Newsletter subscription

Skip information indexNewsletter subscription

If you wish to receive information notices from the Tax Agency, the Economic-Administrative Courts and the General Directorate of Taxes by SMS or email, you can provide a mobile phone number and an email address through the electronic office.

To subscribe to these notifications, you have several access alternatives, if you are a natural person:

- With Cl@ve

- With certificate or electronic ID

- With the Income reference number that you have obtained on the website or in the APP

- With eIDAS ( EU citizens )

If it is a legal person or an entity without legal personality, a representative certificate is required to access the notification subscription procedure.

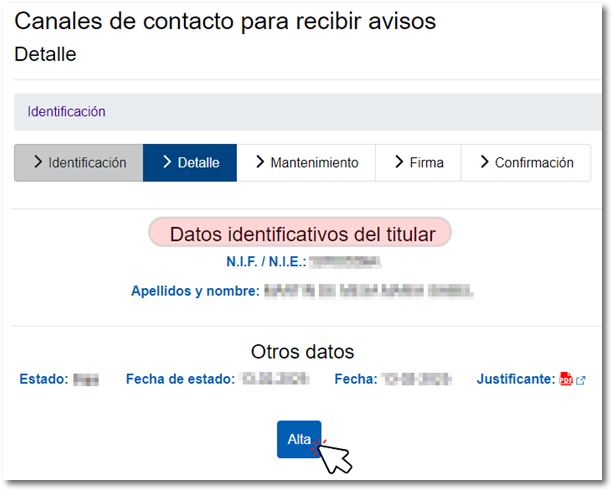

Once you access the service, the existing data of the owner is displayed. Then press the "Add" button.

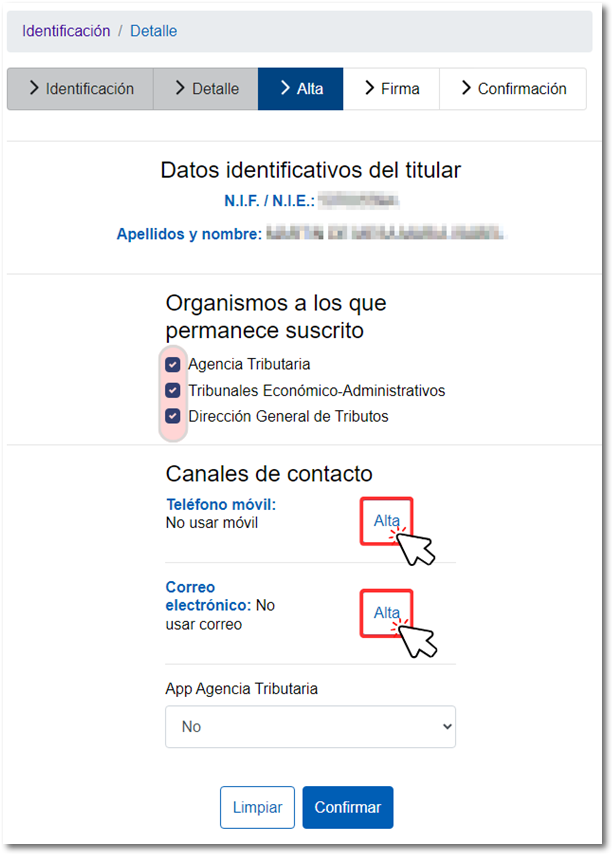

Select the agencies you wish to remain subscribed to, "Tax Agency", "Economic-Administrative Courts" and "General Directorate of Taxes", by checking one, two or all three. Create contact channels by providing phone and/or email details, depending on how you want to receive these notifications.

You have the option to select a Spanish or foreign mobile phone. Click on "Confirm".

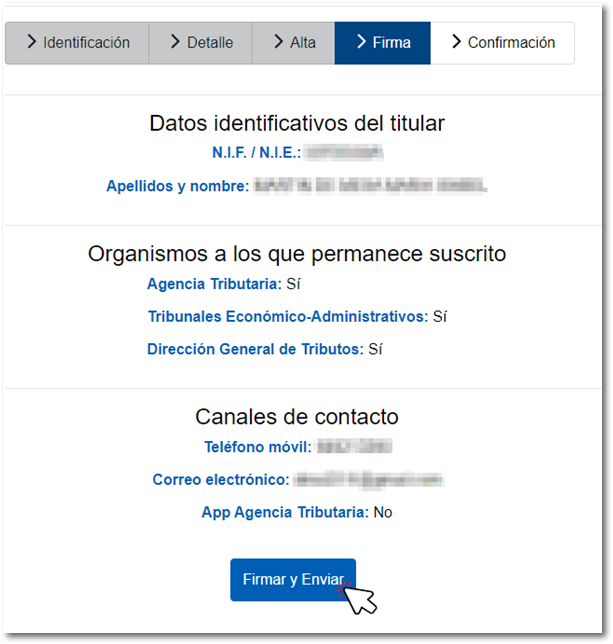

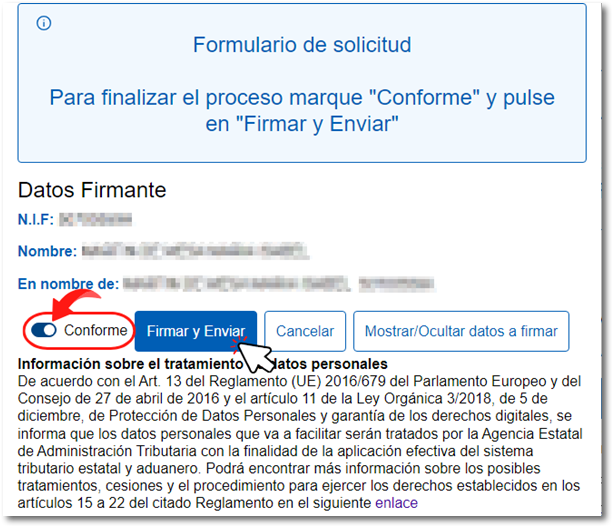

In the new window, verify the data entered and press "Sign Send"; Then, check the "I agree" box and click "Sign and Send."

