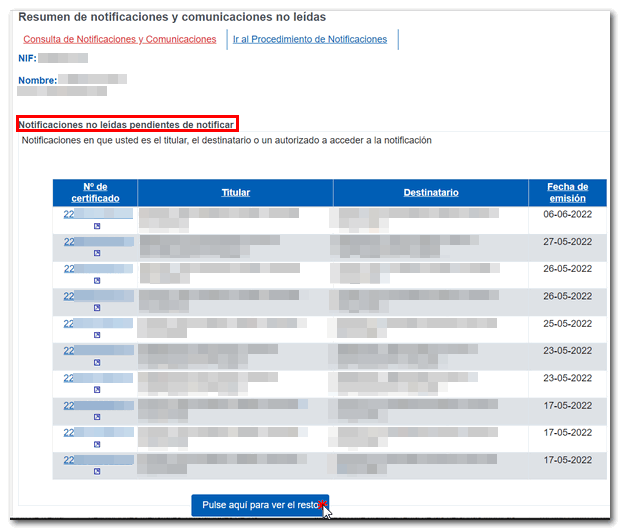

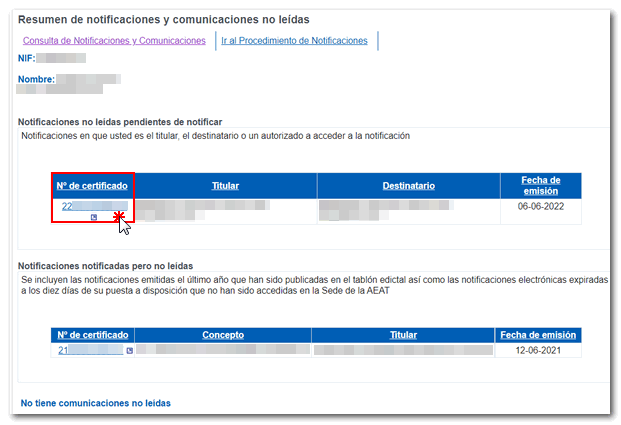

Summary of unread notifications and communications (Via e-Office)

The possibility is offered to prominently access those notifications and communications that, according to the information from the AEAT , have not yet been accessed or read by the taxpayer.

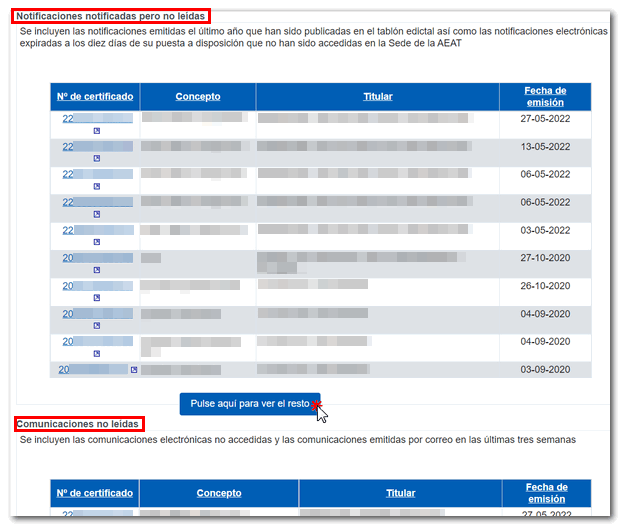

This summary query shows the pending notifications, of which you are both the owner and the recipient or authorized, and two other sections, "Notifications notified but not read" , which includes the notifications published on the Single Edictal Board and the electronic ones expired ten days after being made available that have not been accessed in the Electronic Office and "Unread communications" which includes the electronic communications not accessed and the communications sent by mail in the last three weeks.

