How to access the DEHú through power of attorney

Access to notifications requires identification with a certificate from the obligated party or from an agent who can consult notifications on his/her behalf. Those required to electronically receive communications and notifications from the Tax Agency, whether they are individuals, legal entities or entities without legal personality, may grant the power to receive notifications and communications to one or more individuals or legal entities.

The power of attorney that must be registered in this case is that of procedure GENERALNOT or a specific power of attorney for receiving notifications.

There are 3 ways to grant power of attorney:

-

Power of attorney granted through personal appearance of the principal at the Delegations and Administrations of AEAT using the form "Granting of powers of attorney through appearance of the principal for carrying out procedures and actions online." If the principal is a legal person or one of the entities lacking legal personality, the person appearing must prove that he or she is the legal representative of the entity or that he or she has sufficient power to grant the powers of attorney.

-

Power granted by public document or private document with notarized signature presented to the Tax Agency.

-

Power granted over the Internet through the use of one of the identification and authentication systems provided for in Law 11/2007 on electronic access. In this case, both the principal and the agent must have an electronic certificate or Cl@ve to grant and confirm the power of attorney respectively.

Online Power of Attorney Registration

In order for the power of attorney to be registered, the process must be carried out in two steps:

1. Granting of power. First, the power of attorney must access the option "Power of attorney using electronic identification" with his electronic certificate or Cl@ve .

Identify yourself with a digital signature (certificate or electronic DNI ) or through the identification system Cl@ve (only natural persons). The system will show you the identification options with electronic certificate or with Cl@ve .

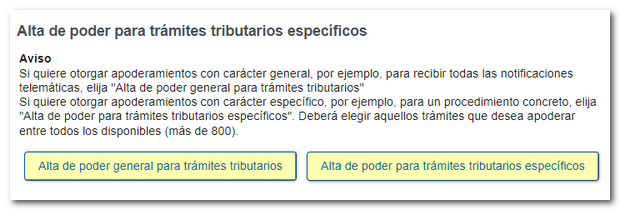

Then read the notice and choose one of the available options. In this case: "Registration of general power of attorney for tax procedures."

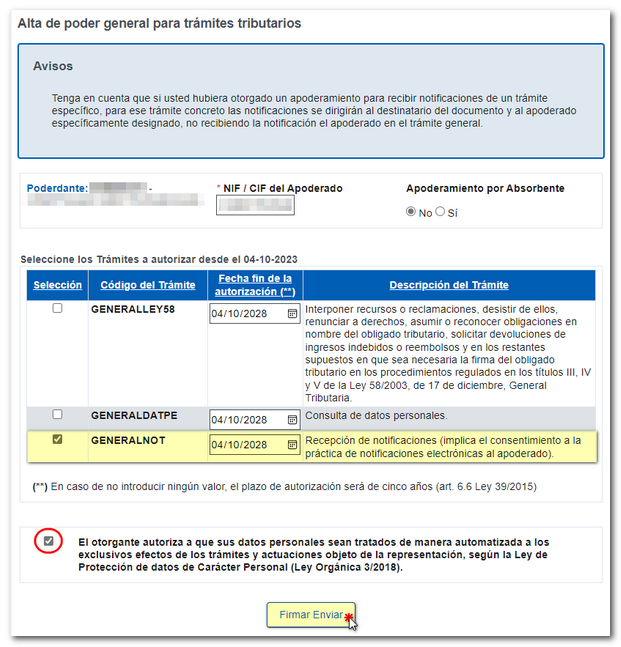

Enter the NIF of the person or entity to whom you are going to grant the power and select the procedure GENERALNOT . An end date for the authorization can be specified, and if left blank it is understood as an indefinite power of attorney (until the principal revokes it or the agent rejects it).

Also check the box authorizing your data to be processed and press "Sign Send".

In the next window, check the box "I agree" and click on "Sign and Send" to complete the granting of power.

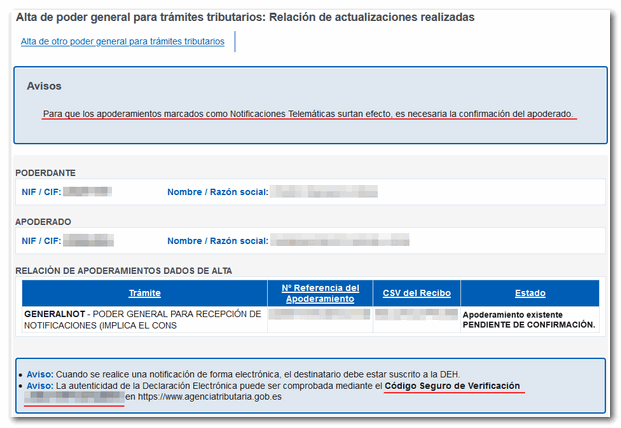

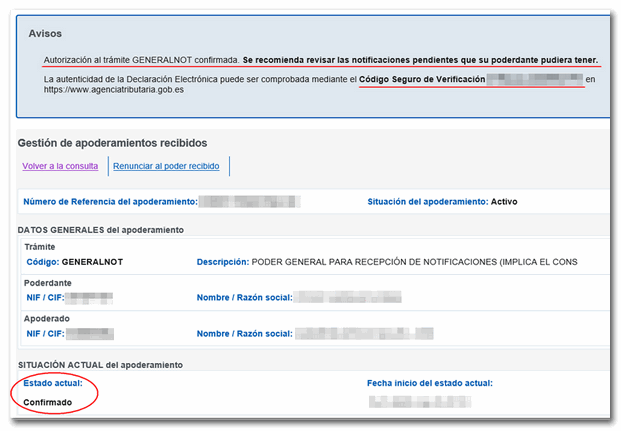

Once the registration has been sent, the data of the principal, the agent, the list of registered powers of attorney and the CSV (Secure Verification Code) will be reported, which you can compare in the "Comparison of documents using a secure verification code" section.

