Frequently asked questions for local authorities

Skip information indexTechnical errors

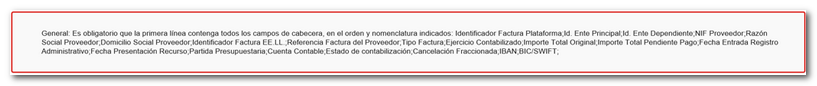

Check that the file . CSV contains the header with all its fields.

If you have the file constructed this way, it is most likely that the file is not being processed correctly due to poorly encoded characters.

Therefore, it is very important that you take the following steps:

-

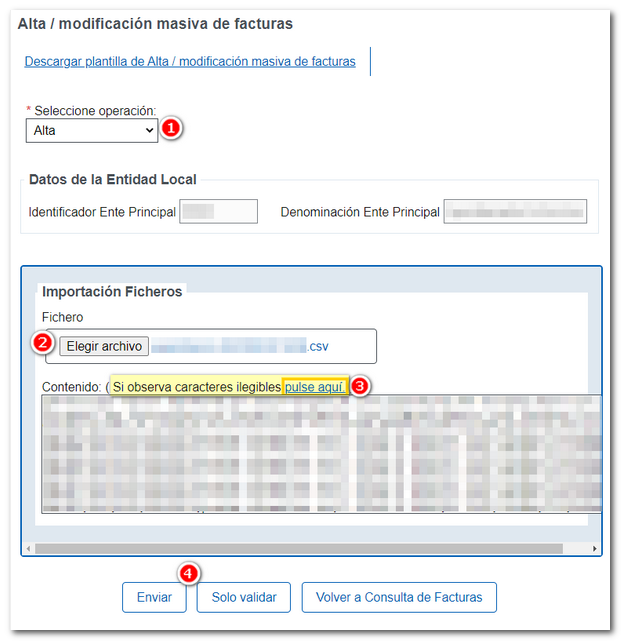

Go back to "Mass actions", "Mass invoice creation/modification" .

-

Select the type of operation " High" .

-

Click " Choose File" and select the correct CSV file.

-

Click on "click here" (to correct any incorrectly encoded characters: ´, ª, º, etc.) . If these types of characters exist, the file may not be processed correctly and you may get an error.

-

Once this is done, try "Send" . However, before "Submit" you can use the " Validate Only" option to check if any errors have been detected in the file and proceed to correct them before submitting.

After submitting, a summary of the results should appear: how many invoices have been processed, how many contain errors (which ones are reported) and how many have been submitted.

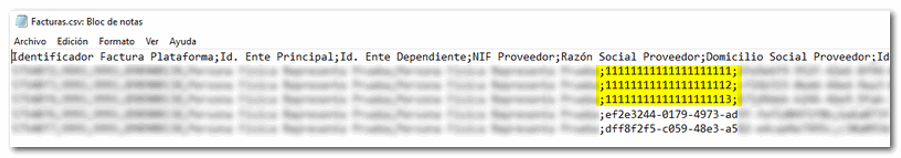

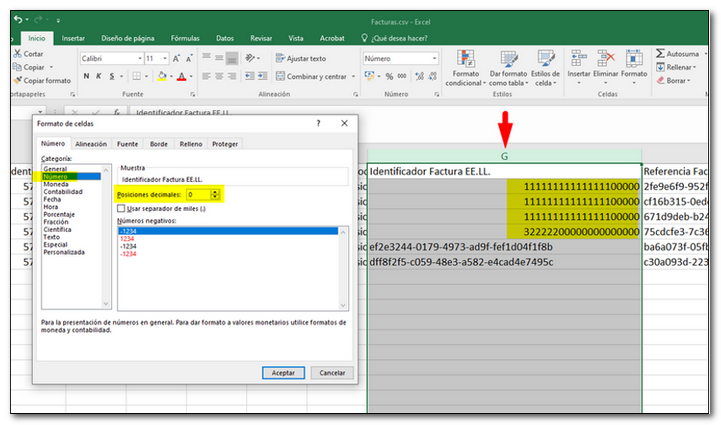

When downloading query files in CSV (comma delimited) format, if you specifically open them with Notepad (rather than Excel) or any other text editor that does not "template" the information, you can see that the data is downloaded correctly, just as it was sent.