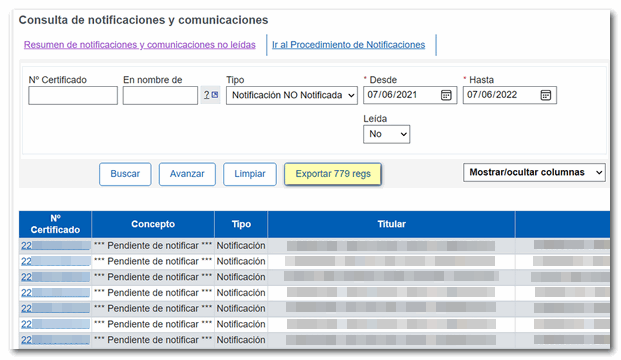

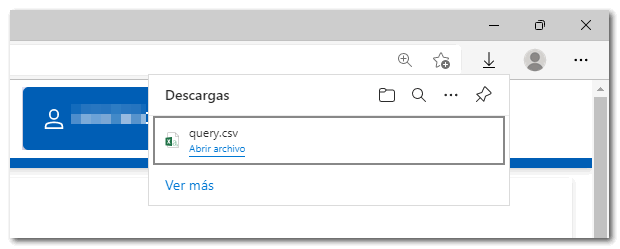

The "Click here to see the rest" button will be displayed if there are more results than those offered on the first page for this typology. This will take you to the general view of the notification and communications search engine with the complete list of this type of notifications already filtered. You can navigate between the different pages and even export the results to a file in CSV format.

To access the notification or communication, click on the certificate number.

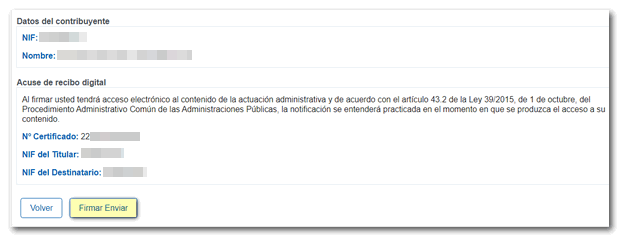

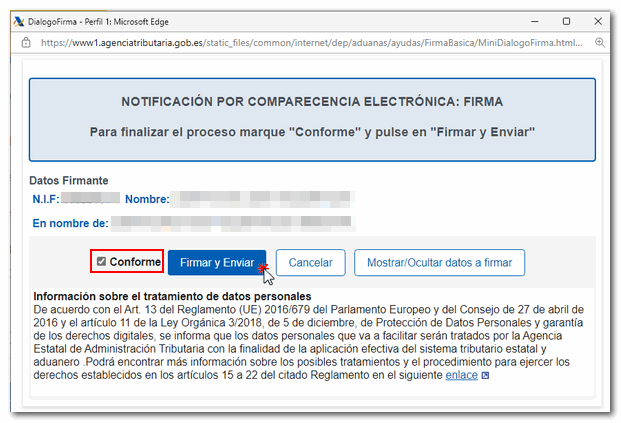

If it is catalogued as pending, to access its content, you will have to click the "Sign and Send" button. Check the 'OK' box and click 'Sign and Send' again. Please note that you must have a PDF document viewer installed and allow file downloads.

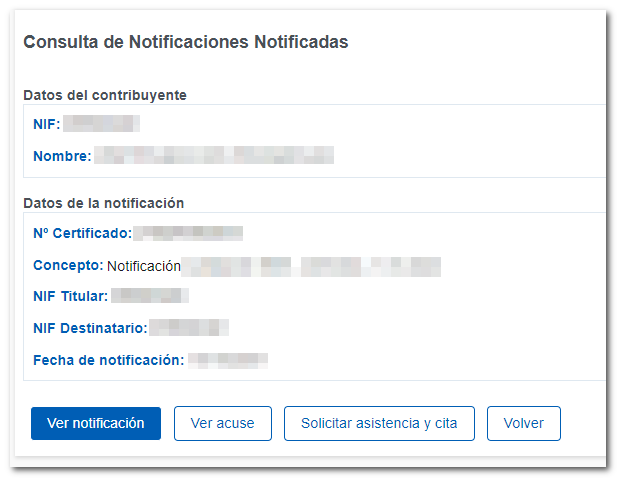

Once access to the notification is signed, the "View notification" button is enabled to view the document in PDF .

Sometimes you may have a link to request assistance and appointment, which will only be displayed for procedures that are set up in the assistance and appointment application, with appointment by CSV .

If you need to perform other searches you can filter by the available criteria, "On behalf of", "Type", date range and "Read". Please note that to access third party notifications it is imperative that you filter the results of the selected person or entity, which may be the taxpayer themselves, an entity to which they succeed or a person or entity empowered by the taxpayer to access their notifications and communications using the "On behalf of" field.