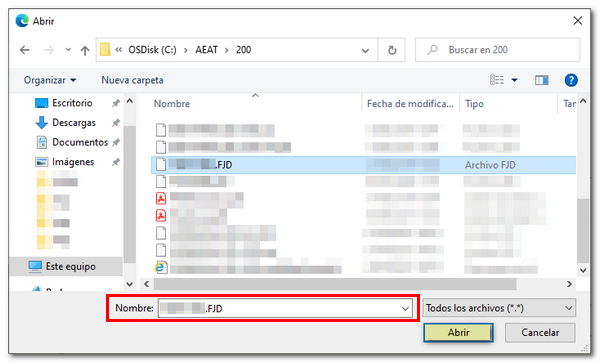

The " Export " button allows you to obtain a file in BOE format, if the declaration does not contain errors. The file will be named " NIF of the declarant. FJD ", the file will be saved by default in the "Downloads" folder of the system or in the default directory in the browser, although you can select a different directory. You can later recover it using the " buttonMatter" selecting the file FJD previously saved.

You can also import a file with the data adjusted to the registration design published on the website.

-

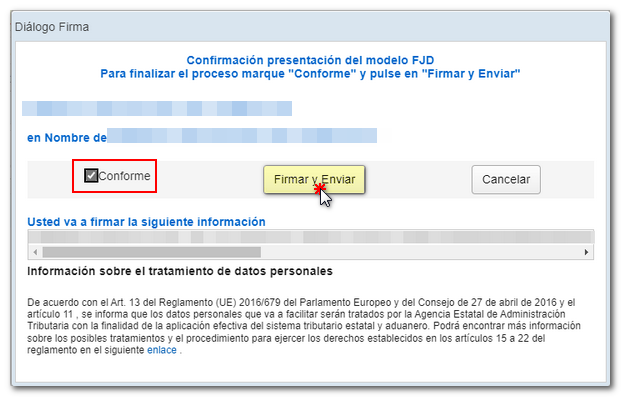

Finally click on " Submit " to submit the return. A window will appear with the encoded declaration information and the data of the filer and the declarant. Check the "I agree" box and press "Sign and Send" to complete the submission.

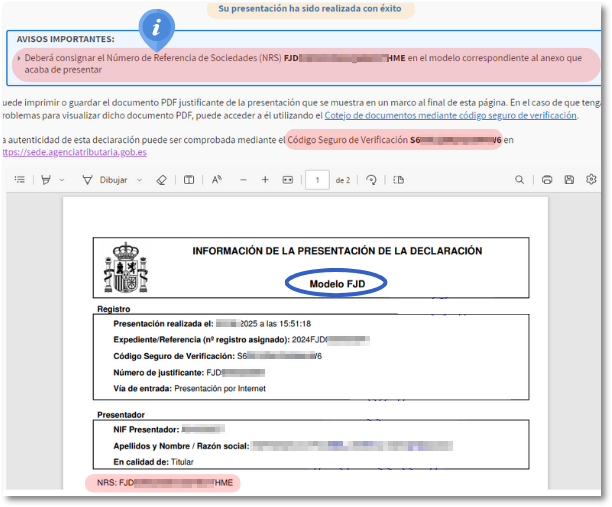

Finally, if everything is correct, you will receive the response sheet with confirmation of submission, the Secure Verification Code and the number NRS which begins with FJD and which you must indicate in Sociedades WEB 2023. An embedded PDF will also appear containing a first page with proof of submission (registration entry number, CSV , proof number, day and time of submission and details of the submitter) and, on the subsequent pages, the complete copy of the declaration.

Reference number NRS must be completed on page 21 of the "Declaration processing service (WEB Companies)".