Consult notifications and communications in the E-Office

Through this option you can access a search engine that allows you to locate both the notifications and the communications of the taxpayer with which you are linked at the time of issuance as the owner of the notification, the recipient or an agent to access the notifications and communications of the owner.

The procedure requires identification with Cl@ve , with an electronic certificate, DNIe of the declarant or eIDAS if you are a citizen of the European Union using the identification of another country.

In addition to the owner himself, a third party acting on his behalf may also access the data. To access notifications on behalf of third parties you must have power of attorney. This empowerment may be general or specific to specific issues. The general authority to receive notifications from third parties is GENERALNOT.

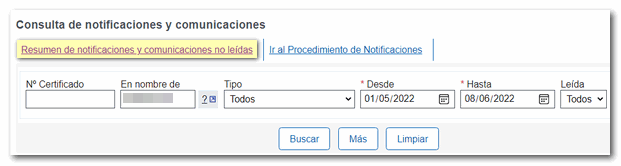

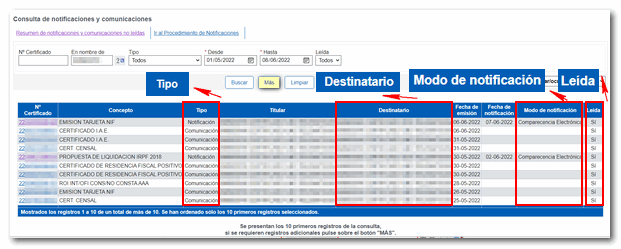

These are the search criteria you can use to access notifications and communications:

- "Certificate No."

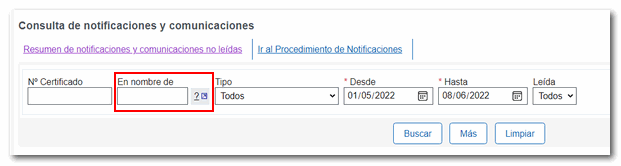

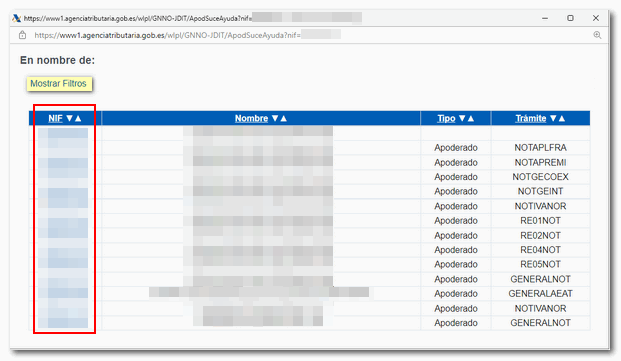

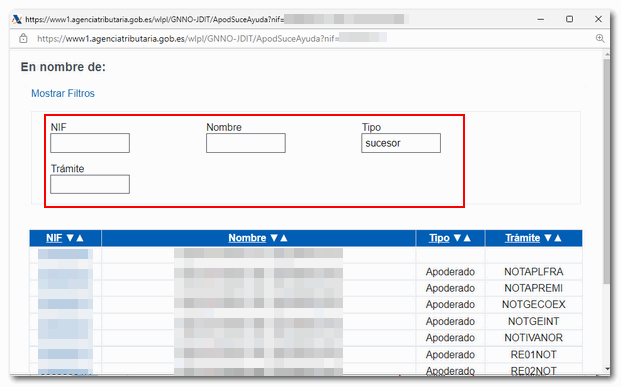

- "On behalf of" , allows you to filter the results for the selected person or entity, which may be the taxpayer themselves, an entity they succeed, or a person or entity authorized by the taxpayer to access their notifications and communications. This criterion also shows all notifications and communications whose owner is the third party, including those that were issued before receiving the power or granting the succession. To make it easier to find the third party, you can click on the new window icon and activate the search window. You can search by NIF , name, type and procedure, by clicking the "Show Filters" link or selecting the taxpayer directly. To locate notifications and communications from third parties, it is essential that you indicate the NIF of the power of attorney or the entity you are succeeding in this field.

- "Type" , filters the results to notifications yes or no notified and communications.

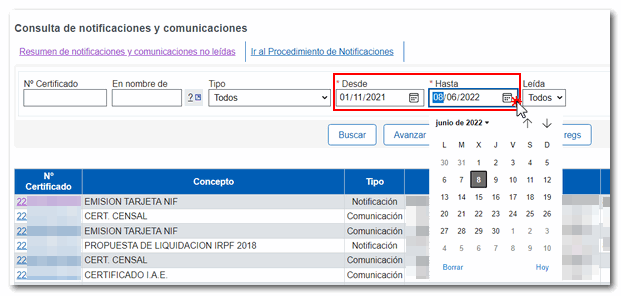

- Date range , allows you to limit the search to the indicated dates, with no minimum or maximum range.

