Frequently asked questions for local authorities

Skip information indexInvoice management

From the option "Local Entity Invoice Management" It is possible to register invoices in two ways:

-

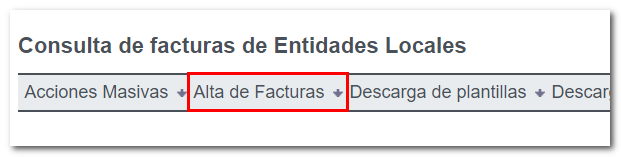

Individually by clicking on the menu "Invoice creation".

-

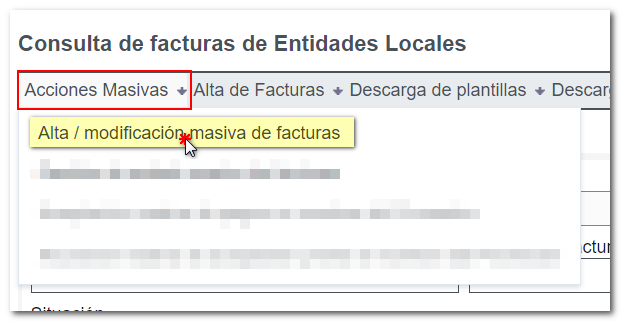

In bulk from the menu "Bulk actions" . In this menu is available "Mass invoice creation/modification" . This option allows you to import a CSV file containing multiple invoices. There are sample templates in each section intended for carrying out mass actions.

Once the operation has been selected, you must import the CSV file that will contain the invoices you want to create and/or modify, using the "Browse" button. This file will contain a first row with the name of the invoice fields that are going to be entered (separated by ";"). The format that the rest of the rows must comply with can be checked by downloading the template for mass incorporation of invoices, whose link with the literal "Download template for mass addition/modification of invoices" is found at the top of the page.

In order to create an invoice, the date on which the action is carried out must comply with the period established for this purpose.

-

From May 26 to June 6: Local Entities, belonging to the mandatory regime, will register on the platform the unpaid invoices from their suppliers.You can make any changes you deem appropriate to the invoices submitted to the platform.

-

From June 27 to July 8: Local Entities, belonging to the voluntary regime, will register their suppliers' outstanding invoices on the platform.You can make any changes you deem appropriate to the invoices submitted to the platform.

NIF , NIE and codes registered in the Expanded Customs Census are accepted.

In the event that the invoice corresponds to a foreign supplier who does not have NIE, contact the Local Entity Support Center through the provided form. You must provide the following information related to the supplier via this channel:

-

Supplier country. Failing this, a standard 2-character code identifying the country of origin.

-

Supplier identifier. Passport number or any other data that identifies the supplier.

-

Name or business name of the supplier.

-

Address or registered office of the supplier. Optional data.

-

Municipality/state/city of origin of the supplier. Optional data.

-

Natural or legal person. Required data.

The data provided will be verified and, if deemed correct, the supplier will be registered.

-

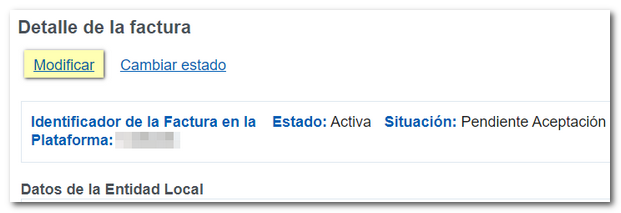

To individually modify an invoice , you must access the invoice details and click on the " Modify" option located at the top.

Note: If this option does not appear, it may be because you are not within the established period for modifying invoices (from May 26 to June 19, 2025 for local entities under the mandatory regime and between June 27 and July 18, 2025 for local entities under the voluntary regime). It is also not possible to modify an invoice if its status is not "Active" or if, even though it is active, its situation is "Manifested acceptance". An invoice that has already been accepted cannot be modified.

-

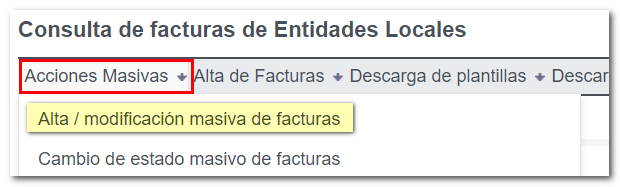

It is also possible to perform a mass modification from the menu "Massive actions", "Mass invoice creation/modification". This section allows you to add new invoices, modify those already added or carry out both operations at the same time (add new invoices and modify existing invoices).