2. Reception of power. In this second step, the representative must access ## "Consult, confirm and waive received powers of attorney" 2## with his/her electronic certificate or Cl@ve 1## to confirm the power of attorney received and complete the registration in the power of attorney registry.

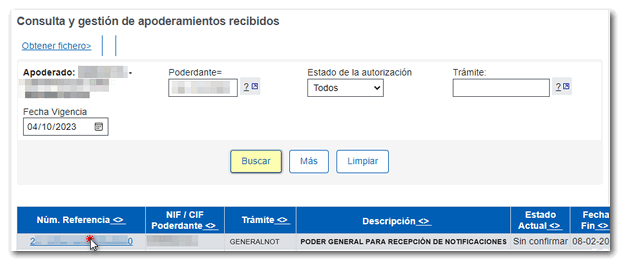

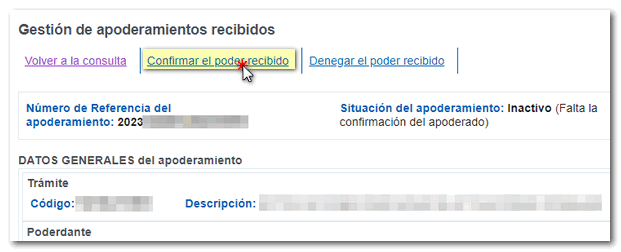

Filter the results by authorization status "Unconfirmed" or by GENERALNOT procedure and click on "Search" . To access the power of attorney, click on the reference number of the power of attorney in question.

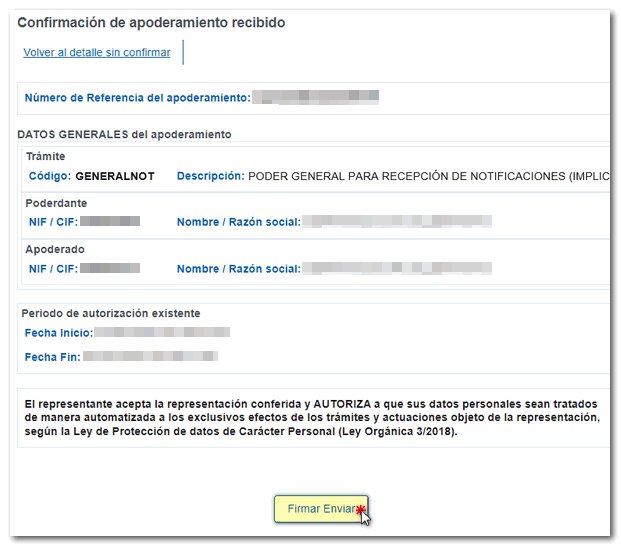

You will access a screen with the general data of the power of attorney (principal, agent, effective date, etc.) and the status of the power of attorney. To finish registering the power of attorney, click the link "Confirm the power received" located at the top of the screen and sign and send the information.

This completes the registration process in the registry of powers of attorney for the GENERALNOT procedure. From that moment on, the agent will be able to consult the electronic notifications of the principal.

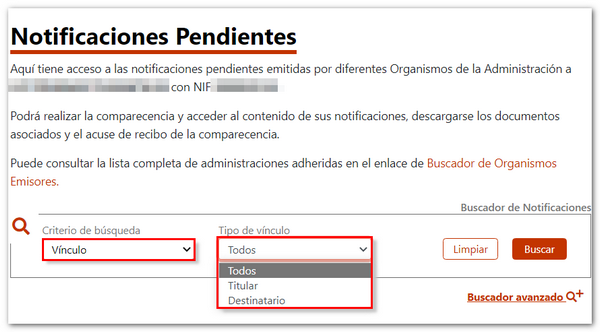

In DEHú , you can use the search engine to locate notifications from your clients. In "Search criteria" select "Link" and in "Type of link" indicate "Owner" or "Recipient".

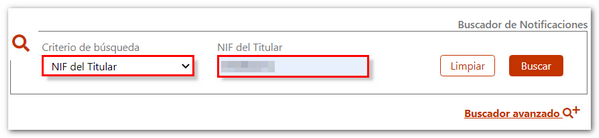

You can also locate notifications from a specific principal by filtering by the NIF of the holder.

If you access the notification details using the arrow icon, the link of the person who has accessed the notification or communication ("Owner" or "Recipient") and the NIF of the owner of the same are reported in the "Recipient" option.

It should be noted that a third party will always be able to access the notifications for which they are authorized from the Electronic Office of the AEAT . After identifying yourself and accessing the notifications and communications query, it is essential to filter using the "On behalf of" field to locate the results of the selected person or entity, which may be the taxpayer themselves, an entity that you succeed, or a person or entity authorized by the taxpayer to access their notifications and communications.