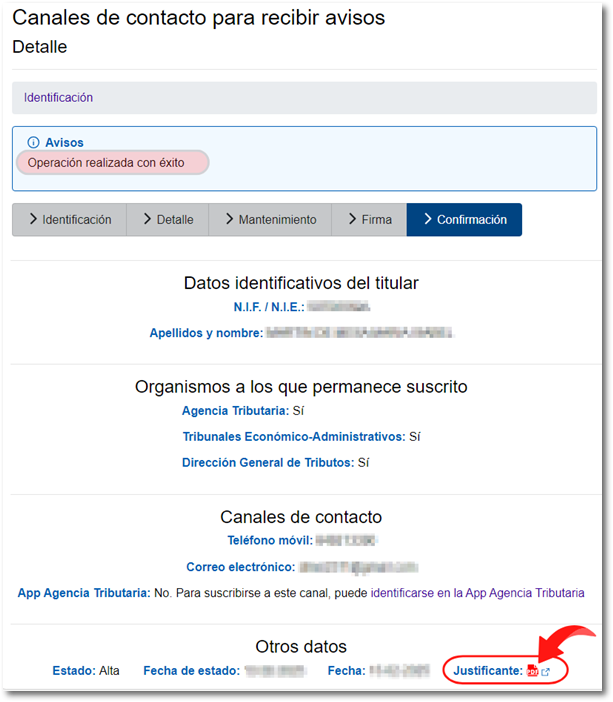

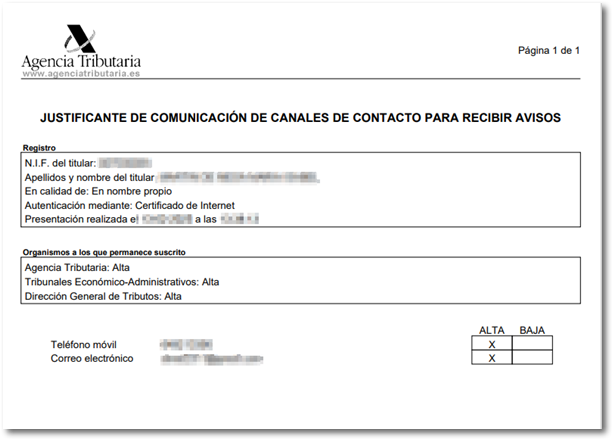

If the procedure has been carried out correctly, a notice is displayed indicating this, showing the organizations to which you are subscribed, as well as the contact information provided and a link to the "Receipt" in PDF .

In the event that a notice is sent informing you of the existence of a notification, the text of the notice that will be received is as follows: "The Tax Agency has issued a notification addressed to NIF XXX". For security reasons, only some digits of the NIF will be displayed.

If it is a notice by email, the sender address will be AgenciaTributaria@correo.aeat.es.

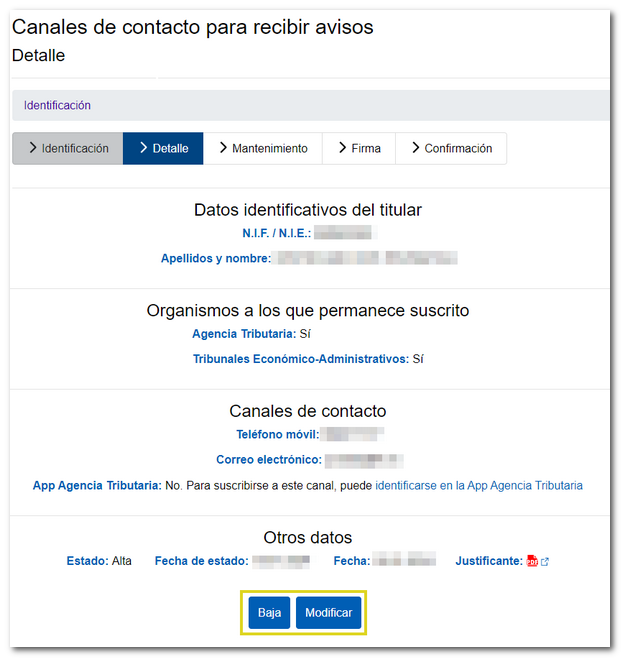

From this same service you can modify your contact information, whenever necessary, or unsubscribe from notifications. In this case, once you log in, the identification and contact details of the owner will be displayed, as well as the "Unsubscribe" and "Modify" buttons.

After modifying the data or cancelling the service, you will again receive the web page with the procedure completed correctly and the link to the receipt in PDF with the modified data and the action performed. If you were previously subscribed to notifications from the Tax Agency, from the "Modify" button you can also subscribe to notifications from the "Economic-Administrative Courts" and the "General Directorate of Taxes".