Once the operation is selected, the file must be imported. CSV which will contain the invoices that you want to register and/or modify, through the button "Examine". This file will contain a first row with the name of the invoice fields that are going to be entered and/or modified (separated by ";"). The format that the rest of the rows must comply with can be checked by downloading the mass invoice incorporation template, whose link is in the literal "Download template for mass invoice creation/modification" is located at the top of the page.

-

Cancellation of invoices individually or in bulk (change of status to "Cancelled") is available from May 26 to June 19, 2025 for local entities under the mandatory regime and between June 27 and July 18, 2025 for local entities under the voluntary regime.

All except the parent entity ID.

First, invoices can be modified as long as the date on which the action is carried out complies with the established period (from May 26 to June 19, 2025, for local entities under the mandatory regime, and between June 27 and July 18, 2025, for local entities under the voluntary regime).

If, even within the established period, it is not possible to modify an invoice, you must check whether the invoice status is "Active" and its situation is "Pending Acceptance" . The status of an invoice can only be modified if these conditions are met.

It is not possible to modify an invoice"Cancelled" or, being active, if your situation is ""Manifested Acceptance".

Accepting payment on behalf of a supplier can be done in two ways: individual and massive.

-

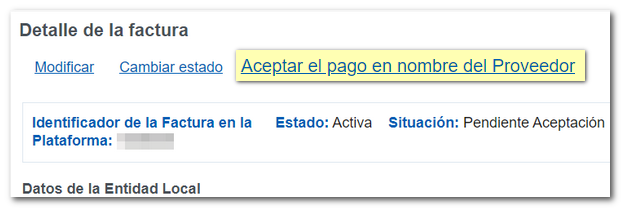

In order to accept payment individually , you must access the invoice details and click on the option "Accept payment on behalf of the Supplier" located at the top.

Note: If this option does not appear, it may be because it is not within the established period for payment acceptances on behalf of the supplier (from June 9 to 19 for local entities of the mandatory regime and from July 9 to 18, 2025 for local entities of the voluntary regime), the invoice has been cancelled, or the payment has already been accepted by the supplier ("Manifest Acceptance" situation).

-

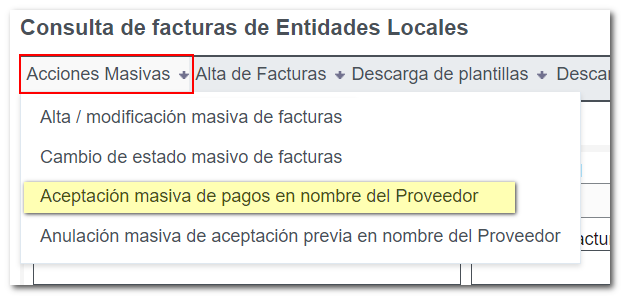

It is also possible to perform a mass acceptance on behalf of the supplier. from the menu ""Bulk Actions", "Bulk Payment Acceptance on Behalf of the Supplier".

Once the operation has been selected, you must import the file CSV that will contain the invoices you want to create and/or modify using the "Browse" button. This file will contain a first row with the name of the invoice fields that are going to be entered and/or modified (separated by ";"). The format that the rest of the rows must comply with can be checked by downloading the mass invoice incorporation template, whose link is with the literal "Download the Mass Payment Acceptance on Behalf of the Supplier template, is located at the top of the page.

Payment can only be accepted on behalf of the supplier within certain time frames: From June 9 to June 19 for local entities under the mandatory regime and from June 9 to July 18, 2025 for local entities under the voluntary regime.

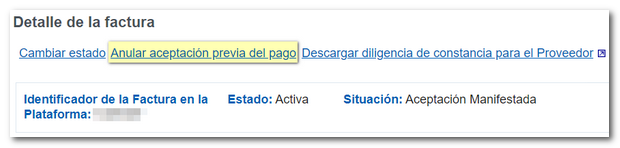

If the payment cannot be accepted within the established period, it is necessary to check whether the invoice status is "Active" and its situation is "Pending Acceptance" . It is not possible to accept an invoice that is already in status "Acceptance Expressed" , when the payment has already been accepted; the EE. LL. could only:

-

Cancel the invoice (change the status to "Cancelled" ).

-

Cancel the supplier's prior acceptance.

-

Obtain the receipt ( "Download certificate of attestation for the Supplier" ).

In order to modify the IBAN it is necessary to previously cancel the acceptance of payment on behalf of the supplier in order to have access to the option "Modify" (which does not appear if an invoice is in the "Acceptance Expressed" status).