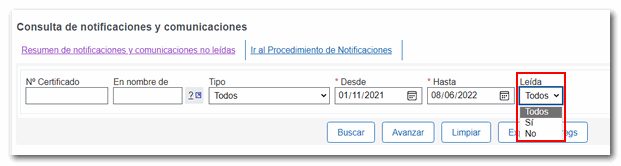

- "Read" , to filter notifications or communications that are read or not. The "Read" mark is activated when the taxpayer, whether the owner, recipient or authorized representative to access notifications, accesses said communication or when it is delivered by Post Office, in person or by a tax agent. In addition, to prevent old notifications or communications from making it difficult to identify more recent shipments that have not been reviewed by the taxpayer, an agreement has been adopted to consider notifications issued before the last year as read, as well as communications issued by post within three weeks.

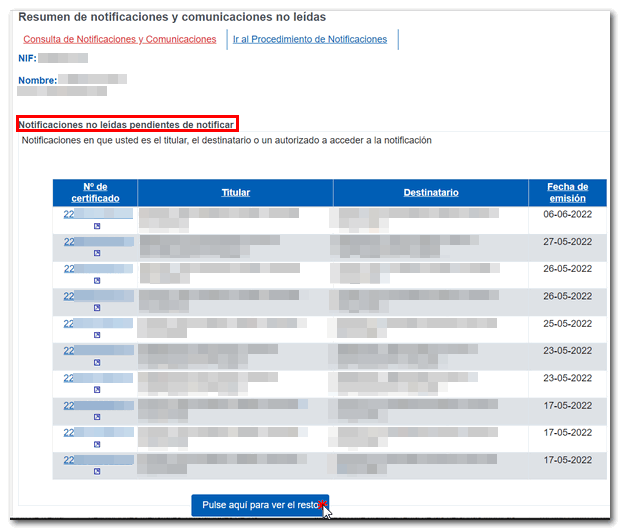

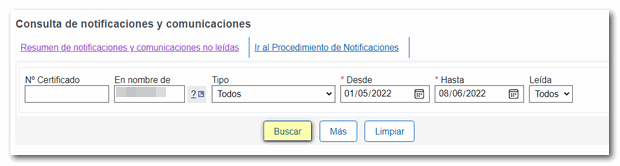

Once you have selected the criteria, press the "Search" button. The first 10 results that meet the selected conditions will be offered.

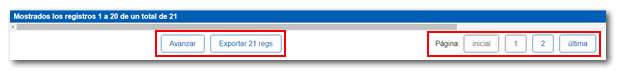

If there are more, the "More" button will be enabled so you can access them. The data provided for each notification or communication are the certificate number, which is a link to access it, the concept, the type, the holder, the recipient, the issue and notification dates, the notification model and whether or not it has been read. Another 10 results will then be displayed and you will be able to page through to locate the rest and even export the results to an Excel document.

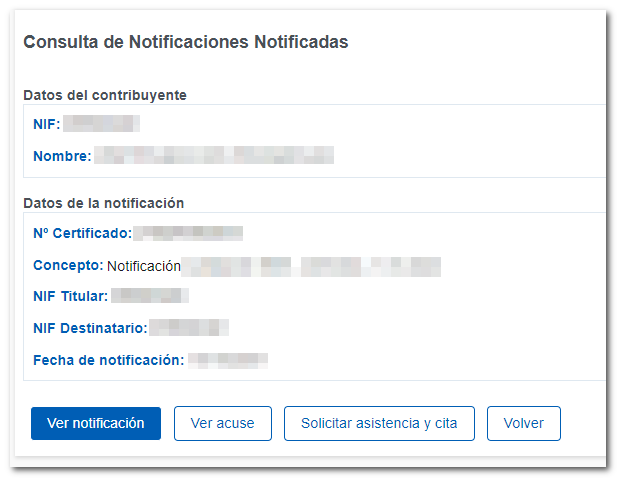

Click on the "Certificate No." link to access the details of the notification or communication.

Depending on whether it is a notification or a communication, and whether it has already been notified or not, and read or not, a different access button will be displayed to download or view it. In addition to a link to request assistance and appointment, which will only be displayed for procedures that are configured in the assistance and appointment application with appointment by CSV .

From the search engine, at the top, you will have a link to access the summary of unread notifications and communications.