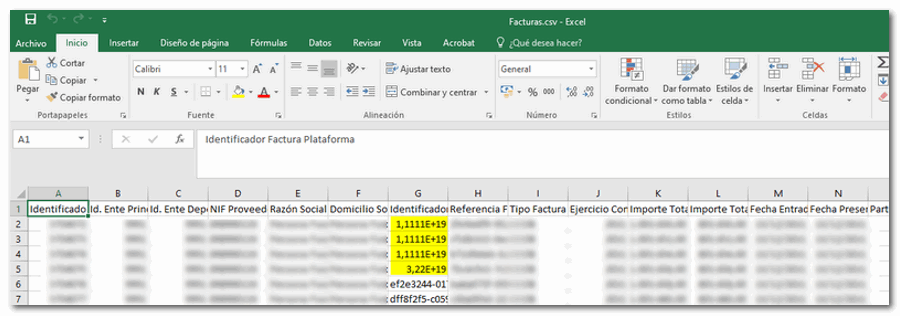

However, when you open them in Excel, certain transformations are performed automatically that can cause problems if you reuse the same file to send it later.

To correct this behavior, simply change the column format to "Number" format without decimals. This prevents the scientific notation from being displayed and ensures that the CSV is generated correctly when you save it again.

This error appears when trying to identify yourself with an electronic certificate that is not enabled to carry out the procedure. Only entities included in one of the schemes established by the Agreement of the Government Delegated Commission for Economic Affairs of May 5, 2025, or persons authorized by these entities, will be able to access the 2025 Supplier Payment Platform.

The list of local entities included in the 2025 Supplier Payment Procedure is published on the Ministry of Finance's Institutional Portal. They are available at the following links:

-

Mandatory participation regime:

-

Voluntary participation regime:

Access must be made with:

-

Electronic certificate of representative of a legal entity. The NIF of the legal entity must correspond with the NIF of a main entity.

-

Certificate of natural person. It needs to be empowered by the main entity.

-

Public employee certificate. The certificate must have the NIF of the main entity and, in addition, it needs to be authorized by the main entity.

-

Key . It will be necessary to have a power of attorney prior to the procedure that allows this procedure to be carried out on behalf of a specific local entity.

The power of attorney required for a third party to access invoice management is ZZ581 - Invoice Management Local Entities (ACDGAE (from 05-05-2025). This power must be granted by the main entity.

You can check whether you have such a power of attorney at the Electronic Office. From "All procedures", "Other services", "Power of attorney", "Power of attorney for carrying out procedures and actions in tax matters online", " Consultation, confirmation and resignation of powers of attorney received" .

If the power of attorney exists then it should appear in that query.

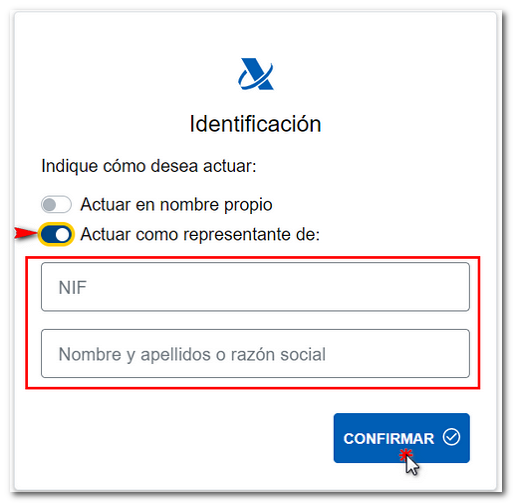

Once verified that the power of attorney exists, the agents may act with their certificate or Key indicating that they act as a representative when accessing "Local Entities Invoice Management" (after entering the NIF and the corporate name of the Entity).

Once this is done, you should no longer get the "Access Restricted" error.