Note: Please note that prior acceptance of payment on behalf of the supplier can only be cancelled within certain time periods: from June 9 to 19 for local entities under the mandatory regime and from July 9 to 18, 2025 for local entities under the voluntary regime. Furthermore, within this period the acceptance of an invoice may only be cancelled if its status is "Active" and its situation "Acceptance Expressed" .

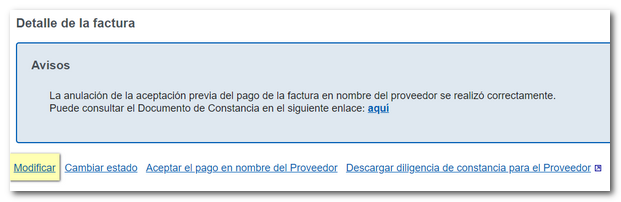

Once the prior acceptance of payment has been cancelled, the invoice returns to status "Pending Acceptance" . In this state, it is possible to access the invoice modification from the "Modify" option.

Once the IBAN has been corrected, since the invoice is in status "Pending Acceptance" you must "Accept payment on behalf of the Supplier" so that the invoice returns to status "Acceptance Expressed" .

It is possible to cancel the prior acceptance of a payment on behalf of the supplier in two ways: individual and massive.

-

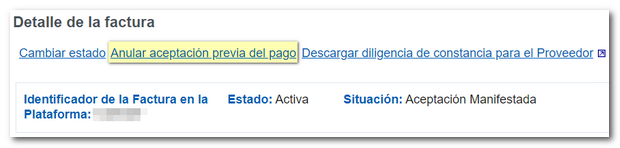

In order to cancel the acceptance of payment individually , you must access the invoice details and click on the option "Cancel prior acceptance of payment" located at the top.

Note: If this option does not appear, it may be because you are not within the established period to carry out this procedure (from June 9 to 19 for local entities under the mandatory regime and from July 9 to 18, 2025 for local entities under the voluntary regime). Additionally, it is only possible to cancel the acceptance of payment if its status is "Active" and its situation is "Acceptance Expressed" .

-

It is also possible to make a mass modification from the menu "Mass actions", "Mass cancellation of prior acceptance by the supplier" .

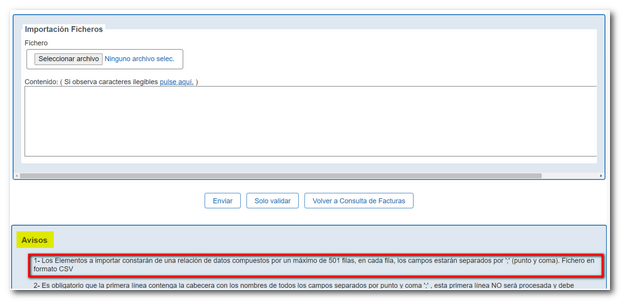

Once the operation has been selected, you must import the file CSV that will contain the invoices you want to create and/or modify using the "Browse" button. This file will contain a first row with the name of the invoice fields that are going to be entered and/or modified (separated by ";"). The format that the rest of the rows must comply with can be checked by downloading the mass invoice incorporation template, whose link with the literal "Download mass payment cancellation template on behalf of the supplier" is located at the top of the page.

In invoices, the acceptance of payment can be cancelled provided that the date on which the action is carried out complies with the period established for this and that the local entity is an entity authorised to do so. Additionally, it is only possible to cancel the acceptance of payment if its status is "Active" and its situation is "Acceptance Expressed" .

As indicated in the "Notices" located at the bottom of the " Mass addition/modification of invoices" section, the elements that are imported will consist of a data list composed of a maximum of 501 rows.

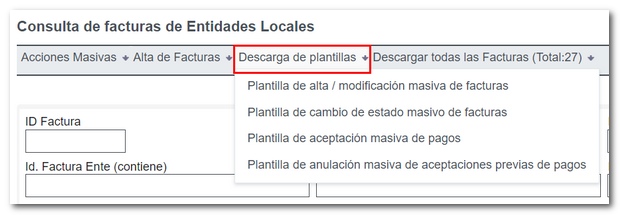

Yes. From the link "Download templates", located at the top of the invoice query page, allows the user to download templates for bulk actions.

The templates for mass actions are:

-

Mass invoice creation/modification template.

-

Mass invoice status change template.

-

Mass payment acceptance template.

-

Template for mass cancellation of previous payment acceptances.

Yes, from the link "Change status" located at the top of the invoice detail (accessed from the invoice query) it is possible to change the status of an invoice to "Cancelled" or "Cancelled due to already paid" .

However, this operation can only be carried out during the established period (from June 9 to 19 for local entities under the mandatory regime and from July 9 to 18, 2025, for local entities under the voluntary regime).